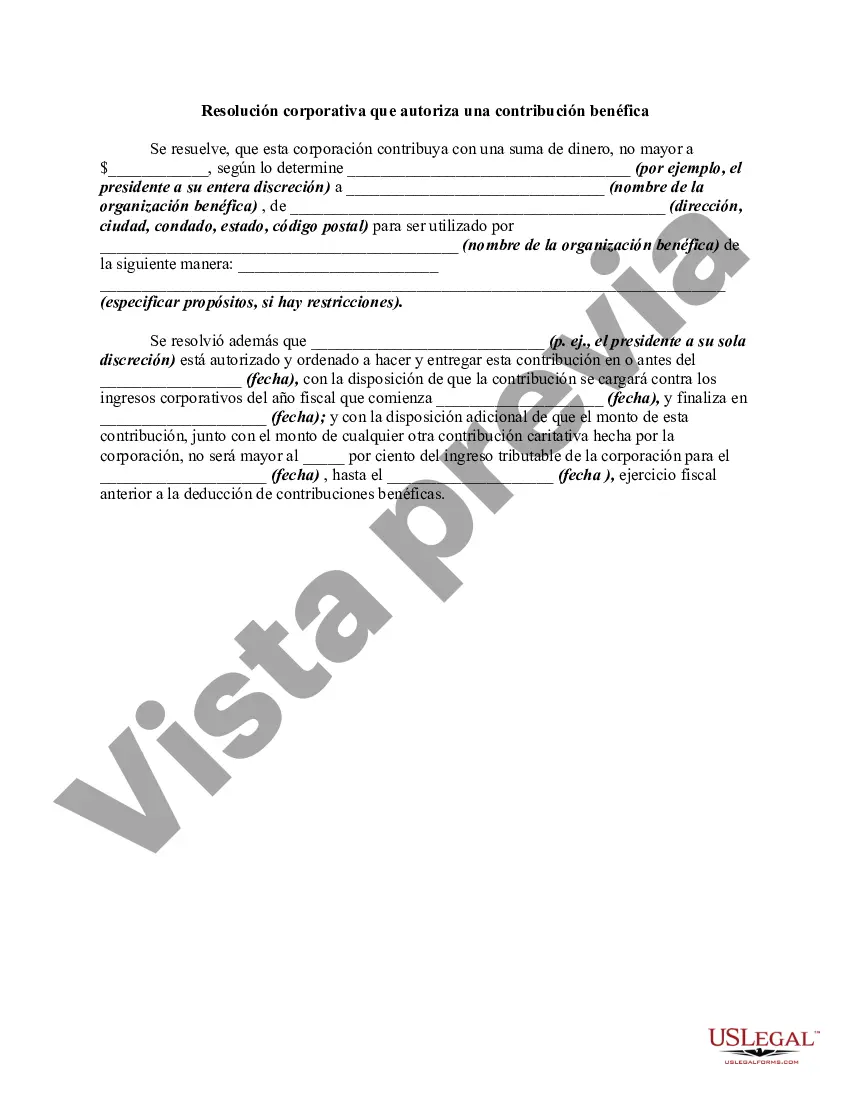

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. In Allegheny, Pennsylvania, a Corporate Resolution Authorizing a Charitable Contribution refers to a legal document executed by a corporation to formally authorize the donation of funds or assets to a charitable organization or cause. This resolution serves as an official record of the corporation's decision and outlines the details of the contribution. Typically, a Corporate Resolution Authorizing a Charitable Contribution in Allegheny, Pennsylvania includes crucial information such as the corporation's name, the date of the resolution, and the specific details of the charitable organization or cause to which the contribution will be made. It also states the amount or nature of the contribution, whether it is a monetary donation, goods, or services. This type of corporate resolution is significant for several reasons. Firstly, it ensures that the charitable contribution is made in accordance with the corporation's bylaws, articles of incorporation, or any internal governance documents. Secondly, it establishes a formal decision-making process within the corporation, as the resolution typically needs to be approved by the board of directors or shareholders, depending on the corporation's structure. Different types of Allegheny Pennsylvania Corporate Resolution Authorizing a Charitable Contribution might include: 1. General Charitable Contribution Resolution: This type of resolution allows a corporation to make a charitable contribution without any specific limitations or restrictions. It provides flexibility in choosing the charitable organization or cause and the amount of the contribution. 2. Specific Charitable Contribution Resolution: In contrast to a general resolution, this type of resolution is more targeted and designates a specific charitable organization or cause to receive the contribution. It may also outline any specific conditions or restrictions related to the donation. 3. Matching Gift Charitable Contribution Resolution: Some corporations offer matching gift programs where they agree to match their employees' charitable contributions up to a certain amount. This resolution authorizes the corporation to match the employees' donations, emphasizing the commitment to charitable giving. 4. In-Kind Donation Resolution: Corporations can also contribute goods, services, or assets instead of monetary donations. An In-Kind Donation Resolution specifies the particular goods or services that the corporation intends to donate and outlines the terms and conditions surrounding the contribution. In conclusion, a Corporate Resolution Authorizing a Charitable Contribution in Allegheny, Pennsylvania is a vital legal document for corporations looking to make philanthropic contributions. It ensures accountability, adherence to corporate governance, and formalizes the decision-making process, enabling businesses to give back to charitable organizations and causes in their communities effectively.

In Allegheny, Pennsylvania, a Corporate Resolution Authorizing a Charitable Contribution refers to a legal document executed by a corporation to formally authorize the donation of funds or assets to a charitable organization or cause. This resolution serves as an official record of the corporation's decision and outlines the details of the contribution. Typically, a Corporate Resolution Authorizing a Charitable Contribution in Allegheny, Pennsylvania includes crucial information such as the corporation's name, the date of the resolution, and the specific details of the charitable organization or cause to which the contribution will be made. It also states the amount or nature of the contribution, whether it is a monetary donation, goods, or services. This type of corporate resolution is significant for several reasons. Firstly, it ensures that the charitable contribution is made in accordance with the corporation's bylaws, articles of incorporation, or any internal governance documents. Secondly, it establishes a formal decision-making process within the corporation, as the resolution typically needs to be approved by the board of directors or shareholders, depending on the corporation's structure. Different types of Allegheny Pennsylvania Corporate Resolution Authorizing a Charitable Contribution might include: 1. General Charitable Contribution Resolution: This type of resolution allows a corporation to make a charitable contribution without any specific limitations or restrictions. It provides flexibility in choosing the charitable organization or cause and the amount of the contribution. 2. Specific Charitable Contribution Resolution: In contrast to a general resolution, this type of resolution is more targeted and designates a specific charitable organization or cause to receive the contribution. It may also outline any specific conditions or restrictions related to the donation. 3. Matching Gift Charitable Contribution Resolution: Some corporations offer matching gift programs where they agree to match their employees' charitable contributions up to a certain amount. This resolution authorizes the corporation to match the employees' donations, emphasizing the commitment to charitable giving. 4. In-Kind Donation Resolution: Corporations can also contribute goods, services, or assets instead of monetary donations. An In-Kind Donation Resolution specifies the particular goods or services that the corporation intends to donate and outlines the terms and conditions surrounding the contribution. In conclusion, a Corporate Resolution Authorizing a Charitable Contribution in Allegheny, Pennsylvania is a vital legal document for corporations looking to make philanthropic contributions. It ensures accountability, adherence to corporate governance, and formalizes the decision-making process, enabling businesses to give back to charitable organizations and causes in their communities effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.