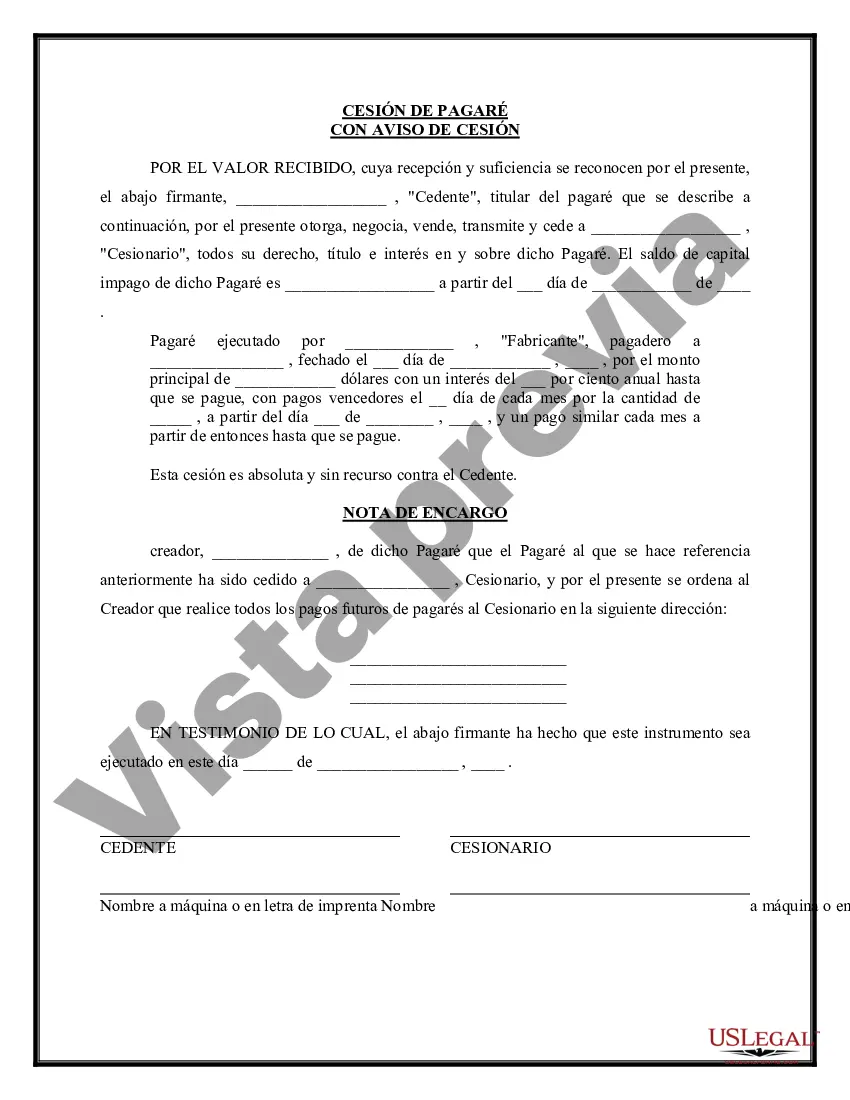

Mecklenburg North Carolina Promissory Note Assignment and Notice of Assignment are legal documents that serve important purposes in financial transactions involving promissory notes. This detailed description will provide an overview of these documents, their significance, and any potential variations or types specific to Mecklenburg County, North Carolina. A Promissory Note Assignment refers to the transfer of rights and obligations from the original holder (assignor) of a promissory note to a new party (assignee). Promissory notes are legal instruments that outline a borrower's promise to repay a specific amount of money to the lender, typically with interest, within a predetermined period. When the lender transfers their rights to another entity, it requires a Promissory Note Assignment. In Mecklenburg County, North Carolina, there may be variations in the format or required content of a Promissory Note Assignment. Some specific types or variations within Mecklenburg County may include: 1. Standard Promissory Note Assignment: This type involves the assignment of a typical promissory note from one party to another. It generally includes details such as the names and addresses of the assignor and assignee, the original promissory note's unique identification, the effective date of the assignment, and any terms or conditions agreed upon by both parties. 2. Real Estate Promissory Note Assignment: This type specifically applies to promissory notes associated with real estate transactions in Mecklenburg County. It may have additional requirements, such as the description of the property, mortgage details, and the involvement of relevant government authorities like the County Recorder's Office. The Notice of Assignment complements the Promissory Note Assignment by formally notifying the borrower of the assignment. This notice informs them that a new party is now the rightful holder of their promissory note and that future payments should be directed accordingly. Providing a Notice of Assignment ensures that the borrower is aware of the change in ownership and knows where to send their payments. Both the Promissory Note Assignment and Notice of Assignment play crucial roles in establishing legal rights and responsibilities between the assignor, assignee, and borrower. They also protect all parties involved in the transaction by documenting the transfer of ownership and ensuring transparency. In summary, Mecklenburg North Carolina Promissory Note Assignment and Notice of Assignment are legal documents used to transfer ownership of promissory notes and notify borrowers of such changes. While variations may exist based on specific circumstances or property types, these documents serve as essential components in financial transactions within Mecklenburg County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Cesión de Pagaré y Notificación de Cesión - Promissory Note Assignment and Notice of Assignment

Description

How to fill out Mecklenburg North Carolina Cesión De Pagaré Y Notificación De Cesión?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Mecklenburg Promissory Note Assignment and Notice of Assignment is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Mecklenburg Promissory Note Assignment and Notice of Assignment. Follow the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Promissory Note Assignment and Notice of Assignment in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!