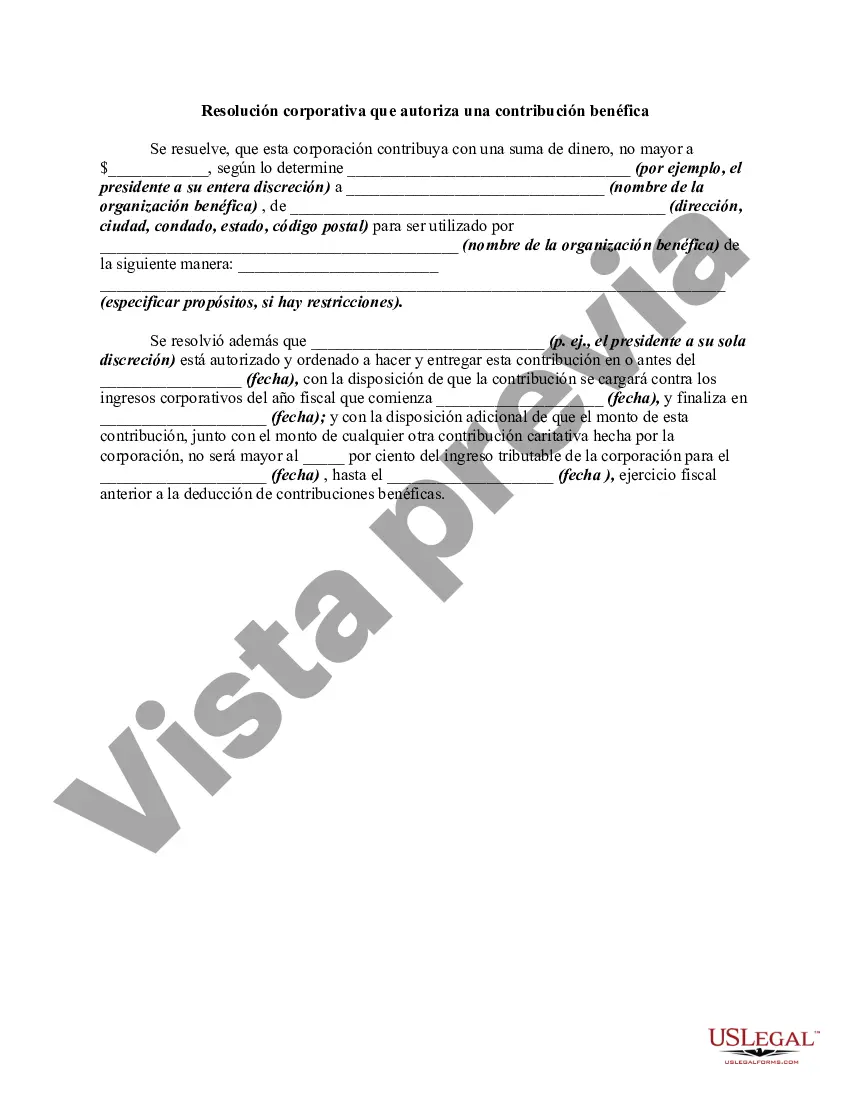

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution is a legal document that enables corporations based in Philadelphia to authorize and make a monetary donation to a charitable organization or cause. This resolution outlines the decision-making process and formal approval required within the corporation to make such contributions, ensuring compliance with the applicable laws and regulations. Keywords: Philadelphia Pennsylvania, corporate resolution, charitable contribution, legal document, monetary donation, charitable organization, decision-making process, formal approval, compliance, laws, regulations. There are several types of Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution, including: 1. General Charitable Contribution Resolution: This type of resolution authorizes the corporation to donate funds to a charitable organization without specifying any particular cause or recipient. It provides flexibility for the corporation to support various charitable purposes as deemed appropriate. 2. Specific Charitable Contribution Resolution: This resolution is used when the corporation intends to make a donation to a specific charitable organization or cause. It outlines the details of the recipient organization, the purpose of the contribution, and any restrictions or conditions associated with the donation. 3. Annual Charitable Contribution Resolution: Some corporations may adopt an annual resolution to authorize a predetermined amount or a percentage of their profits to be contributed to charitable causes throughout the fiscal year. This resolution ensures a consistent commitment to charitable giving by the corporation. 4. Emergency Charitable Contribution Resolution: In certain unforeseen circumstances, such as natural disasters or humanitarian crises, corporations may need to make an immediate charitable contribution. This resolution allows quick authorization and allocation of funds for emergency relief purposes. Regardless of the type, each Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution should include essential components. These include the purpose of the resolution, justification for the contribution, the specified amount or method of determining the donation, the designated recipient, the authority within the corporation responsible for overseeing the process, and the approval process required from relevant corporate officials or board members. Overall, Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution plays a crucial role in guiding and regulating corporate giving, emphasizing transparency and accountability while supporting the corporation's philanthropic endeavors.

Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution is a legal document that enables corporations based in Philadelphia to authorize and make a monetary donation to a charitable organization or cause. This resolution outlines the decision-making process and formal approval required within the corporation to make such contributions, ensuring compliance with the applicable laws and regulations. Keywords: Philadelphia Pennsylvania, corporate resolution, charitable contribution, legal document, monetary donation, charitable organization, decision-making process, formal approval, compliance, laws, regulations. There are several types of Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution, including: 1. General Charitable Contribution Resolution: This type of resolution authorizes the corporation to donate funds to a charitable organization without specifying any particular cause or recipient. It provides flexibility for the corporation to support various charitable purposes as deemed appropriate. 2. Specific Charitable Contribution Resolution: This resolution is used when the corporation intends to make a donation to a specific charitable organization or cause. It outlines the details of the recipient organization, the purpose of the contribution, and any restrictions or conditions associated with the donation. 3. Annual Charitable Contribution Resolution: Some corporations may adopt an annual resolution to authorize a predetermined amount or a percentage of their profits to be contributed to charitable causes throughout the fiscal year. This resolution ensures a consistent commitment to charitable giving by the corporation. 4. Emergency Charitable Contribution Resolution: In certain unforeseen circumstances, such as natural disasters or humanitarian crises, corporations may need to make an immediate charitable contribution. This resolution allows quick authorization and allocation of funds for emergency relief purposes. Regardless of the type, each Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution should include essential components. These include the purpose of the resolution, justification for the contribution, the specified amount or method of determining the donation, the designated recipient, the authority within the corporation responsible for overseeing the process, and the approval process required from relevant corporate officials or board members. Overall, Philadelphia Pennsylvania Corporate Resolution Authorizing a Charitable Contribution plays a crucial role in guiding and regulating corporate giving, emphasizing transparency and accountability while supporting the corporation's philanthropic endeavors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.