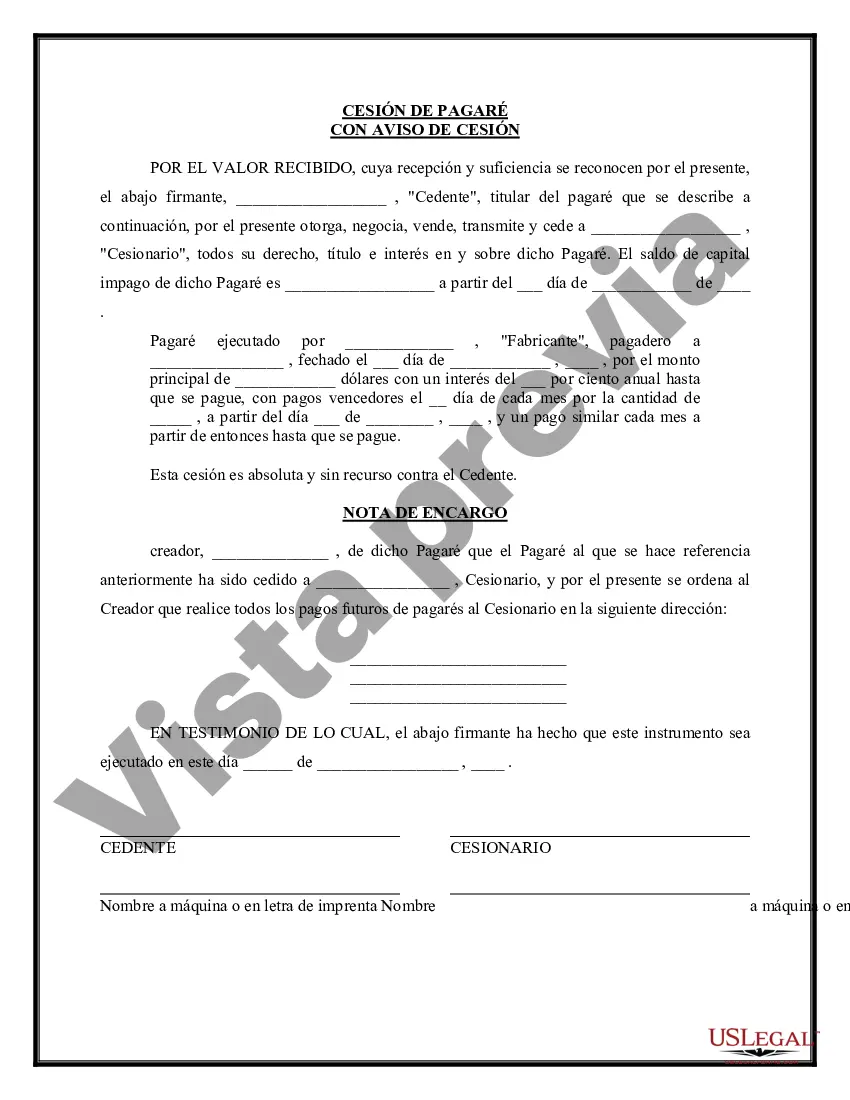

Salt Lake City, Utah is a vibrant city located in the western United States. It serves as the capital of Utah and is the most populous city in the state. With its stunning mountain backdrop, thriving economy, and numerous recreational opportunities, Salt Lake City is a sought-after destination for both residents and visitors. In the realm of financial matters, Salt Lake City, Utah is also home to various legal and financial instruments, such as the Promissory Note Assignment and Notice of Assignment. These documents are commonly utilized in lending and borrowing transactions, serving important functions in the financial industry. The Salt Lake Utah Promissory Note Assignment is a legal agreement that transfers the rights and obligations of a promissory note from one party, known as the assignor, to another party, referred to as the assignee. This assignment typically occurs when a lender decides to sell or transfer their interest in a promissory note to a third party. By doing so, the assignor effectively transfers the right to collect payments and enforce the terms of the promissory note to the assignee. The Notice of Assignment, on the other hand, is a written communication that informs the borrower about the transfer or assignment of their promissory note to a new party. It serves as a formal notice to the borrower, informing them of the change in ownership and directing them to make future payments to the assignee rather than the original lender. In Salt Lake City, Utah, individuals and businesses engage in various types of Promissory Note Assignment and Notice of Assignment transactions. Some common types include: 1. Mortgage Assignment: This type of assignment commonly occurs when a mortgage lender sells or transfers the mortgage loan to another financial institution or investor. 2. Business Loan Assignment: In commercial lending, businesses may assign their promissory notes to secure additional financing. This assignment allows lenders to take over the existing loan, while the business benefits from the infusion of capital. 3. Student Loan Assignment: Student loans, often held by lenders or loan services, may be assigned to other financial entities. Changes in loan ownership can impact borrowers, so a Notice of Assignment is sent to inform them of the assignment and provide payment instructions. 4. Personal Loan Assignment: Individuals who have borrowed money through personal loans may assign their promissory notes to family members, friends, or investors. This type of assignment allows for the transfer of debt obligations and related rights. It is important to note that the specific terms and conditions of Salt Lake Utah Promissory Note Assignment and Notice of Assignment transactions can vary based on the parties involved and the nature of the underlying promissory note. Seeking legal guidance or professional advice when engaging in such transactions is highly recommended ensuring compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Cesión de Pagaré y Notificación de Cesión - Promissory Note Assignment and Notice of Assignment

Description

How to fill out Salt Lake Utah Cesión De Pagaré Y Notificación De Cesión?

Preparing papers for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Salt Lake Promissory Note Assignment and Notice of Assignment without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Salt Lake Promissory Note Assignment and Notice of Assignment by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guide below to get the Salt Lake Promissory Note Assignment and Notice of Assignment:

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!