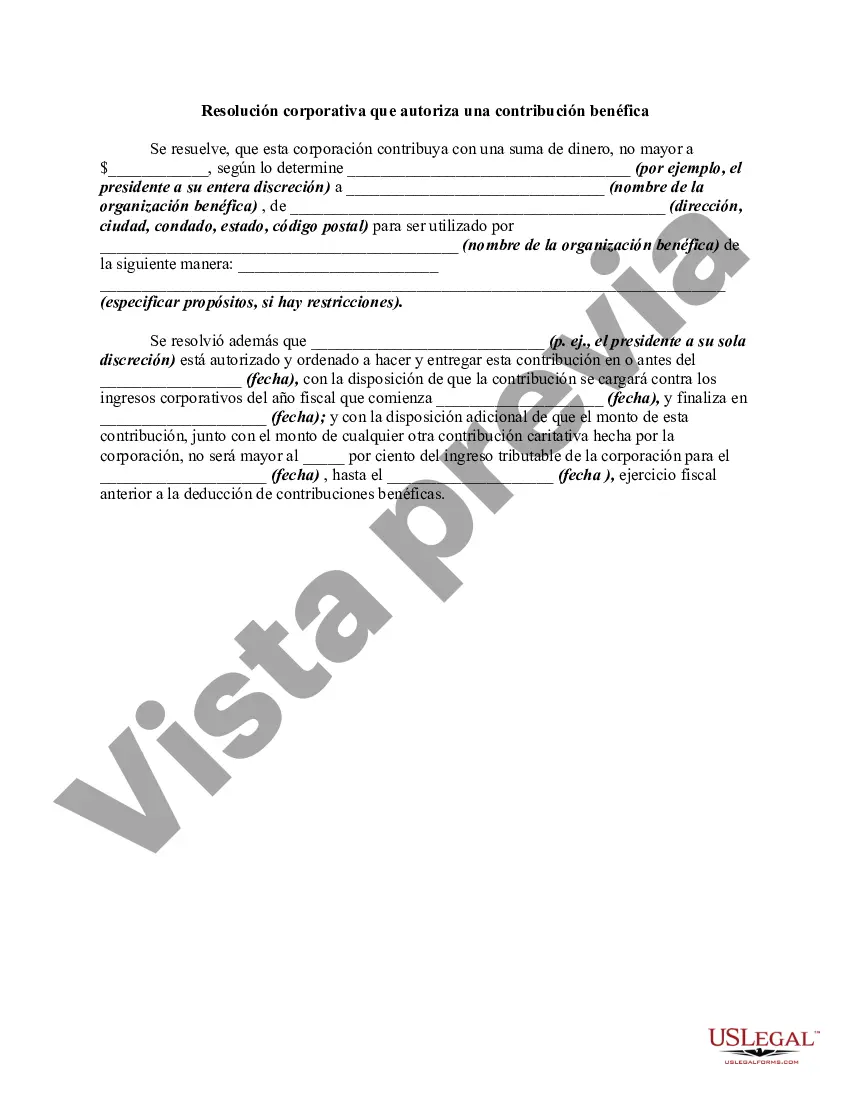

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Fairfax Virginia Corporate Resolution Authorizing a Charitable Contribution is a legal document that affirms a corporate entity's decision to make a monetary donation or contribution to a charitable organization or cause. This resolution is an essential instrument ensuring transparency, legality, and accountability within corporate philanthropy. A Corporate Resolution Authorizing a Charitable Contribution typically includes key information such as the corporation's name, address, and identifying details, the purpose and amount of the charitable contribution, the intended recipient or organization, and a description of the charitable cause or program the contribution will support. In Fairfax, Virginia, various types of Corporate Resolutions Authorizing Charitable Contributions may exist, depending on the specific intent and structure of the contribution. These resolutions can be categorized based on the purpose, type of charitable organization, or the way the contribution will be made. Some common types of Fairfax Virginia Corporate Resolutions Authorizing Charitable Contributions may include: 1. General Charitable Contribution Resolution: This type of resolution authorizes a corporation to make a general charitable contribution to a qualified 501(c)(3) nonprofit organization without specific restrictions or conditions. 2. Program or Project-Specific Charitable Contribution Resolution: This resolution outlines a corporation's authorization to contribute a specific amount to support a particular program, project, or initiative run by a charitable organization. It may specify the purpose, expected outcomes, and timeline for the contribution. 3. Matching Gift Charitable Contribution Resolution: A resolution of this kind allows a corporation to match the charitable contributions made by its employees. It establishes guidelines, limitations, and eligibility criteria for matching funds, such as a maximum contribution amount or a specific percentage match. 4. Grant or Endowment Charitable Contribution Resolution: This resolution enables a corporation to establish an endowment or grant fund to support multiple charitable organizations or initiatives. It may outline the criteria for selecting beneficiaries, the process for evaluating grant proposals, and the maximum amount allocated for grants. 5. In-Kind Contribution Resolution: This resolution authorizes a corporation to donate goods, services, or assets instead of monetary contributions. It specifies the nature and value of the in-kind contribution and the intended recipient organization. Regardless of the specific type, a Fairfax Virginia Corporate Resolution Authorizing a Charitable Contribution serves as legal documentation of a corporation's decision to engage in philanthropic activities. It supports transparency, accountability, and aligns the corporation's objectives with its commitment to giving back to the community.

Fairfax Virginia Corporate Resolution Authorizing a Charitable Contribution is a legal document that affirms a corporate entity's decision to make a monetary donation or contribution to a charitable organization or cause. This resolution is an essential instrument ensuring transparency, legality, and accountability within corporate philanthropy. A Corporate Resolution Authorizing a Charitable Contribution typically includes key information such as the corporation's name, address, and identifying details, the purpose and amount of the charitable contribution, the intended recipient or organization, and a description of the charitable cause or program the contribution will support. In Fairfax, Virginia, various types of Corporate Resolutions Authorizing Charitable Contributions may exist, depending on the specific intent and structure of the contribution. These resolutions can be categorized based on the purpose, type of charitable organization, or the way the contribution will be made. Some common types of Fairfax Virginia Corporate Resolutions Authorizing Charitable Contributions may include: 1. General Charitable Contribution Resolution: This type of resolution authorizes a corporation to make a general charitable contribution to a qualified 501(c)(3) nonprofit organization without specific restrictions or conditions. 2. Program or Project-Specific Charitable Contribution Resolution: This resolution outlines a corporation's authorization to contribute a specific amount to support a particular program, project, or initiative run by a charitable organization. It may specify the purpose, expected outcomes, and timeline for the contribution. 3. Matching Gift Charitable Contribution Resolution: A resolution of this kind allows a corporation to match the charitable contributions made by its employees. It establishes guidelines, limitations, and eligibility criteria for matching funds, such as a maximum contribution amount or a specific percentage match. 4. Grant or Endowment Charitable Contribution Resolution: This resolution enables a corporation to establish an endowment or grant fund to support multiple charitable organizations or initiatives. It may outline the criteria for selecting beneficiaries, the process for evaluating grant proposals, and the maximum amount allocated for grants. 5. In-Kind Contribution Resolution: This resolution authorizes a corporation to donate goods, services, or assets instead of monetary contributions. It specifies the nature and value of the in-kind contribution and the intended recipient organization. Regardless of the specific type, a Fairfax Virginia Corporate Resolution Authorizing a Charitable Contribution serves as legal documentation of a corporation's decision to engage in philanthropic activities. It supports transparency, accountability, and aligns the corporation's objectives with its commitment to giving back to the community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.