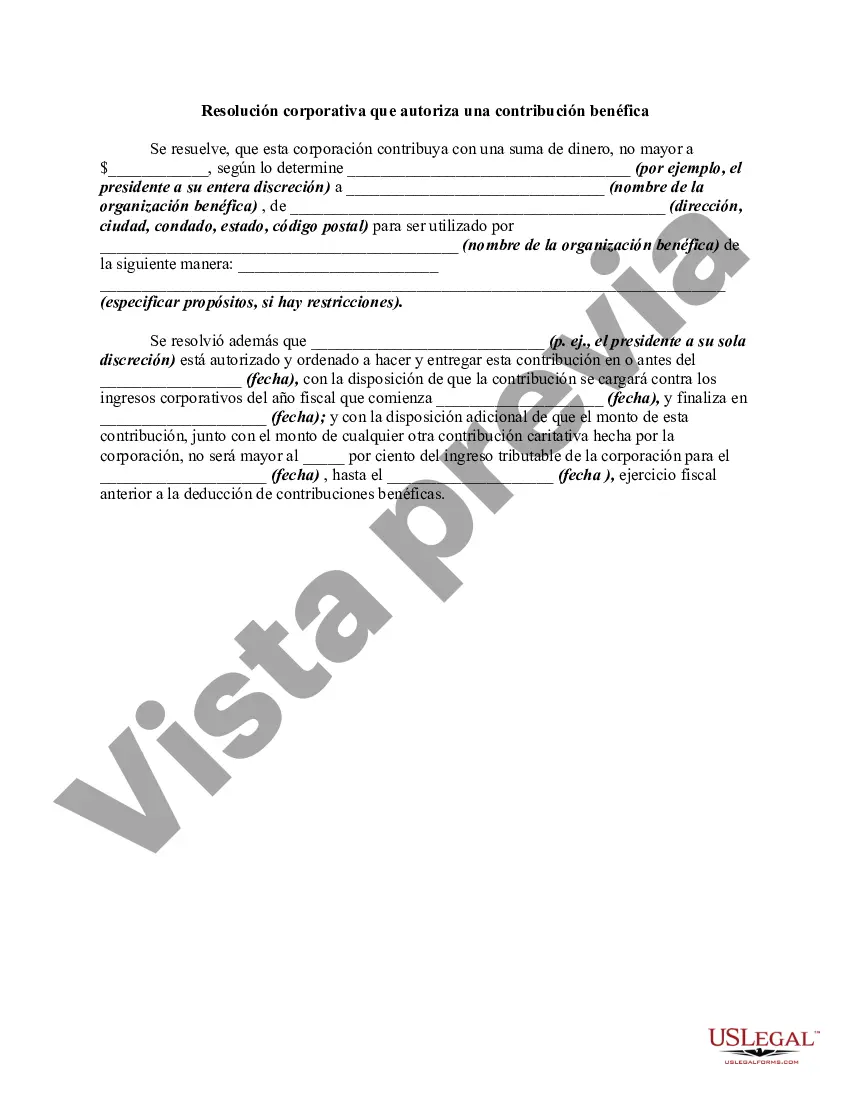

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. A Houston Texas Corporate Resolution Authorizing a Charitable Contribution is a formal and legal document that outlines the decision-making process within a corporate entity for authorizing charitable contributions. This resolution is usually created and adopted by the board of directors or the shareholders of a corporation based in Houston, Texas. The purpose of this resolution is to provide clear guidelines and procedures for approving charitable contributions made by the corporation. It ensures that the decision is in line with the company's objectives, aligns with its values, and complies with any applicable legal requirements. Different types of Houston Texas Corporate Resolution Authorizing a Charitable Contribution may exist based on the nature and scope of the contribution. Some common types include: 1. General Charitable Contribution Resolution: This type of resolution is used when the corporation wishes to make a donation to a charitable organization without any specific purpose or restriction. 2. Specific Charitable Contribution Resolution: In certain cases, corporations may intend to make a contribution to a particular charitable organization or cause. This resolution would outline the specific details, purpose, and conditions of the donation. 3. Matching Gift Program Resolution: Some corporations establish matching gift programs, wherein they pledge to match the charitable contributions made by their employees. This resolution would establish the guidelines and criteria for such a program. 4. Emergency Relief Contribution Resolution: In times of natural disasters, corporate entities may dedicate resources and funds for emergency relief efforts. This resolution would authorize the charitable contribution specifically for these crisis situations. Key elements typically incorporated in a Houston Texas Corporate Resolution Authorizing a Charitable Contribution include: a) Identification of the corporation: The resolution should clearly state the legal name, registered address, and any relevant identification details of the corporation. b) Purpose and objectives: The resolution should outline the purpose of the contribution, whether it is to support a specific cause, foster community engagement, or enhance corporate social responsibility. c) Donation amount and method: The resolution should specify the donation amount or the criteria for determining the contribution. It may also include information on the mode of payment, such as cash, check, or securities. d) Receiver identification: If the resolution pertains to a specific charitable organization, it should clearly identify the recipient, including its legal name, address, and tax-exempt status. e) Approval process: It is crucial to outline the approval process, including who has the authority to initiate and approve the contribution, whether it is the board of directors, shareholders, or a specific committee. The resolution should also specify the number of votes or percentage required for approval. f) Legal compliance: The resolution should acknowledge that the contribution will be made in compliance with all applicable laws, regulations, and internal policies. g) Record keeping: It may be beneficial to include provisions for maintaining appropriate records of the contribution, including receipts, acknowledgments, and other documentation required for tax reporting. In conclusion, a Houston Texas Corporate Resolution Authorizing a Charitable Contribution serves as a formal documentation of a corporation’s decision to donate to charitable causes. By offering clear guidelines, it ensures transparency, accountability, and legal compliance while reflecting the corporation’s commitment to making a positive impact on the community and society at large.

