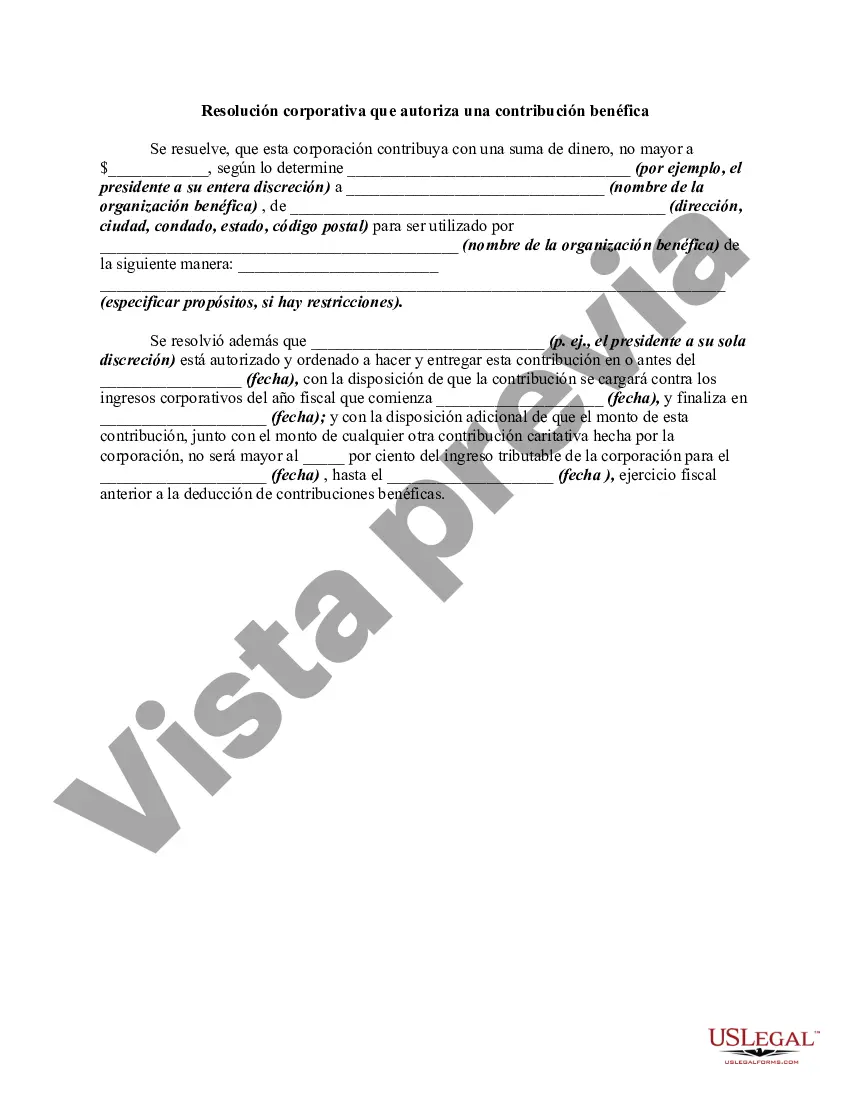

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Title: Understanding Contra Costa California Corporate Resolution Authorizing a Charitable Contribution Introduction: A Contra Costa California Corporate Resolution Authorizing a Charitable Contribution is a legal document used to grant authority for a business entity to make a charitable donation. This detailed description will explain the purpose, requirements, and various types of resolutions related to charitable contributions in Contra Costa County, California. 1. Key Features: — A Corporate Resolution: A formal decision made by a corporation's board of directors or shareholders. — Charitable Contribution: A donation made to a qualified tax-exempt organization for philanthropic or community-oriented purposes. — Contra Costa County: Located in the San Francisco Bay Area, Contra Costa County is known for its numerous businesses and corporate entities. 2. Purpose of the Resolution: The primary purpose of a Contra Costa California Corporate Resolution Authorizing a Charitable Contribution is to legally authorize a specific amount or type of donation. This resolution ensures compliance with corporate governance rules and the California state laws governing charitable contributions. 3. Requirements for a Contra Costa Corporate Resolution: — Identification of the Business: The resolution should clearly state the legal name and address of the corporation. — Description of the Contribution: Specify the amount, form (cash, stock, property, etc.), recipient organization, and purpose of the charitable contribution. — Board Approval: The resolution must be approved by the corporation's board of directors or shareholders in accordance with their bylaws and legal requirements. — Authorizing Officer: Designate an authorized officer or signatory who is empowered to execute the resolution on behalf of the corporation. 4. Types of Contra Costa California Corporate Resolution Authorizing a Charitable Contribution: — General Charitable Contribution Resolution: Grants authority to the corporation to make charitable donations without any specific restrictions. — Annual Giving Resolution: Specifies an amount, budget, or percentage of profits to be donated annually towards charitable causes. — Specific Event/Project Resolution: Authorizes a one-time or periodic contribution to support a particular cause, charity event, or community project. 5. Drafting the Resolution: When drafting a Contra Costa Corporate Resolution, it is advisable to consult legal counsel or use pre-drafted templates, such as those provided by state bar associations or corporate legal service providers. These resources ensure compliance with specific legal requirements and help customize the resolution based on the corporation's objectives. Conclusion: A Contra Costa California Corporate Resolution Authorizing a Charitable Contribution is a vital document that enables corporations in Contra Costa County to make philanthropic contributions in a transparent and legally compliant manner. Understanding the purpose, requirements, and types of resolutions associated with charitable donations ensures that businesses can promote social responsibility while adhering to respective legal obligations.

