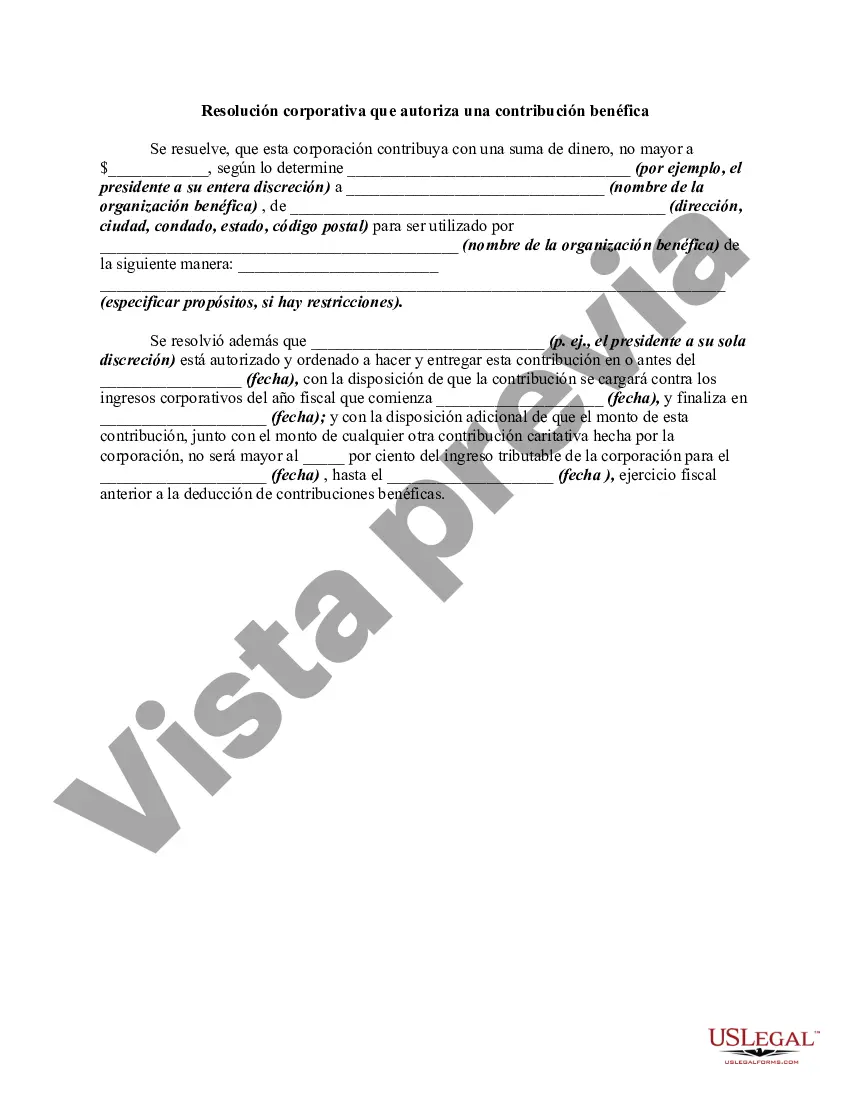

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Hennepin County, Minnesota, Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process for corporations located in Hennepin County, Minnesota, to make charitable contributions. This resolution allows corporations to allocate funds towards charitable organizations or initiatives to support and give back to the community. The resolution serves as a formal authorization by the corporation's board of directors or designated officials, granting permission to make a charitable contribution in alignment with the company's philanthropic goals and values. The Hennepin County Corporate Resolution can come in various types depending on the specific nature of the charitable contribution. Some common types of resolutions may include: 1. Monetary Charitable Contribution Resolution: This resolution authorizes the corporation to donate a specified amount of money to a chosen charitable organization or cause. It outlines the purpose of the contribution, the intended recipient, and any conditions or restrictions that may apply. 2. In-Kind Charitable Contribution Resolution: This resolution permits the corporation to donate goods, products, or services instead of monetary funds. It identifies the items or services to be donated, their estimated value, and the recipient organization. 3. Employee Payroll Deduction Charitable Contribution Resolution: This resolution establishes a system by which employees can voluntarily contribute a portion of their salary to charitable causes. It outlines the logistics, including the percentage or amount eligible for deduction, the designated charities, and the payroll deduction process. 4. Matching Gift Program Resolution: This resolution establishes guidelines for a corporate matching gift program, where the corporation commits to matching employee donations to eligible charitable organizations. It defines the matching ratio, contribution limits, and organizations that qualify for the program. 5. Multi-Year Charitable Contribution Resolution: This type of resolution allows corporations to authorize a recurring charitable contribution over a specific period, such as annually, biennially, or for a set number of years. It outlines the terms, including the contribution amount, recipient organization, and duration of the commitment. Hennepin County, as part of the larger Minneapolis-St. Paul metropolitan area, has a thriving business community. Many corporations in the county recognize the importance of corporate social responsibility and strive to make a positive impact through charitable contributions. The Hennepin County Corporate Resolution Authorizing a Charitable Contribution is a crucial tool that enables these companies to formalize their commitment to philanthropy and support the local community's needs.

Hennepin County, Minnesota, Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process for corporations located in Hennepin County, Minnesota, to make charitable contributions. This resolution allows corporations to allocate funds towards charitable organizations or initiatives to support and give back to the community. The resolution serves as a formal authorization by the corporation's board of directors or designated officials, granting permission to make a charitable contribution in alignment with the company's philanthropic goals and values. The Hennepin County Corporate Resolution can come in various types depending on the specific nature of the charitable contribution. Some common types of resolutions may include: 1. Monetary Charitable Contribution Resolution: This resolution authorizes the corporation to donate a specified amount of money to a chosen charitable organization or cause. It outlines the purpose of the contribution, the intended recipient, and any conditions or restrictions that may apply. 2. In-Kind Charitable Contribution Resolution: This resolution permits the corporation to donate goods, products, or services instead of monetary funds. It identifies the items or services to be donated, their estimated value, and the recipient organization. 3. Employee Payroll Deduction Charitable Contribution Resolution: This resolution establishes a system by which employees can voluntarily contribute a portion of their salary to charitable causes. It outlines the logistics, including the percentage or amount eligible for deduction, the designated charities, and the payroll deduction process. 4. Matching Gift Program Resolution: This resolution establishes guidelines for a corporate matching gift program, where the corporation commits to matching employee donations to eligible charitable organizations. It defines the matching ratio, contribution limits, and organizations that qualify for the program. 5. Multi-Year Charitable Contribution Resolution: This type of resolution allows corporations to authorize a recurring charitable contribution over a specific period, such as annually, biennially, or for a set number of years. It outlines the terms, including the contribution amount, recipient organization, and duration of the commitment. Hennepin County, as part of the larger Minneapolis-St. Paul metropolitan area, has a thriving business community. Many corporations in the county recognize the importance of corporate social responsibility and strive to make a positive impact through charitable contributions. The Hennepin County Corporate Resolution Authorizing a Charitable Contribution is a crucial tool that enables these companies to formalize their commitment to philanthropy and support the local community's needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.