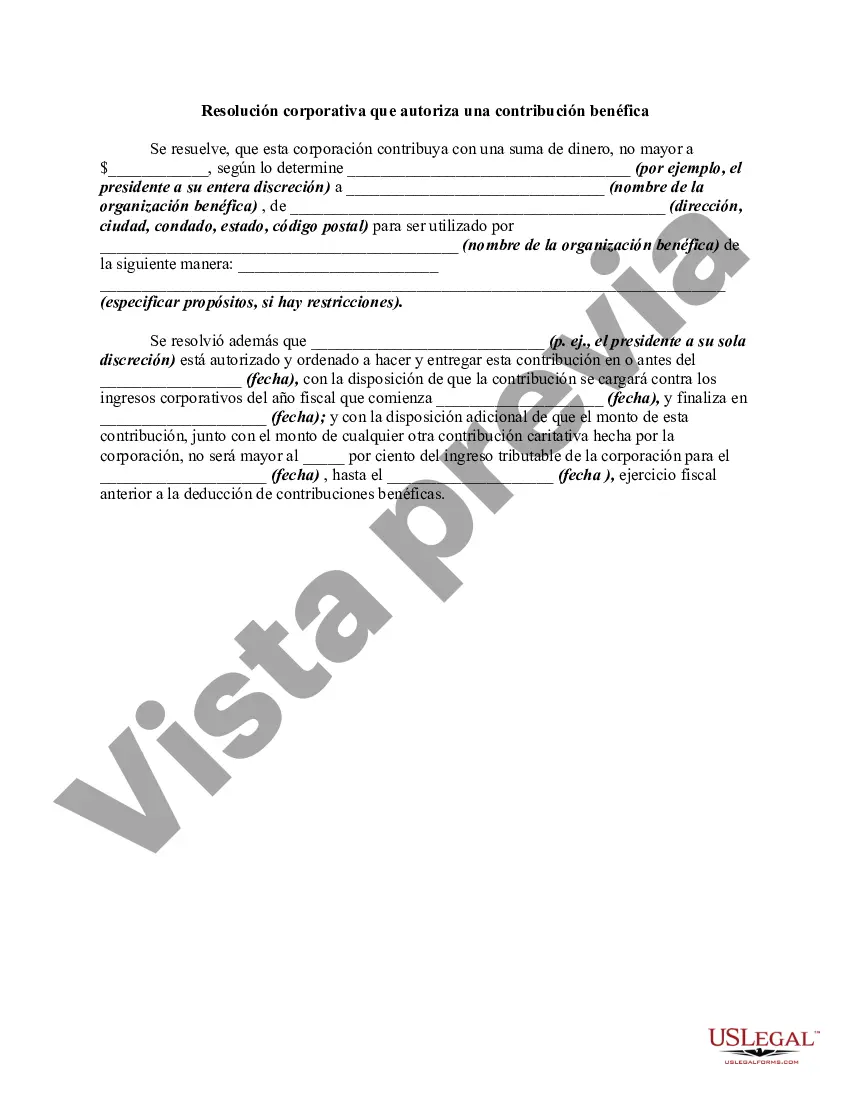

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. A Collin Texas Corporate Resolution Authorizing a Charitable Contribution is a legal document that grants authorization for a corporate entity in Collin County, Texas, to make a charitable contribution. This resolution is crucial for corporations seeking to donate funds or assets to charitable organizations in a way that aligns with their corporate objectives, values, and charitable mission. This resolution typically includes important details such as the name of the corporation, its registered office address, the specific charitable organization or cause that will receive the contribution, and the amount or nature of the contribution. It may also outline any restrictions or conditions associated with the donation, ensuring that the corporation's interests and intentions are duly represented. There are different types of Collin Texas Corporate Resolutions Authorizing a Charitable Contribution that may vary depending on the specific circumstances and requirements of the corporation. These may include: 1. General Charitable Contribution Resolution: This is the most common type of resolution, granting authorization for a corporation to make a charitable contribution without any specific limitations or restrictions. 2. Restricted Charitable Contribution Resolution: This type of resolution includes specific conditions or restrictions on how the charitable contribution can be used. For example, the resolution may specify that the funds should be used for a particular program or project within the charitable organization. 3. In-Kind Charitable Contribution Resolution: Sometimes a corporation may wish to donate goods, services, or other non-monetary assets instead of cash. In this case, an in-kind charitable contribution resolution is used to authorize the donation of these tangible or intangible assets. 4. Annual Charitable Contribution Resolution: This resolution may be employed by corporations with established charitable giving programs. It provides authorization for recurring or annual contributions to one or more charitable organizations, enabling the corporation to specify a predetermined amount or percentage of its profits to be donated. When drafting a Collin Texas Corporate Resolution Authorizing a Charitable Contribution, it is crucial to consult with legal professionals experienced in corporate law and philanthropy to ensure compliance with applicable laws and regulations. This document serves as a formal record of a corporate entity's commitment to philanthropy and can have important legal implications for both the corporation and the charitable organization it supports.

A Collin Texas Corporate Resolution Authorizing a Charitable Contribution is a legal document that grants authorization for a corporate entity in Collin County, Texas, to make a charitable contribution. This resolution is crucial for corporations seeking to donate funds or assets to charitable organizations in a way that aligns with their corporate objectives, values, and charitable mission. This resolution typically includes important details such as the name of the corporation, its registered office address, the specific charitable organization or cause that will receive the contribution, and the amount or nature of the contribution. It may also outline any restrictions or conditions associated with the donation, ensuring that the corporation's interests and intentions are duly represented. There are different types of Collin Texas Corporate Resolutions Authorizing a Charitable Contribution that may vary depending on the specific circumstances and requirements of the corporation. These may include: 1. General Charitable Contribution Resolution: This is the most common type of resolution, granting authorization for a corporation to make a charitable contribution without any specific limitations or restrictions. 2. Restricted Charitable Contribution Resolution: This type of resolution includes specific conditions or restrictions on how the charitable contribution can be used. For example, the resolution may specify that the funds should be used for a particular program or project within the charitable organization. 3. In-Kind Charitable Contribution Resolution: Sometimes a corporation may wish to donate goods, services, or other non-monetary assets instead of cash. In this case, an in-kind charitable contribution resolution is used to authorize the donation of these tangible or intangible assets. 4. Annual Charitable Contribution Resolution: This resolution may be employed by corporations with established charitable giving programs. It provides authorization for recurring or annual contributions to one or more charitable organizations, enabling the corporation to specify a predetermined amount or percentage of its profits to be donated. When drafting a Collin Texas Corporate Resolution Authorizing a Charitable Contribution, it is crucial to consult with legal professionals experienced in corporate law and philanthropy to ensure compliance with applicable laws and regulations. This document serves as a formal record of a corporate entity's commitment to philanthropy and can have important legal implications for both the corporation and the charitable organization it supports.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.