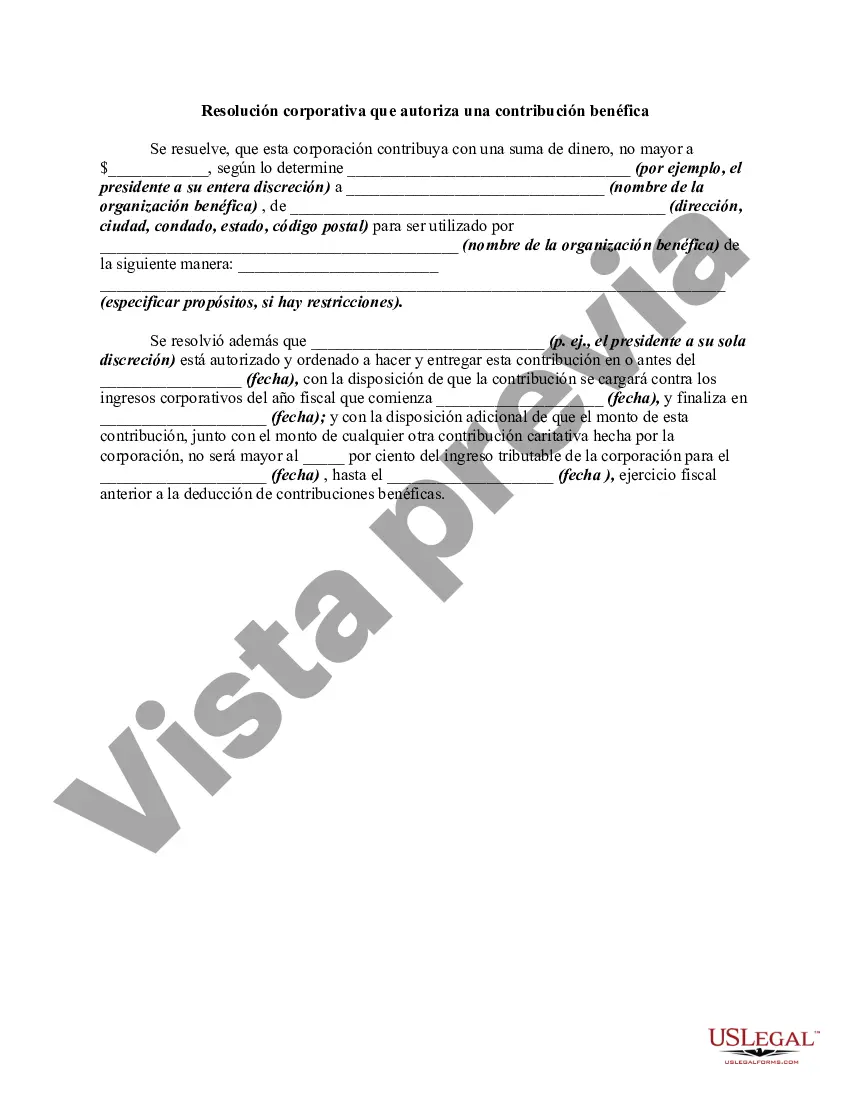

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Salt Lake Utah Corporate Resolution Authorizing a Charitable Contribution is a legally binding document that outlines the decision-making process within a corporate entity located in Salt Lake, Utah, regarding making a charitable contribution. This document serves as official proof of the corporation's approval to donate funds or assets to a nonprofit organization or a charitable cause. Keywords: Salt Lake, Utah, corporate resolution, charitable contribution, legally binding, decision-making process, corporate entity, nonprofit organization, donate funds, assets, official proof, approval. Types of Salt Lake Utah Corporate Resolution Authorizing a Charitable Contribution: 1. One-Time Charitable Contribution: This type of resolution authorizes a corporate entity in Salt Lake, Utah, to make a single donation of a specific amount or assets to a charitable cause or nonprofit organization. It may include the purpose of the contribution, the amount or assets being donated, and any restrictions or conditions placed on the donation. 2. Recurring Charitable Contribution: This type of resolution authorizes a corporate entity in Salt Lake, Utah, to make a regular or periodic donation to a specific charitable cause or nonprofit organization. It outlines the frequency, amount, and duration of the contributions, as well as any guidelines or restrictions associated with them. 3. Matching Gift Program Resolution: Some corporations establish matching gift programs to encourage employee philanthropy. This type of resolution authorizes the corporate entity in Salt Lake, Utah, to match its employees' charitable contributions up to a certain limit. It includes guidelines for employee eligibility, the contribution matching policy, and the process for verifying and disbursing the matching donations. 4. Charitable Sponsorship Resolution: This type of resolution authorizes a corporate entity in Salt Lake, Utah, to sponsor a specific event, program, or initiative organized by a nonprofit organization or a charitable cause. It outlines the sponsorship terms, including the financial commitment, promotional opportunities, and any benefits or recognition the corporation expects in return. 5. In-Kind Charitable Contribution Resolution: In addition to monetary donations, corporations in Salt Lake, Utah, may also authorize in-kind contributions, such as goods or services. This type of resolution outlines the nature, value, and purpose of the in-kind contribution, as well as any related conditions or restrictions. 6. Board Approval Resolution: In some cases, a corporate entity in Salt Lake, Utah, may require a formal board approval for significant charitable contributions. This resolution details the reasons behind the proposed contribution, presents financial justifications, and seeks the board's endorsement to proceed with the donation. Overall, these different types of Salt Lake Utah Corporate Resolution Authorizing a Charitable Contribution cater to various scenarios and specific needs of corporate entities in Salt Lake, Utah, when deciding to support charitable causes or nonprofit organizations. They ensure transparency, accountability, and alignment with the corporation's mission and values while engaging in philanthropic activities.

