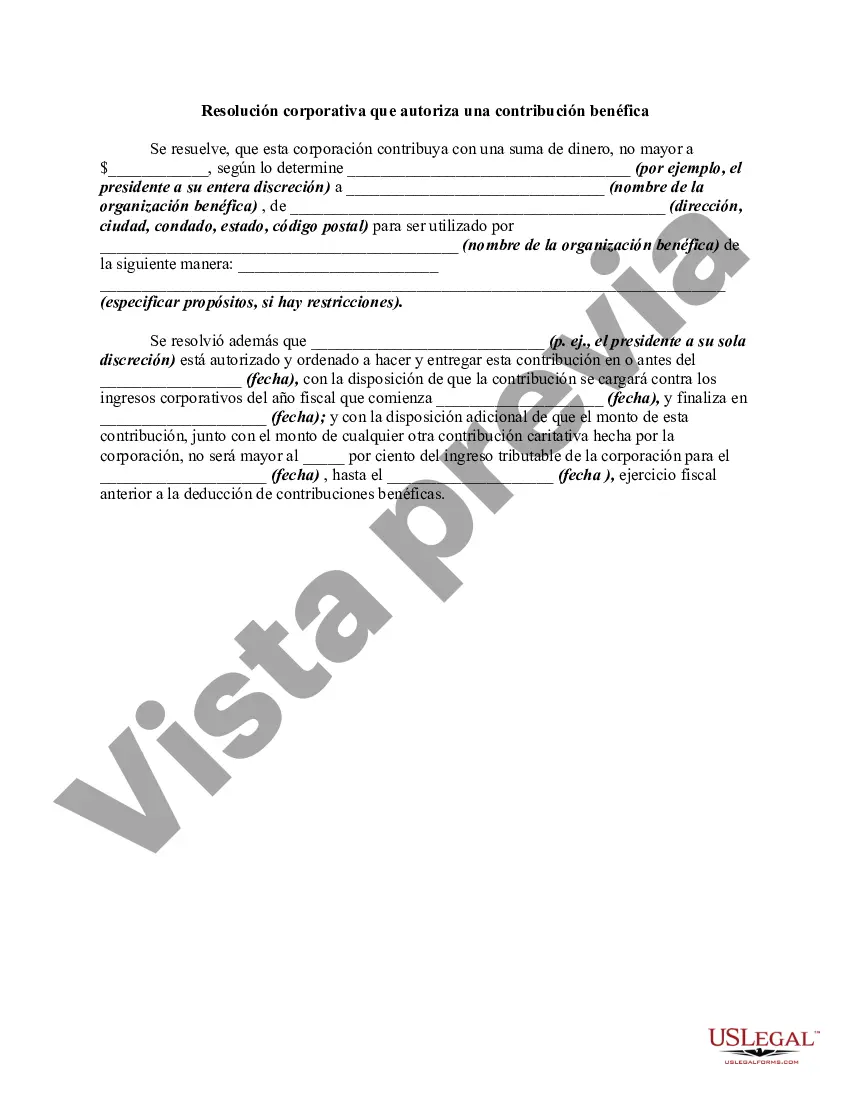

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Riverside, California Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process and approval of a corporate philanthropic donation in Riverside, California. This resolution allows corporations to contribute to charitable causes and support nonprofit organizations within the region. It demonstrates the commitment of businesses in Riverside to giving back and making a positive impact on the local community. There can be various types of Riverside California Corporate Resolution Authorizing a Charitable Contribution, depending on the specific nature of the donation. Here are a few examples: 1. Monetary Donation: This resolution authorizes a corporation to provide a financial contribution to a specific charitable organization or cause in Riverside, California. The resolution typically outlines the amount of the donation, the recipient organization or cause, and any other relevant details related to the contribution process. 2. In-Kind Donation: Sometimes, instead of financial support, businesses may choose to donate goods, services, or assets to a charitable cause. This type of resolution authorizes the transfer of such non-monetary donations to a specific organization or purpose in Riverside, California, ensuring proper documentation and authorization. 3. Volunteer Support Authorization: In addition to monetary or in-kind donations, corporations may encourage their employees to volunteer their time and skills for community service. This type of resolution allows the company to commit resources and provide employees with paid time off or other incentives to participate in charitable activities. 4. Matching Contribution: Corporations may offer a matching gift program, where they match the donations made by their employees to eligible charitable organizations. This resolution enables the corporation to establish the terms and conditions for the matching gift program, including maximum limits, eligible organizations, and verification processes. 5. Donor-Advised Fund Contribution: This type of resolution authorizes a corporation to contribute to a donor-advised fund, a charitable giving vehicle that provides individuals or businesses with flexibility in distributing their donations. The resolution outlines the intention to establish or contribute to a donor-advised fund for prioritizing future charitable disbursements. These variations of Riverside California Corporate Resolution Authorizing a Charitable Contribution ensure that corporations can choose the most appropriate form of support to fulfill their philanthropic goals while complying with legal requirements and demonstrating transparency in their contributions to the Riverside community.

Riverside, California Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process and approval of a corporate philanthropic donation in Riverside, California. This resolution allows corporations to contribute to charitable causes and support nonprofit organizations within the region. It demonstrates the commitment of businesses in Riverside to giving back and making a positive impact on the local community. There can be various types of Riverside California Corporate Resolution Authorizing a Charitable Contribution, depending on the specific nature of the donation. Here are a few examples: 1. Monetary Donation: This resolution authorizes a corporation to provide a financial contribution to a specific charitable organization or cause in Riverside, California. The resolution typically outlines the amount of the donation, the recipient organization or cause, and any other relevant details related to the contribution process. 2. In-Kind Donation: Sometimes, instead of financial support, businesses may choose to donate goods, services, or assets to a charitable cause. This type of resolution authorizes the transfer of such non-monetary donations to a specific organization or purpose in Riverside, California, ensuring proper documentation and authorization. 3. Volunteer Support Authorization: In addition to monetary or in-kind donations, corporations may encourage their employees to volunteer their time and skills for community service. This type of resolution allows the company to commit resources and provide employees with paid time off or other incentives to participate in charitable activities. 4. Matching Contribution: Corporations may offer a matching gift program, where they match the donations made by their employees to eligible charitable organizations. This resolution enables the corporation to establish the terms and conditions for the matching gift program, including maximum limits, eligible organizations, and verification processes. 5. Donor-Advised Fund Contribution: This type of resolution authorizes a corporation to contribute to a donor-advised fund, a charitable giving vehicle that provides individuals or businesses with flexibility in distributing their donations. The resolution outlines the intention to establish or contribute to a donor-advised fund for prioritizing future charitable disbursements. These variations of Riverside California Corporate Resolution Authorizing a Charitable Contribution ensure that corporations can choose the most appropriate form of support to fulfill their philanthropic goals while complying with legal requirements and demonstrating transparency in their contributions to the Riverside community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.