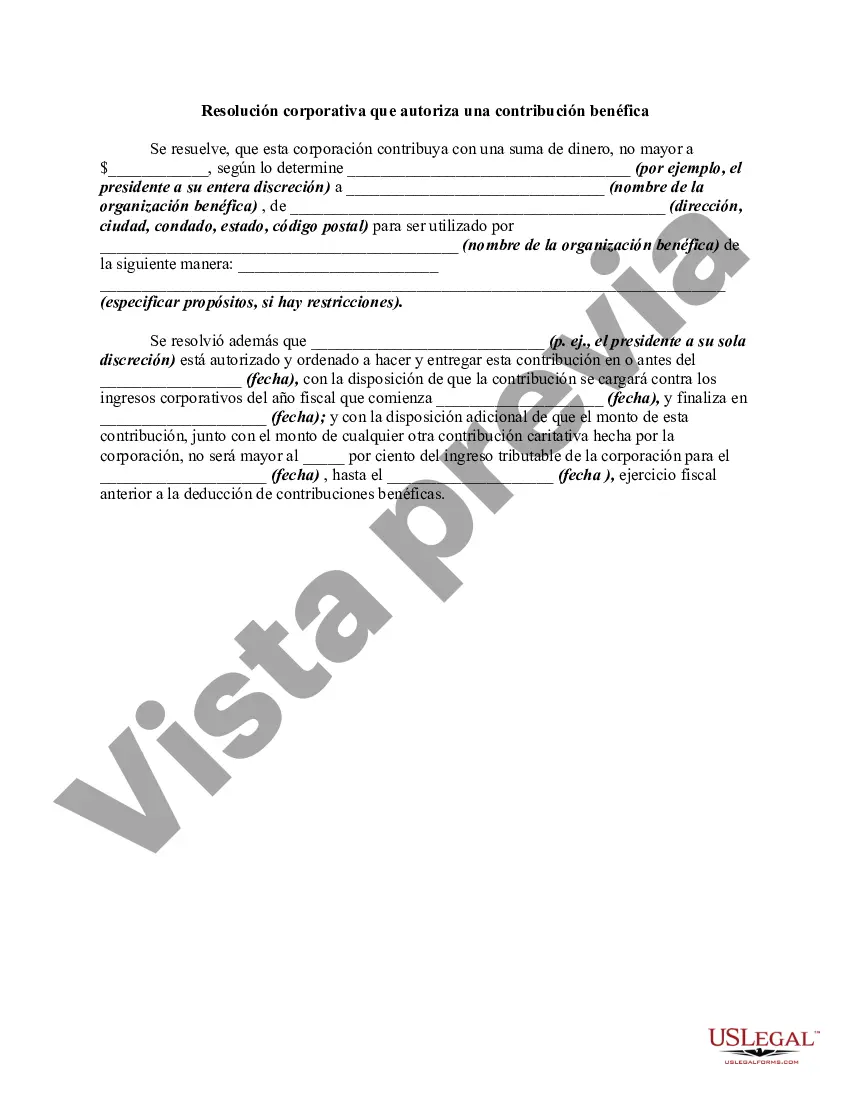

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. San Jose, California Corporate Resolution Authorizing a Charitable Contribution refers to a legal document drafted by corporations in the city of San Jose, California, to authorize and formalize a donation made to a charitable organization. This resolution typically outlines the details of the contribution, including the amount, purpose, recipient, and any special conditions or requirements. Corporate entities in San Jose commonly employ resolutions of this nature to support various charitable causes and make a positive impact in their community. By utilizing this resolution, corporations demonstrate their commitment to corporate social responsibility and philanthropic efforts. Some different types of San Jose California Corporate Resolution Authorizing a Charitable Contribution may include: 1. Monetary Contribution Resolution: This type of resolution authorizes the donation of a specific amount of money to a designated charitable organization. It usually details the purpose of the contribution and may require the recipient organization to provide documentation or acknowledgment of the donation. 2. In-Kind Contribution Resolution: In addition to monetary donations, corporations may also opt to make in-kind contributions. This resolution outlines the specific non-monetary items or services being donated to a charitable organization, such as goods, equipment, or professional services. 3. Employee Matching Gift Resolution: Many corporations have employee-matching gift programs where they match their employees' charitable donations. This resolution formalizes the process of authorizing and approving such matching gifts, stating the parameters and conditions for the employer's contribution. 4. Multi-Year Pledge Resolution: In certain cases, a corporation may commit to making a charitable contribution over several years rather than in a single installment. This resolution specifies the terms and conditions of the multi-year pledge, including the annual donation amount, the charitable organization, and any additional requirements or milestones. 5. Strategic Partnership Resolution: Occasionally, corporations may form strategic partnerships with specific charitable organizations. This resolution outlines the terms of the partnership, including the scope of activities, financial support, and mutual commitments. It serves as a formal agreement between the corporation and the charitable entity to ensure transparency and align the objectives of both parties. In summary, San Jose, California Corporate Resolution Authorizing a Charitable Contribution is a legal document that corporations in the city used to approve, regulate, and formalize their charitable donations. Various types of resolutions exist depending on the nature of the contribution, such as monetary donations, in-kind contributions, employee matching gifts, multi-year pledges, and strategic partnerships. These resolutions showcase corporate social responsibility and serve as a testament to the commitment of San Jose corporations in making a positive impact in their community.

San Jose, California Corporate Resolution Authorizing a Charitable Contribution refers to a legal document drafted by corporations in the city of San Jose, California, to authorize and formalize a donation made to a charitable organization. This resolution typically outlines the details of the contribution, including the amount, purpose, recipient, and any special conditions or requirements. Corporate entities in San Jose commonly employ resolutions of this nature to support various charitable causes and make a positive impact in their community. By utilizing this resolution, corporations demonstrate their commitment to corporate social responsibility and philanthropic efforts. Some different types of San Jose California Corporate Resolution Authorizing a Charitable Contribution may include: 1. Monetary Contribution Resolution: This type of resolution authorizes the donation of a specific amount of money to a designated charitable organization. It usually details the purpose of the contribution and may require the recipient organization to provide documentation or acknowledgment of the donation. 2. In-Kind Contribution Resolution: In addition to monetary donations, corporations may also opt to make in-kind contributions. This resolution outlines the specific non-monetary items or services being donated to a charitable organization, such as goods, equipment, or professional services. 3. Employee Matching Gift Resolution: Many corporations have employee-matching gift programs where they match their employees' charitable donations. This resolution formalizes the process of authorizing and approving such matching gifts, stating the parameters and conditions for the employer's contribution. 4. Multi-Year Pledge Resolution: In certain cases, a corporation may commit to making a charitable contribution over several years rather than in a single installment. This resolution specifies the terms and conditions of the multi-year pledge, including the annual donation amount, the charitable organization, and any additional requirements or milestones. 5. Strategic Partnership Resolution: Occasionally, corporations may form strategic partnerships with specific charitable organizations. This resolution outlines the terms of the partnership, including the scope of activities, financial support, and mutual commitments. It serves as a formal agreement between the corporation and the charitable entity to ensure transparency and align the objectives of both parties. In summary, San Jose, California Corporate Resolution Authorizing a Charitable Contribution is a legal document that corporations in the city used to approve, regulate, and formalize their charitable donations. Various types of resolutions exist depending on the nature of the contribution, such as monetary donations, in-kind contributions, employee matching gifts, multi-year pledges, and strategic partnerships. These resolutions showcase corporate social responsibility and serve as a testament to the commitment of San Jose corporations in making a positive impact in their community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.