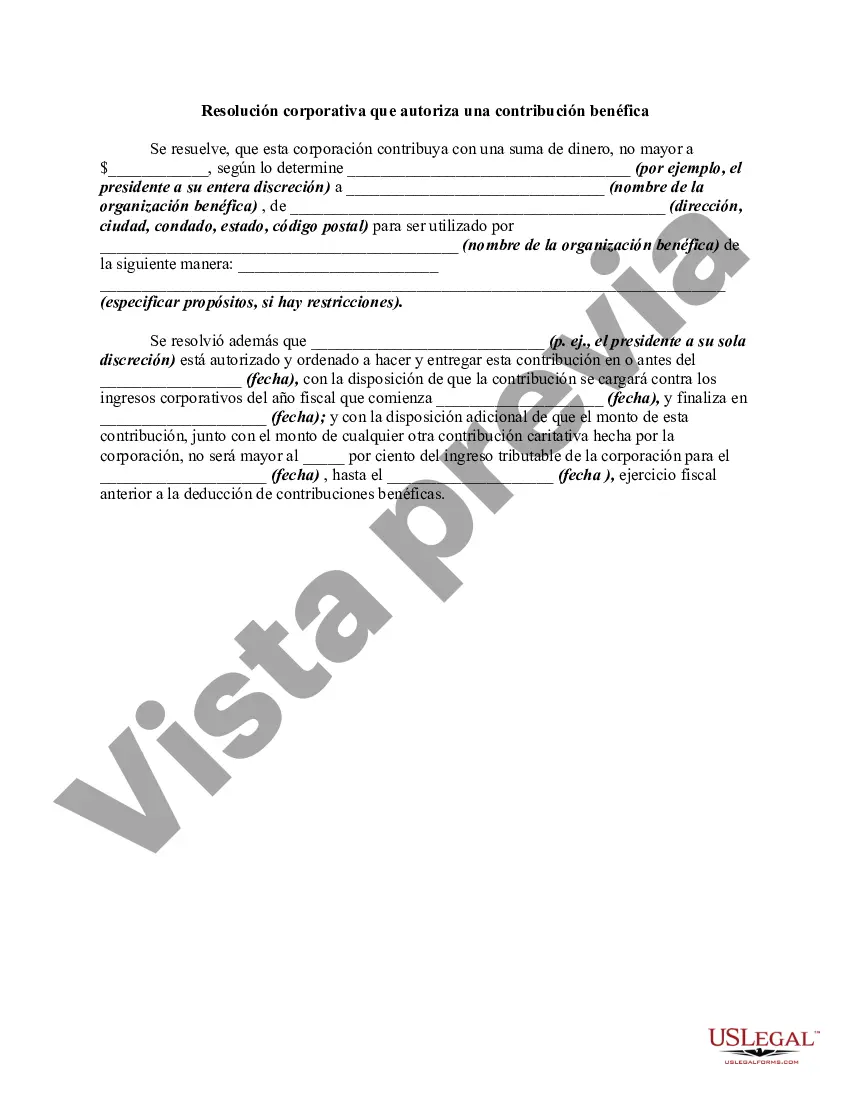

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Franklin Ohio Corporate Resolution Authorizing a Charitable Contribution is a legal document that allows a corporation or organization in Franklin, Ohio to officially approve a donation to a charitable cause or nonprofit organization. This resolution outlines the specific details of the contribution, such as the amount, purpose, and recipient, along with any conditions or restrictions. The resolution typically starts with a statement of the corporation's intent to make a charitable contribution, highlighting the importance of giving back to the community and supporting causes aligned with the company's values. It may also mention any tax benefits or public relations advantages associated with charitable donations. Different types of Franklin Ohio Corporate Resolution Authorizing a Charitable Contribution may include: 1. General Charitable Contribution Resolution: This type of resolution authorizes a corporate entity in Franklin, Ohio to make an overall donation to a charitable organization, without specifying a particular recipient or purpose. The resolution may include a provision allowing the board of directors or executive team to determine the specific recipient(s) at a later time. 2. Specific Charitable Contribution Resolution: In contrast to a general resolution, this type specifically identifies the recipient organization(s) and the purpose of the donation. It outlines the details of the contribution, such as the amount, timeline, and any conditions or restrictions associated with the gift. For example, the resolution may specify that the donation must be used for a particular program or project. 3. Matching Charitable Contribution Resolution: Many corporations in Franklin, Ohio have programs that match their employees' charitable donations. This type of resolution authorizes the corporation to match employees' contributions up to a certain limit, encouraging and amplifying their philanthropic efforts. The resolution may include guidelines for employees to follow in order to qualify for the matching funds. 4. In-Kind Charitable Contribution Resolution: Some resolutions may involve donating goods, services, or other non-monetary assets to charitable organizations. This resolution outlines the specific details of the in-kind contribution, including the nature and value of the donated items, as well as any conditions or requirements associated with the gift. Overall, a Franklin Ohio Corporate Resolution Authorizing a Charitable Contribution provides the necessary legal framework for corporations and organizations to support charitable causes and give back to the community. By having a formal resolution in place, companies can ensure transparency, accountability, and adherence to applicable laws and regulations while making a positive impact on society.

Franklin Ohio Corporate Resolution Authorizing a Charitable Contribution is a legal document that allows a corporation or organization in Franklin, Ohio to officially approve a donation to a charitable cause or nonprofit organization. This resolution outlines the specific details of the contribution, such as the amount, purpose, and recipient, along with any conditions or restrictions. The resolution typically starts with a statement of the corporation's intent to make a charitable contribution, highlighting the importance of giving back to the community and supporting causes aligned with the company's values. It may also mention any tax benefits or public relations advantages associated with charitable donations. Different types of Franklin Ohio Corporate Resolution Authorizing a Charitable Contribution may include: 1. General Charitable Contribution Resolution: This type of resolution authorizes a corporate entity in Franklin, Ohio to make an overall donation to a charitable organization, without specifying a particular recipient or purpose. The resolution may include a provision allowing the board of directors or executive team to determine the specific recipient(s) at a later time. 2. Specific Charitable Contribution Resolution: In contrast to a general resolution, this type specifically identifies the recipient organization(s) and the purpose of the donation. It outlines the details of the contribution, such as the amount, timeline, and any conditions or restrictions associated with the gift. For example, the resolution may specify that the donation must be used for a particular program or project. 3. Matching Charitable Contribution Resolution: Many corporations in Franklin, Ohio have programs that match their employees' charitable donations. This type of resolution authorizes the corporation to match employees' contributions up to a certain limit, encouraging and amplifying their philanthropic efforts. The resolution may include guidelines for employees to follow in order to qualify for the matching funds. 4. In-Kind Charitable Contribution Resolution: Some resolutions may involve donating goods, services, or other non-monetary assets to charitable organizations. This resolution outlines the specific details of the in-kind contribution, including the nature and value of the donated items, as well as any conditions or requirements associated with the gift. Overall, a Franklin Ohio Corporate Resolution Authorizing a Charitable Contribution provides the necessary legal framework for corporations and organizations to support charitable causes and give back to the community. By having a formal resolution in place, companies can ensure transparency, accountability, and adherence to applicable laws and regulations while making a positive impact on society.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.