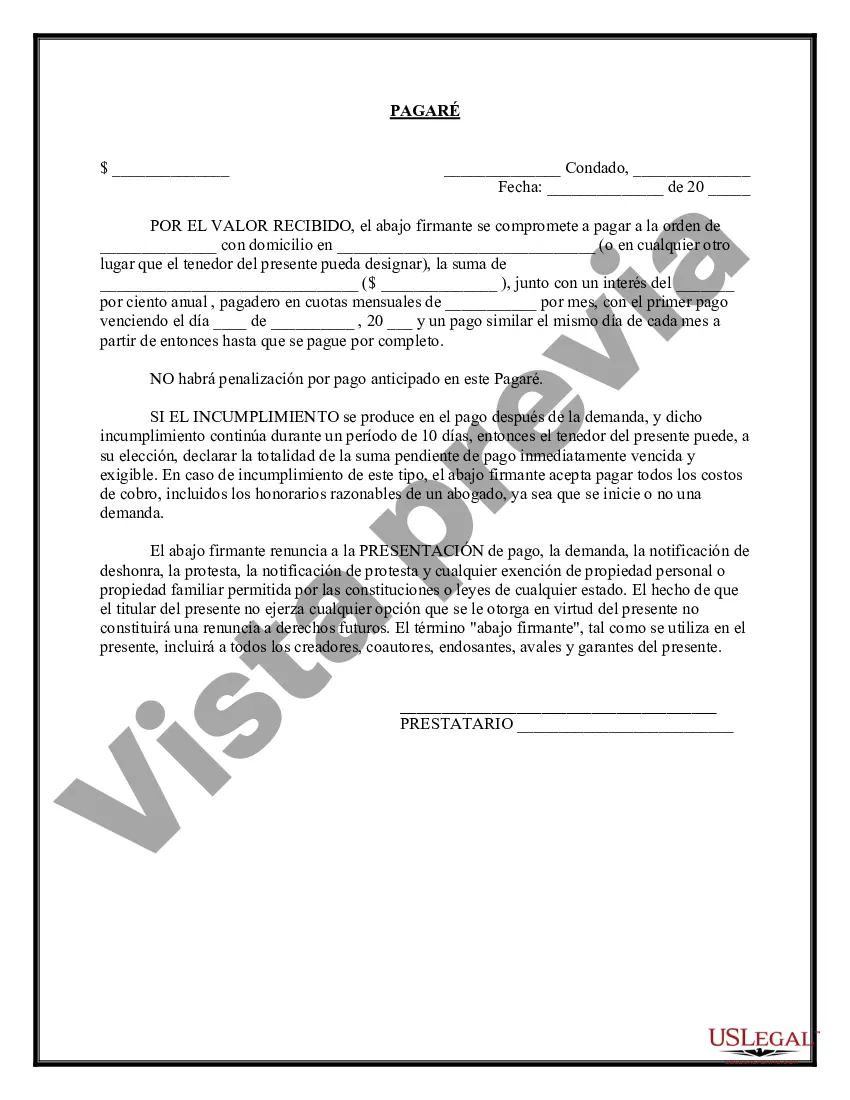

Allegheny Pennsylvania Promissory Note with Installment Payments is a legal document that outlines the terms and conditions of a loan agreement made between a lender and a borrower in the Allegheny County of Pennsylvania. This type of promissory note involves the repayment of the loan amount through scheduled installments. In Allegheny County, there are various types of Promissory Notes with Installment Payments that individuals and businesses can utilize, depending on their specific requirements. Some common ones include: 1. Personal Promissory Note: This note is used when an individual borrower needs to borrow money from a lender, typically for personal purposes. It lays out the agreed-upon repayment terms and conditions, including the installment amounts and the duration of the repayment period. 2. Business Promissory Note: In the case of business-related loans, this note is employed to establish a legally binding agreement between a business entity or company and a lender. It ensures that the borrower repays the borrowed sum in designated installments over a specified timeframe. 3. Real Estate Promissory Note: This type of note is specifically designed for loans related to real estate transactions in Allegheny Pennsylvania. It serves as a written proof of the agreement between the lender and the borrower, incorporating installment payment terms, interest rates, and any other specific conditions related to the loan. 4. Secured Promissory Note: A secured note involves collateral or a valuable asset that the borrower pledges as security against the loan. If the borrower fails to make the installment payments, the lender has the right to seize the collateral as compensation for the outstanding debt. 5. Unsecured Promissory Note: In contrast to a secured promissory note, an unsecured note does not require any collateral. Typically, this type of note is based on the borrower's creditworthiness, and the lender relies solely on the borrower's promise to repay the loan as per the agreed-upon installment plan. It is essential for both lenders and borrowers in Allegheny Pennsylvania to fully comprehend the terms and conditions outlined in a Promissory Note with Installment Payments. This legal document protects the rights and interests of both parties and serves as evidence of the loan agreement. Seek professional legal advice to draft or review any promissory note to ensure compliance with Pennsylvania laws and regulations. Remember, the terms of these notes can vary depending on the specific circumstances and requirements of the borrower and lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Allegheny Pennsylvania Pagaré Con Pagos A Plazos?

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Allegheny Promissory Note with Installment Payments is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several more steps to obtain the Allegheny Promissory Note with Installment Payments. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Promissory Note with Installment Payments in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!