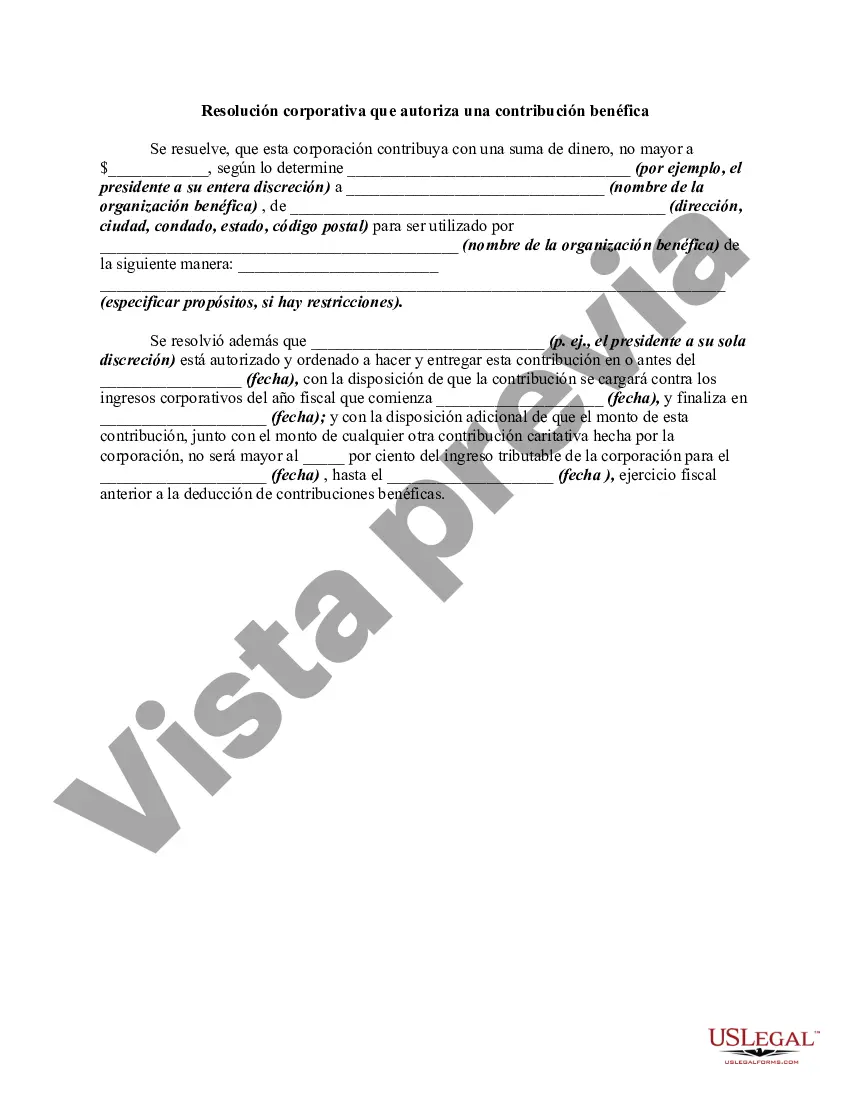

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Clark Nevada Corporate Resolution Authorizing a Charitable Contribution is a legal document that allows a corporation based in Clark County, Nevada, to donate funds or assets to a charitable organization or cause. This resolution serves as an official authorization and ensures that the contribution aligns with the company's bylaws, policies, and the board's consent. It is essential for corporations in Clark Nevada to have a clear and well-drafted corporate resolution when authorizing a charitable contribution. This document outlines important details such as the purpose of the donation and the specific recipient, ensuring transparency and accountability in the decision-making process. Different types of Clark Nevada Corporate Resolutions Authorizing Charitable Contributions may include: 1. General Charitable Contribution Resolution: This resolution is a broad authorization to make donations to charitable organizations in line with the corporation's overall charitable giving guidelines. It allows the board to contribute a specific amount or percentage of the company's profits or assets to support various causes. 2. Specific Charitable Contribution Resolution: Sometimes, a corporation may wish to contribute to a particular charitable organization or cause due to its relevance to the company's mission or values. This resolution focuses on authorizing a one-time donation or a series of donations to a specific recipient, restricting the use of funds solely for that purpose. 3. Matching Gift Charitable Contribution Resolution: Many companies encourage employee philanthropy by offering a matching gift program. This resolution outlines the corporation's commitment to matching charitable contributions made by its employees, providing an incentive for staff members to support charities of their choice. 4. Annual Giving Program Resolution: Some corporations establish an annual giving program that includes a set budget or percentage of revenue to be allocated for charitable donations. This resolution authorizes the board to annually allocate funds to eligible charitable organizations, enabling consistent and strategic giving throughout the year. It is crucial for the board of directors and legal counsel to review and approve any Clark Nevada Corporate Resolution Authorizing a Charitable Contribution carefully. Compliance with state and federal laws, fiduciary duty, and ensuring the contribution positively impacts the community are important considerations when drafting and approving such resolutions.

Clark Nevada Corporate Resolution Authorizing a Charitable Contribution is a legal document that allows a corporation based in Clark County, Nevada, to donate funds or assets to a charitable organization or cause. This resolution serves as an official authorization and ensures that the contribution aligns with the company's bylaws, policies, and the board's consent. It is essential for corporations in Clark Nevada to have a clear and well-drafted corporate resolution when authorizing a charitable contribution. This document outlines important details such as the purpose of the donation and the specific recipient, ensuring transparency and accountability in the decision-making process. Different types of Clark Nevada Corporate Resolutions Authorizing Charitable Contributions may include: 1. General Charitable Contribution Resolution: This resolution is a broad authorization to make donations to charitable organizations in line with the corporation's overall charitable giving guidelines. It allows the board to contribute a specific amount or percentage of the company's profits or assets to support various causes. 2. Specific Charitable Contribution Resolution: Sometimes, a corporation may wish to contribute to a particular charitable organization or cause due to its relevance to the company's mission or values. This resolution focuses on authorizing a one-time donation or a series of donations to a specific recipient, restricting the use of funds solely for that purpose. 3. Matching Gift Charitable Contribution Resolution: Many companies encourage employee philanthropy by offering a matching gift program. This resolution outlines the corporation's commitment to matching charitable contributions made by its employees, providing an incentive for staff members to support charities of their choice. 4. Annual Giving Program Resolution: Some corporations establish an annual giving program that includes a set budget or percentage of revenue to be allocated for charitable donations. This resolution authorizes the board to annually allocate funds to eligible charitable organizations, enabling consistent and strategic giving throughout the year. It is crucial for the board of directors and legal counsel to review and approve any Clark Nevada Corporate Resolution Authorizing a Charitable Contribution carefully. Compliance with state and federal laws, fiduciary duty, and ensuring the contribution positively impacts the community are important considerations when drafting and approving such resolutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.