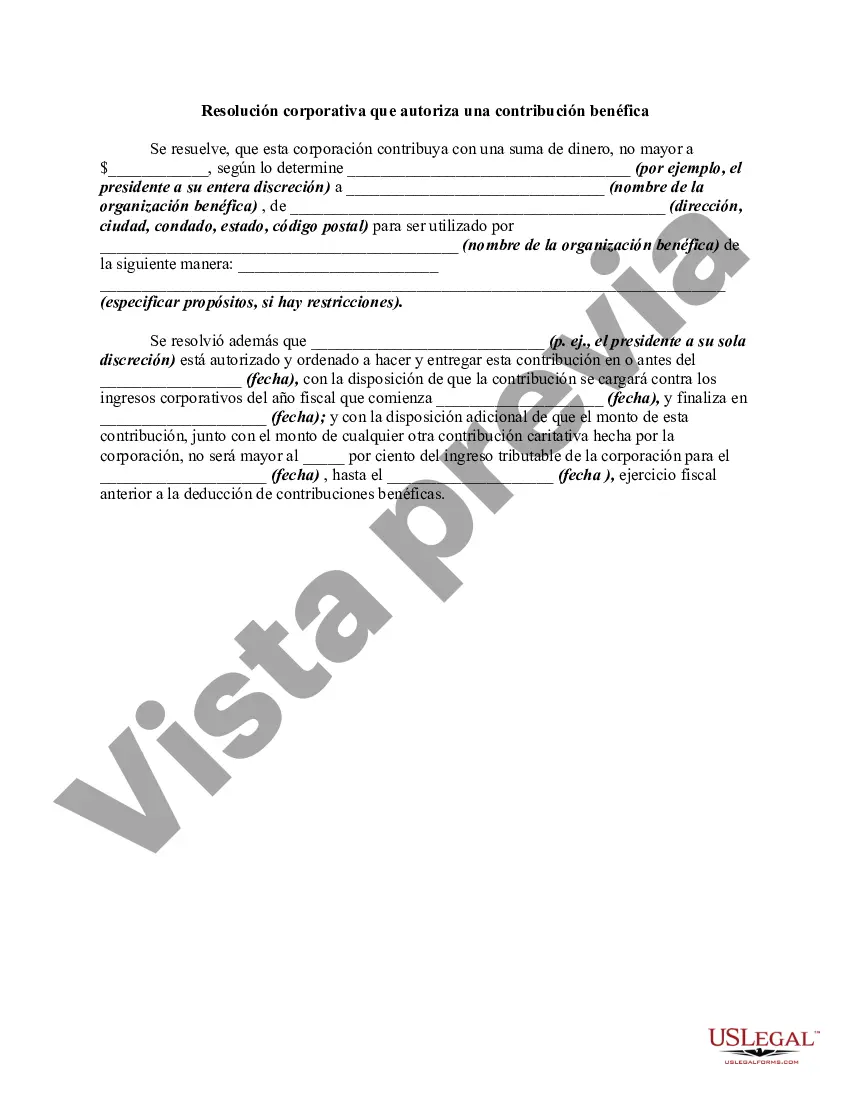

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Bexar Texas Corporate Resolution Authorizing a Charitable Contribution is a legal document that enables a corporation in Bexar County, Texas, to make a donation or contribution to a charitable organization. This resolution outlines the specific details regarding the contribution and ensures that it is authorized and within the legal framework. In Bexar County, there are several types of Bexar Texas Corporate Resolutions Authorizing a Charitable Contribution, each with its own purpose and requirements. These may include: 1. General Charitable Contribution Resolution: This type of resolution grants general authorization to the corporation to make charitable contributions within a defined budget or limit. It provides the broad discretion to the corporation's officers or designated individuals to select suitable charitable organizations and specify the funds allocated. 2. Program-Specific Charitable Contribution Resolution: Sometimes, a corporation may want to allocate funds specifically towards a particular charitable program or cause. This resolution outlines the program or cause for which the contribution is intended, providing clear guidance to the corporation's management and ensuring that the funds are utilized in a targeted manner. 3. Employee-Driven Charitable Contribution Resolution: This type of resolution establishes a framework for allowing employees to contribute a certain portion of their salaries or wages towards charitable organizations. The resolution defines the process, guidelines, and organizational support necessary to facilitate employee donations, encouraging a culture of giving back within the corporation. 4. Matching Charitable Contribution Resolution: Many corporations engage in matching programs, whereby they match the charitable contributions made by their employees. This resolution outlines the terms, conditions, and maximum limits for matching employee contributions, ensuring consistency and fairness in the corporate matching program. When drafting or utilizing a Bexar Texas Corporate Resolution Authorizing a Charitable Contribution, it is imperative to adhere to the legal requirements and follow corporate governance practices. Consulting with legal professionals or experienced corporate consultants can provide essential guidance to ensure compliance and maximize the positive impact of the corporation's charitable giving.

Bexar Texas Corporate Resolution Authorizing a Charitable Contribution is a legal document that enables a corporation in Bexar County, Texas, to make a donation or contribution to a charitable organization. This resolution outlines the specific details regarding the contribution and ensures that it is authorized and within the legal framework. In Bexar County, there are several types of Bexar Texas Corporate Resolutions Authorizing a Charitable Contribution, each with its own purpose and requirements. These may include: 1. General Charitable Contribution Resolution: This type of resolution grants general authorization to the corporation to make charitable contributions within a defined budget or limit. It provides the broad discretion to the corporation's officers or designated individuals to select suitable charitable organizations and specify the funds allocated. 2. Program-Specific Charitable Contribution Resolution: Sometimes, a corporation may want to allocate funds specifically towards a particular charitable program or cause. This resolution outlines the program or cause for which the contribution is intended, providing clear guidance to the corporation's management and ensuring that the funds are utilized in a targeted manner. 3. Employee-Driven Charitable Contribution Resolution: This type of resolution establishes a framework for allowing employees to contribute a certain portion of their salaries or wages towards charitable organizations. The resolution defines the process, guidelines, and organizational support necessary to facilitate employee donations, encouraging a culture of giving back within the corporation. 4. Matching Charitable Contribution Resolution: Many corporations engage in matching programs, whereby they match the charitable contributions made by their employees. This resolution outlines the terms, conditions, and maximum limits for matching employee contributions, ensuring consistency and fairness in the corporate matching program. When drafting or utilizing a Bexar Texas Corporate Resolution Authorizing a Charitable Contribution, it is imperative to adhere to the legal requirements and follow corporate governance practices. Consulting with legal professionals or experienced corporate consultants can provide essential guidance to ensure compliance and maximize the positive impact of the corporation's charitable giving.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.