Salt Lake Utah Corporate Resolution Authorizing a Charitable Contribution is a legally binding document that outlines the decision-making process within a corporate entity located in Salt Lake, Utah, regarding making a charitable contribution. This document serves as official proof of the corporation's approval to donate funds or assets to a nonprofit organization or a charitable cause. Keywords: Salt Lake, Utah, corporate resolution, charitable contribution, legally binding, decision-making process, corporate entity, nonprofit organization, donate funds, assets, official proof, approval. Types of Salt Lake Utah Corporate Resolution Authorizing a Charitable Contribution: 1. One-Time Charitable Contribution: This type of resolution authorizes a corporate entity in Salt Lake, Utah, to make a single donation of a specific amount or assets to a charitable cause or nonprofit organization. It may include the purpose of the contribution, the amount or assets being donated, and any restrictions or conditions placed on the donation. 2. Recurring Charitable Contribution: This type of resolution authorizes a corporate entity in Salt Lake, Utah, to make a regular or periodic donation to a specific charitable cause or nonprofit organization. It outlines the frequency, amount, and duration of the contributions, as well as any guidelines or restrictions associated with them. 3. Matching Gift Program Resolution: Some corporations establish matching gift programs to encourage employee philanthropy. This type of resolution authorizes the corporate entity in Salt Lake, Utah, to match its employees' charitable contributions up to a certain limit. It includes guidelines for employee eligibility, the contribution matching policy, and the process for verifying and disbursing the matching donations. 4. Charitable Sponsorship Resolution: This type of resolution authorizes a corporate entity in Salt Lake, Utah, to sponsor a specific event, program, or initiative organized by a nonprofit organization or a charitable cause. It outlines the sponsorship terms, including the financial commitment, promotional opportunities, and any benefits or recognition the corporation expects in return. 5. In-Kind Charitable Contribution Resolution: In addition to monetary donations, corporations in Salt Lake, Utah, may also authorize in-kind contributions, such as goods or services. This type of resolution outlines the nature, value, and purpose of the in-kind contribution, as well as any related conditions or restrictions. 6. Board Approval Resolution: In some cases, a corporate entity in Salt Lake, Utah, may require a formal board approval for significant charitable contributions. This resolution details the reasons behind the proposed contribution, presents financial justifications, and seeks the board's endorsement to proceed with the donation. Overall, these different types of Salt Lake Utah Corporate Resolution Authorizing a Charitable Contribution cater to various scenarios and specific needs of corporate entities in Salt Lake, Utah, when deciding to support charitable causes or nonprofit organizations. They ensure transparency, accountability, and alignment with the corporation's mission and values while engaging in philanthropic activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.