Title: Understanding Contra Costa California Corporate Resolution Authorizing a Charitable Contribution Introduction: A Contra Costa California Corporate Resolution Authorizing a Charitable Contribution is a legal document used to grant authority for a business entity to make a charitable donation. This detailed description will explain the purpose, requirements, and various types of resolutions related to charitable contributions in Contra Costa County, California. 1. Key Features: — A Corporate Resolution: A formal decision made by a corporation's board of directors or shareholders. — Charitable Contribution: A donation made to a qualified tax-exempt organization for philanthropic or community-oriented purposes. — Contra Costa County: Located in the San Francisco Bay Area, Contra Costa County is known for its numerous businesses and corporate entities. 2. Purpose of the Resolution: The primary purpose of a Contra Costa California Corporate Resolution Authorizing a Charitable Contribution is to legally authorize a specific amount or type of donation. This resolution ensures compliance with corporate governance rules and the California state laws governing charitable contributions. 3. Requirements for a Contra Costa Corporate Resolution: — Identification of the Business: The resolution should clearly state the legal name and address of the corporation. — Description of the Contribution: Specify the amount, form (cash, stock, property, etc.), recipient organization, and purpose of the charitable contribution. — Board Approval: The resolution must be approved by the corporation's board of directors or shareholders in accordance with their bylaws and legal requirements. — Authorizing Officer: Designate an authorized officer or signatory who is empowered to execute the resolution on behalf of the corporation. 4. Types of Contra Costa California Corporate Resolution Authorizing a Charitable Contribution: — General Charitable Contribution Resolution: Grants authority to the corporation to make charitable donations without any specific restrictions. — Annual Giving Resolution: Specifies an amount, budget, or percentage of profits to be donated annually towards charitable causes. — Specific Event/Project Resolution: Authorizes a one-time or periodic contribution to support a particular cause, charity event, or community project. 5. Drafting the Resolution: When drafting a Contra Costa Corporate Resolution, it is advisable to consult legal counsel or use pre-drafted templates, such as those provided by state bar associations or corporate legal service providers. These resources ensure compliance with specific legal requirements and help customize the resolution based on the corporation's objectives. Conclusion: A Contra Costa California Corporate Resolution Authorizing a Charitable Contribution is a vital document that enables corporations in Contra Costa County to make philanthropic contributions in a transparent and legally compliant manner. Understanding the purpose, requirements, and types of resolutions associated with charitable donations ensures that businesses can promote social responsibility while adhering to respective legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.