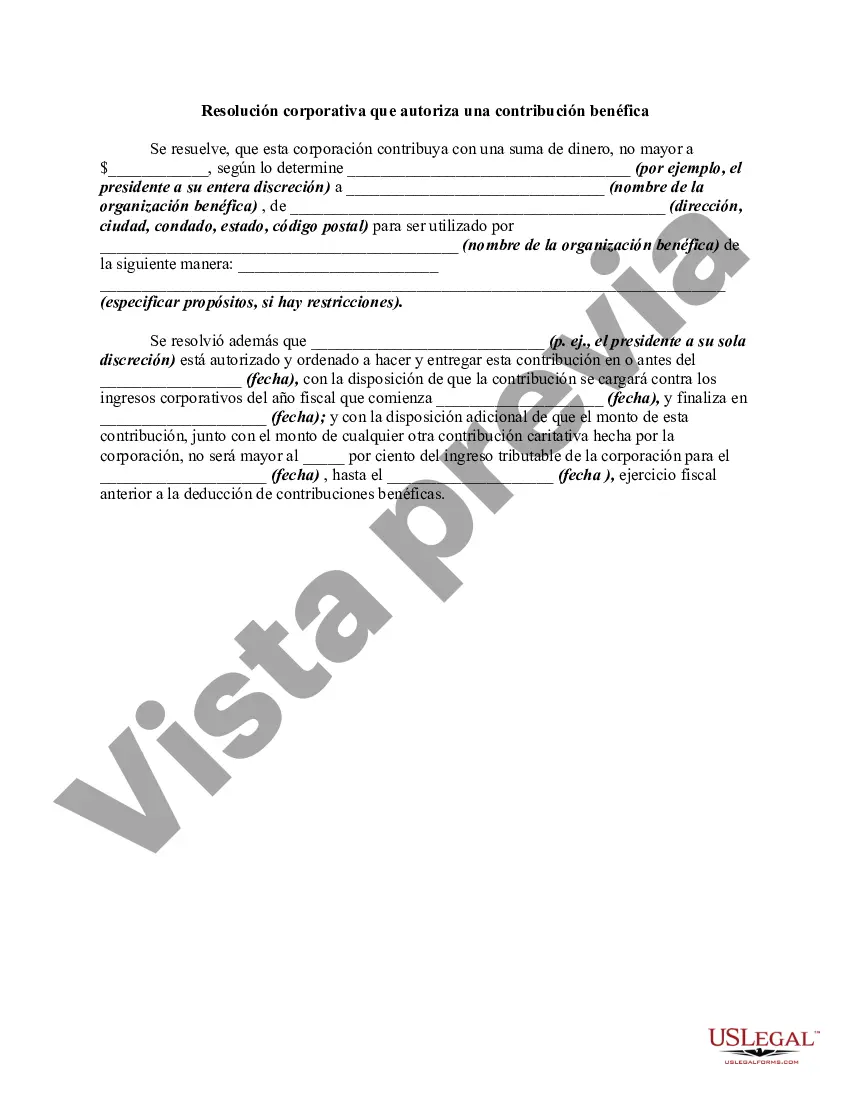

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Maricopa, Arizona Corporate Resolution Authorizing a Charitable Contribution is a legally binding document that outlines the decision-making process for a corporation based in Maricopa, Arizona, to make a charitable contribution. It serves as an official authorization by the board of directors or members of the corporation, indicating their consent and approval to donate a specific amount or asset to a charitable organization or cause. This resolution demonstrates the corporation's philanthropic commitment and desire to give back to the local community or support charitable initiatives aligning with its mission and values. By creating a resolution, the corporation ensures transparency, accountability, and compliance with legal regulations governing charitable contributions. The resolution typically includes the following key elements: 1. Title: Maricopa, Arizona Corporate Resolution Authorizing a Charitable Contribution. 2. Identification: The resolution states the legal name and address of the corporation. Types or Variations of Maricopa, Arizona Corporate Resolution Authorizing a Charitable Contribution may include: 1. General Charitable Contribution Resolution: This type of resolution authorizes the corporation to make a charitable donation without specifying a particular organization or cause. It offers the flexibility to contribute to various charities as determined by the board at a later date. 2. Specific Charitable Contribution Resolution: In contrast to the general resolution, this type specifically names the recipient charitable organization or cause and outlines the amount or asset being donated. It details the purpose, conditions, and restrictions (if any) associated with the contribution. 3. Cash or Asset Contribution Resolution: This resolution distinguishes between cash donations and non-cash donations (such as property, stocks, or intellectual property) and establishes the parameters for each type of contribution. 4. Charitable Matching Contribution Resolution: Some corporations offer matching gift programs to encourage employee giving. This resolution outlines the guidelines for the corporation's matching contribution, including the eligible recipient organizations, maximum matching amounts, and any additional terms or restrictions. 5. Extraordinary Charitable Contribution Resolution: There may be instances when a corporation wishes to make an extraordinary or substantial donation beyond its typical charitable giving. This type of resolution provides a framework for board approval for such contributions, which may require additional legal and financial considerations. It is important to consult with legal professionals and consider the specific requirements of the Maricopa, Arizona jurisdiction while drafting and executing a Corporate Resolution Authorizing a Charitable Contribution. This ensures compliance with state laws, the corporation's bylaws, and tax regulations governing charitable giving.

Maricopa, Arizona Corporate Resolution Authorizing a Charitable Contribution is a legally binding document that outlines the decision-making process for a corporation based in Maricopa, Arizona, to make a charitable contribution. It serves as an official authorization by the board of directors or members of the corporation, indicating their consent and approval to donate a specific amount or asset to a charitable organization or cause. This resolution demonstrates the corporation's philanthropic commitment and desire to give back to the local community or support charitable initiatives aligning with its mission and values. By creating a resolution, the corporation ensures transparency, accountability, and compliance with legal regulations governing charitable contributions. The resolution typically includes the following key elements: 1. Title: Maricopa, Arizona Corporate Resolution Authorizing a Charitable Contribution. 2. Identification: The resolution states the legal name and address of the corporation. Types or Variations of Maricopa, Arizona Corporate Resolution Authorizing a Charitable Contribution may include: 1. General Charitable Contribution Resolution: This type of resolution authorizes the corporation to make a charitable donation without specifying a particular organization or cause. It offers the flexibility to contribute to various charities as determined by the board at a later date. 2. Specific Charitable Contribution Resolution: In contrast to the general resolution, this type specifically names the recipient charitable organization or cause and outlines the amount or asset being donated. It details the purpose, conditions, and restrictions (if any) associated with the contribution. 3. Cash or Asset Contribution Resolution: This resolution distinguishes between cash donations and non-cash donations (such as property, stocks, or intellectual property) and establishes the parameters for each type of contribution. 4. Charitable Matching Contribution Resolution: Some corporations offer matching gift programs to encourage employee giving. This resolution outlines the guidelines for the corporation's matching contribution, including the eligible recipient organizations, maximum matching amounts, and any additional terms or restrictions. 5. Extraordinary Charitable Contribution Resolution: There may be instances when a corporation wishes to make an extraordinary or substantial donation beyond its typical charitable giving. This type of resolution provides a framework for board approval for such contributions, which may require additional legal and financial considerations. It is important to consult with legal professionals and consider the specific requirements of the Maricopa, Arizona jurisdiction while drafting and executing a Corporate Resolution Authorizing a Charitable Contribution. This ensures compliance with state laws, the corporation's bylaws, and tax regulations governing charitable giving.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.