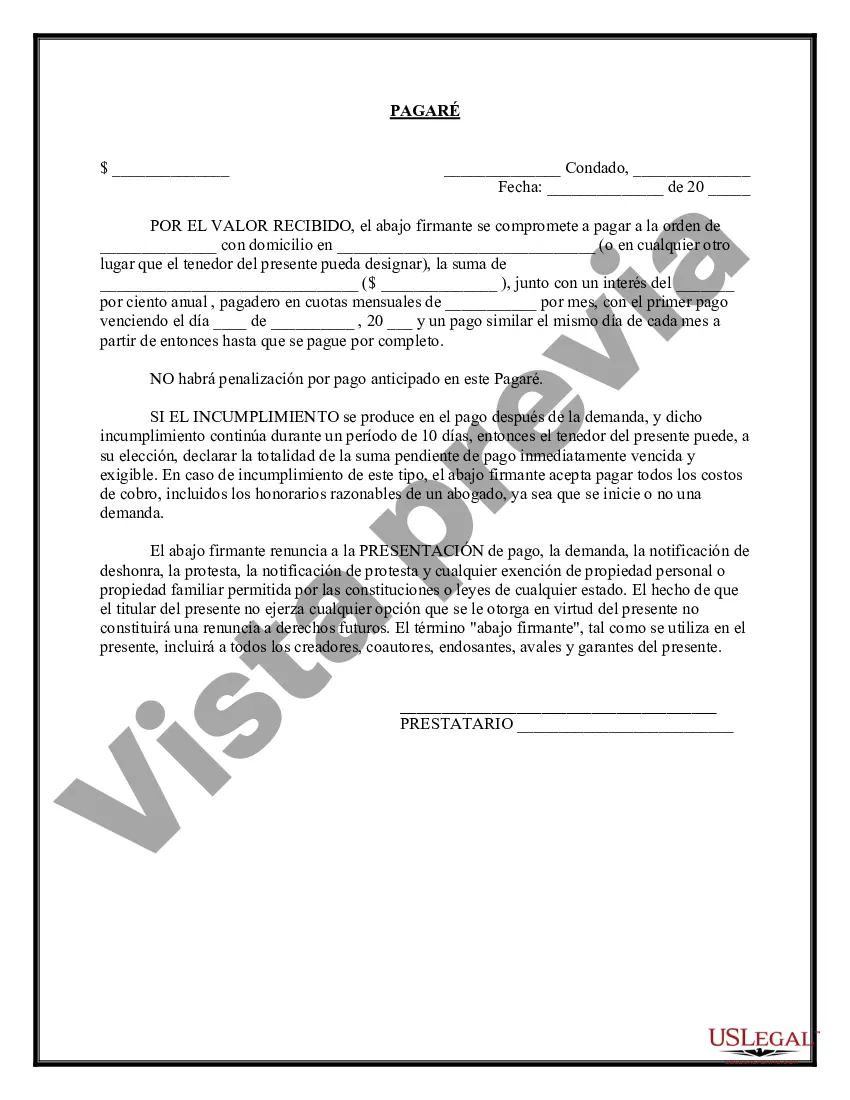

Fulton Georgia Promissory Note with Installment Payments: A Comprehensive Guide A Fulton Georgia Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender (also known as the payee) and a borrower (also known as the maker). This type of promissory note is widely used in Fulton, Georgia, for various lending transactions, ensuring both parties are protected and aware of their responsibilities and rights. In a Fulton Georgia Promissory Note with Installment Payments, the borrower promises to repay the borrowed amount along with accrued interest over a specified period through a series of installment payments. These payments are typically scheduled at regular intervals, such as monthly or quarterly, until the full loan amount is repaid. The promissory note serves as evidence of the loan agreement and includes critical details such as the loan amount, interest rate, payment schedule, and consequences of default. Different types of Fulton Georgia Promissory Notes with Installment Payments may include: 1. Personal Loan Promissory Note with Installment Payments: This type of promissory note is commonly used between family members, friends, or individuals engaged in private lending transactions. It outlines the terms of a loan given for personal purposes, such as medical expenses, education, or home improvements. 2. Business Loan Promissory Note with Installment Payments: This promissory note is utilized by entrepreneurs and business owners to document loans obtained for business-related expenses, such as expansion, inventory purchase, or equipment acquisition. It includes specific clauses related to the borrower's business activities and collateral requirements. 3. Mortgage Promissory Note with Installment Payments: In real estate transactions, a mortgage promissory note with installment payments is used to outline the terms and conditions of a loan secured by a property. This type of note incorporates provisions related to the mortgage instrument, such as the property's legal description, loan-to-value ratio, and consequences of foreclosure. 4. Student Loan Promissory Note with Installment Payments: Educational institutions and private lenders often employ this type of promissory note to define the terms under which a student borrower will repay a loan disbursed for educational purposes. These notes address aspects like deferment options, grace periods, and repayment start dates. Fulton Georgia Promissory Notes with Installment Payments are valuable tools for both lenders and borrowers, as they establish transparent and enforceable loan terms. It is always recommended consulting with legal professionals or financial advisors when drafting or entering into such agreements to ensure compliance with local regulations and to secure the best interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Fulton Georgia Pagaré Con Pagos A Plazos?

Drafting documents for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Fulton Promissory Note with Installment Payments without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Fulton Promissory Note with Installment Payments by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Fulton Promissory Note with Installment Payments:

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a few clicks!