A Houston Texas Corporate Resolution Authorizing a Charitable Contribution is a formal and legal document that outlines the decision-making process within a corporate entity for authorizing charitable contributions. This resolution is usually created and adopted by the board of directors or the shareholders of a corporation based in Houston, Texas. The purpose of this resolution is to provide clear guidelines and procedures for approving charitable contributions made by the corporation. It ensures that the decision is in line with the company's objectives, aligns with its values, and complies with any applicable legal requirements. Different types of Houston Texas Corporate Resolution Authorizing a Charitable Contribution may exist based on the nature and scope of the contribution. Some common types include: 1. General Charitable Contribution Resolution: This type of resolution is used when the corporation wishes to make a donation to a charitable organization without any specific purpose or restriction. 2. Specific Charitable Contribution Resolution: In certain cases, corporations may intend to make a contribution to a particular charitable organization or cause. This resolution would outline the specific details, purpose, and conditions of the donation. 3. Matching Gift Program Resolution: Some corporations establish matching gift programs, wherein they pledge to match the charitable contributions made by their employees. This resolution would establish the guidelines and criteria for such a program. 4. Emergency Relief Contribution Resolution: In times of natural disasters, corporate entities may dedicate resources and funds for emergency relief efforts. This resolution would authorize the charitable contribution specifically for these crisis situations. Key elements typically incorporated in a Houston Texas Corporate Resolution Authorizing a Charitable Contribution include: a) Identification of the corporation: The resolution should clearly state the legal name, registered address, and any relevant identification details of the corporation. b) Purpose and objectives: The resolution should outline the purpose of the contribution, whether it is to support a specific cause, foster community engagement, or enhance corporate social responsibility. c) Donation amount and method: The resolution should specify the donation amount or the criteria for determining the contribution. It may also include information on the mode of payment, such as cash, check, or securities. d) Receiver identification: If the resolution pertains to a specific charitable organization, it should clearly identify the recipient, including its legal name, address, and tax-exempt status. e) Approval process: It is crucial to outline the approval process, including who has the authority to initiate and approve the contribution, whether it is the board of directors, shareholders, or a specific committee. The resolution should also specify the number of votes or percentage required for approval. f) Legal compliance: The resolution should acknowledge that the contribution will be made in compliance with all applicable laws, regulations, and internal policies. g) Record keeping: It may be beneficial to include provisions for maintaining appropriate records of the contribution, including receipts, acknowledgments, and other documentation required for tax reporting. In conclusion, a Houston Texas Corporate Resolution Authorizing a Charitable Contribution serves as a formal documentation of a corporation’s decision to donate to charitable causes. By offering clear guidelines, it ensures transparency, accountability, and legal compliance while reflecting the corporation’s commitment to making a positive impact on the community and society at large.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.