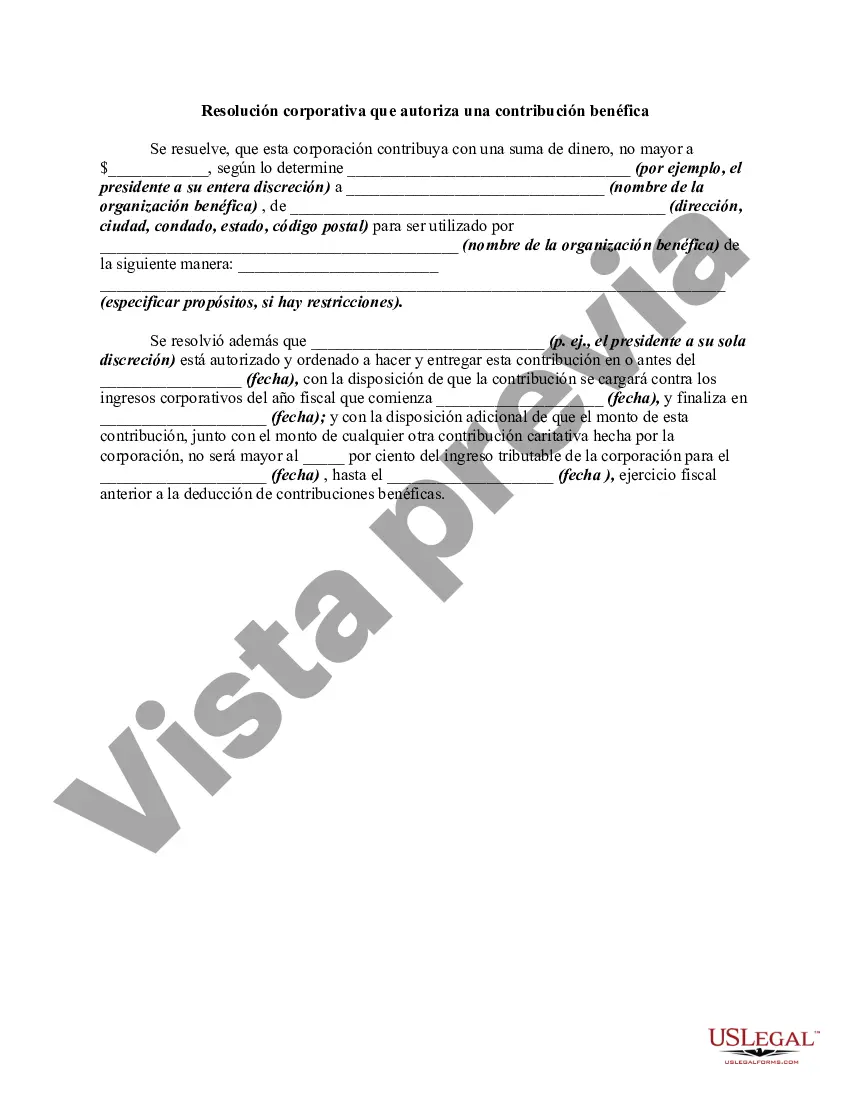

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. A Suffolk New York Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process and approval of a charitable donation by a corporation operating in Suffolk County, New York. This resolution serves as evidence of the corporation's intent to make a charitable contribution and ensures compliance with internal policies and legal requirements. The resolution typically includes key information such as the corporation's name, address, and relevant legal information, as well as the specific purpose of the donation and the chosen charitable organization. It details the amount or property to be donated, any specific conditions or restrictions attached to the contribution, and the authorization of persons responsible for executing the donation on behalf of the corporation. Different types of Suffolk New York Corporate Resolutions Authorizing Charitable Contributions may exist based on varying circumstances or preferences of corporations. Some of these types or variations include: 1. General Charitable Contribution Resolution: This is the most common type, authorizing a corporation to make a charitable contribution to a specific organization or cause without any further restrictions. 2. Restricted Charitable Contribution Resolution: In certain cases, a corporation may wish to limit the use or purpose of the donation. This resolution outlines the specific restrictions, such as allocating funds for a particular project, scholarship, or research. 3. Matching Gift Program Resolution: Many corporations offer matching gift programs to encourage employee donations. This resolution establishes the guidelines and procedures for matching donations made by employees to eligible charitable organizations. 4. Corporate Foundation Resolution: Some corporations establish their foundations to support charitable causes. This resolution lays out the framework for the foundation's activities, including donation criteria, decision-making processes, and governance. It is crucial for corporations to draft and adopt these resolutions in compliance with legal requirements and align them with their corporate bylaws or operating agreements. Seeking legal advice to ensure accuracy and compliance is recommended. By doing so, corporations can enhance transparency, demonstrate their commitment to corporate social responsibility, and foster positive relationships with the local community and charitable organizations.

A Suffolk New York Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process and approval of a charitable donation by a corporation operating in Suffolk County, New York. This resolution serves as evidence of the corporation's intent to make a charitable contribution and ensures compliance with internal policies and legal requirements. The resolution typically includes key information such as the corporation's name, address, and relevant legal information, as well as the specific purpose of the donation and the chosen charitable organization. It details the amount or property to be donated, any specific conditions or restrictions attached to the contribution, and the authorization of persons responsible for executing the donation on behalf of the corporation. Different types of Suffolk New York Corporate Resolutions Authorizing Charitable Contributions may exist based on varying circumstances or preferences of corporations. Some of these types or variations include: 1. General Charitable Contribution Resolution: This is the most common type, authorizing a corporation to make a charitable contribution to a specific organization or cause without any further restrictions. 2. Restricted Charitable Contribution Resolution: In certain cases, a corporation may wish to limit the use or purpose of the donation. This resolution outlines the specific restrictions, such as allocating funds for a particular project, scholarship, or research. 3. Matching Gift Program Resolution: Many corporations offer matching gift programs to encourage employee donations. This resolution establishes the guidelines and procedures for matching donations made by employees to eligible charitable organizations. 4. Corporate Foundation Resolution: Some corporations establish their foundations to support charitable causes. This resolution lays out the framework for the foundation's activities, including donation criteria, decision-making processes, and governance. It is crucial for corporations to draft and adopt these resolutions in compliance with legal requirements and align them with their corporate bylaws or operating agreements. Seeking legal advice to ensure accuracy and compliance is recommended. By doing so, corporations can enhance transparency, demonstrate their commitment to corporate social responsibility, and foster positive relationships with the local community and charitable organizations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.