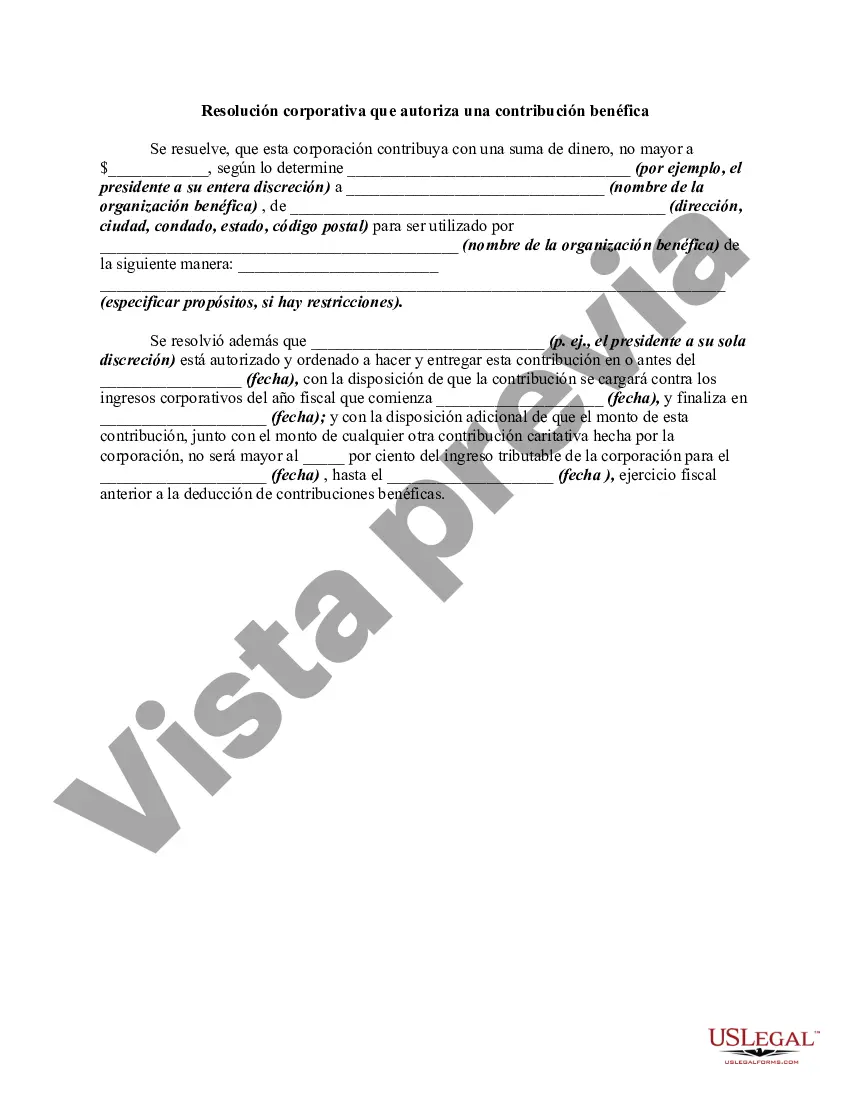

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution. Travis Texas Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process of a corporation in Travis County, Texas, regarding making a charitable contribution. This resolution identifies the specific details, terms, and conditions related to the donation, ensuring proper governance and compliance. This resolution serves as evidence of the corporation's official authorization to make a charitable donation, providing a clear record of the decision made by the board of directors or shareholders. It illustrates the commitment of the corporation to philanthropy and reinforces its dedication to supporting charitable causes within the Travis County community. There are various types of Travis Texas Corporate Resolutions Authorizing Charitable Contributions, including but not limited to: 1. General Charitable Contribution Resolution: This type of resolution grants the corporation the general authority to make charitable contributions within a specified monetary limit or without any predetermined limit. It allows the corporation to identify and support charitable organizations aligned with its values and mission. 2. Specific Charitable Contribution Resolution: In certain cases, a corporation may choose to authorize a charitable contribution to a specific organization or cause. This resolution outlines the details of the contribution, including the recipient, the purpose of the donation, and the amount or assets being contributed. 3. Charitable Contribution Policy Resolution: This resolution establishes a comprehensive policy framework for charitable contributions, defining the corporation's guidelines, criteria, and procedures for evaluating and approving donations. It ensures transparency, accountability, and consistency in the decision-making process related to charitable donations. Some relevant keywords associated with Travis Texas Corporate Resolution Authorizing a Charitable Contribution include: — Travis CountyTextxa— - Corporate resolution — Charitacontributionutio— - Donation authorization — Philanthrop— - Governance - Compliance — Board of director— - Shareholders - Specific contribution — Generacontributionio— - Charitable organization — Communsupportppor— - Mission alignment - Contribution policy — Decision-makinprocesses— - Transparency — Accountability Remember to consult legal professionals or advisors to ensure the accuracy and compliance of the specific content when drafting or using corporate resolutions in a legal context.

Travis Texas Corporate Resolution Authorizing a Charitable Contribution is a legal document that outlines the decision-making process of a corporation in Travis County, Texas, regarding making a charitable contribution. This resolution identifies the specific details, terms, and conditions related to the donation, ensuring proper governance and compliance. This resolution serves as evidence of the corporation's official authorization to make a charitable donation, providing a clear record of the decision made by the board of directors or shareholders. It illustrates the commitment of the corporation to philanthropy and reinforces its dedication to supporting charitable causes within the Travis County community. There are various types of Travis Texas Corporate Resolutions Authorizing Charitable Contributions, including but not limited to: 1. General Charitable Contribution Resolution: This type of resolution grants the corporation the general authority to make charitable contributions within a specified monetary limit or without any predetermined limit. It allows the corporation to identify and support charitable organizations aligned with its values and mission. 2. Specific Charitable Contribution Resolution: In certain cases, a corporation may choose to authorize a charitable contribution to a specific organization or cause. This resolution outlines the details of the contribution, including the recipient, the purpose of the donation, and the amount or assets being contributed. 3. Charitable Contribution Policy Resolution: This resolution establishes a comprehensive policy framework for charitable contributions, defining the corporation's guidelines, criteria, and procedures for evaluating and approving donations. It ensures transparency, accountability, and consistency in the decision-making process related to charitable donations. Some relevant keywords associated with Travis Texas Corporate Resolution Authorizing a Charitable Contribution include: — Travis CountyTextxa— - Corporate resolution — Charitacontributionutio— - Donation authorization — Philanthrop— - Governance - Compliance — Board of director— - Shareholders - Specific contribution — Generacontributionio— - Charitable organization — Communsupportppor— - Mission alignment - Contribution policy — Decision-makinprocesses— - Transparency — Accountability Remember to consult legal professionals or advisors to ensure the accuracy and compliance of the specific content when drafting or using corporate resolutions in a legal context.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.