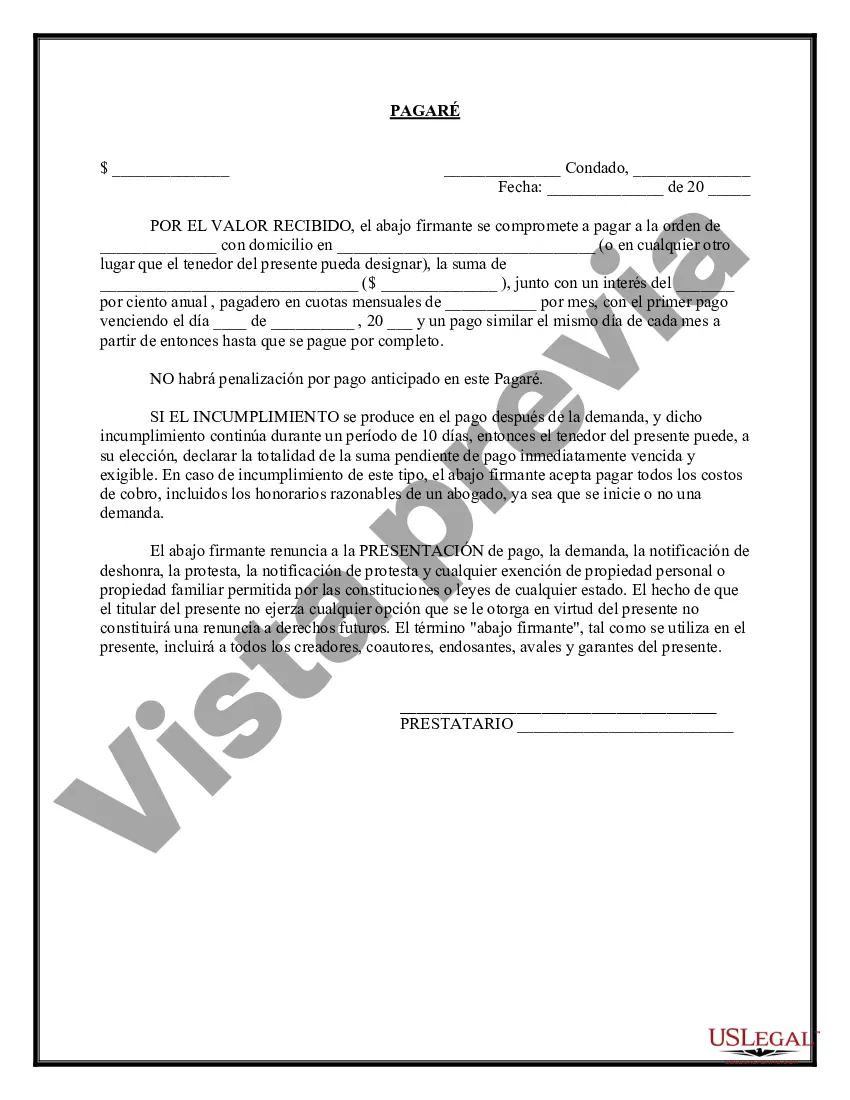

A Chicago Illinois Promissory Note with Installment Payments is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in the state of Illinois, specifically in the city of Chicago. This type of promissory note allows the borrower to repay the loaned amount in regular installments over a specified period of time. The Chicago Illinois Promissory Note with Installment Payments typically includes essential details such as the names and addresses of both parties involved (lender and borrower), the principal loan amount, the interest rate, the payment schedule, and the consequences of default. There are several types of Chicago Illinois Promissory Note with Installment Payments, including: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral or security from the borrower. However, it is important to note that lenders often charge higher interest rates for unsecured loans to compensate for the increased risk. 2. Secured Promissory Note: In contrast to an unsecured promissory note, a secured promissory note involves the borrower providing collateral as a form of security for the lender. If the borrower fails to repay the loan as agreed upon, the lender may claim the collateral to recover their losses. 3. Personal Promissory Note: A personal promissory note is commonly used for loans between individuals who have a personal relationship, such as family or friends. This type of promissory note may lack formalities found in commercial transactions but is still legally binding. 4. Commercial Promissory Note: A commercial promissory note outlines a loan agreement between a business entity and a lender. The terms and conditions are typically more complex compared to a personal promissory note as commercial transactions involve larger sums of money and varying repayment periods. It is crucial for both parties involved in a Chicago Illinois Promissory Note with Installment Payments to carefully review and understand all the terms stated in the document before signing. Consulting with legal professionals and preparing a well-drafted promissory note ensures clarity and protects the rights and obligations of both the lender and borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Chicago Illinois Pagaré Con Pagos A Plazos?

Drafting papers for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate Chicago Promissory Note with Installment Payments without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Chicago Promissory Note with Installment Payments on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Chicago Promissory Note with Installment Payments:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!