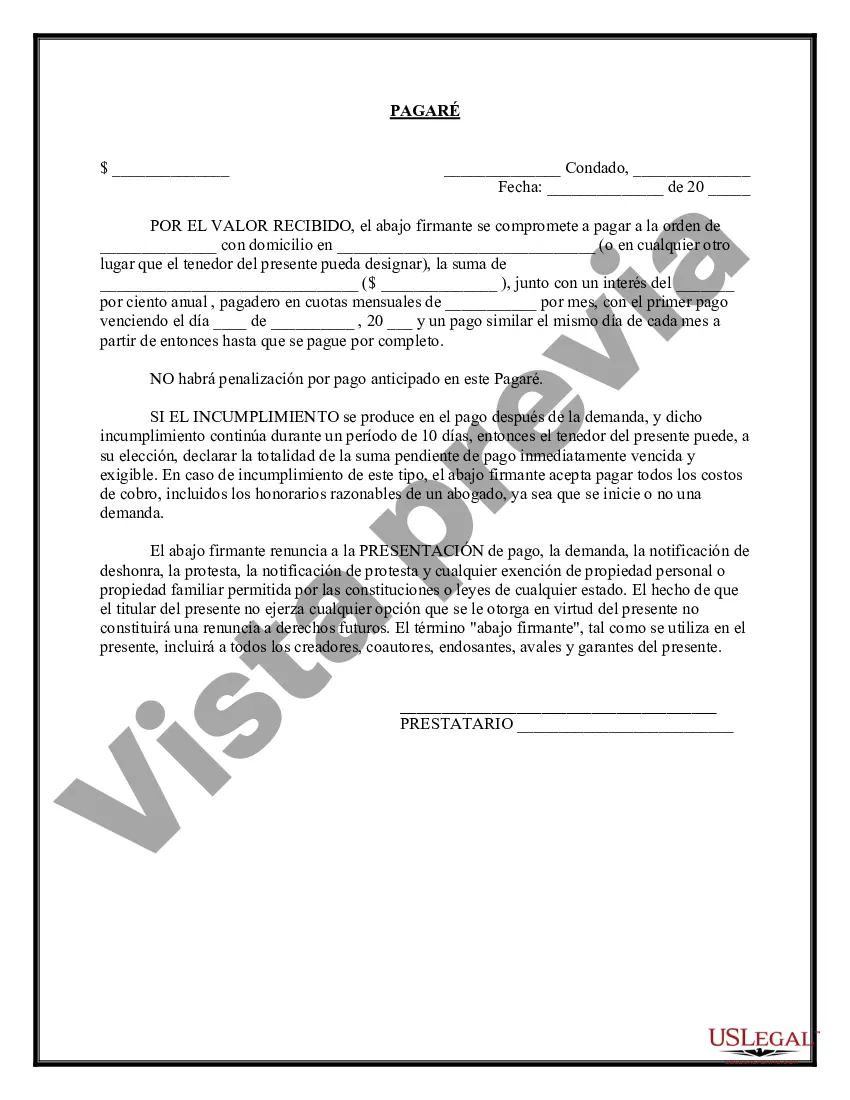

The King Washington Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specifically designed for individuals or businesses in need of financial assistance from King Washington, a prominent lending institution. By opting for an installment payment plan, the borrower can repay the loan amount over a defined period, reducing the immediate financial burden. One common type of King Washington Promissory Note with Installment Payments is the Secured Promissory Note. In this agreement, the borrower pledges collateral, such as real estate or valuable assets, to secure the loan. This provides a layer of security for the lender, as they can seize the collateral in case of default. Another type of King Washington Promissory Note with Installment Payments is the Unsecured Promissory Note. Unlike the secured option, this note does not require any collateral but may involve higher interest rates due to the increased risk for the lender. Borrowers with a strong credit history and income stability typically choose this option. Additionally, King Washington offers Promissory Notes with Installment Payments that are specifically tailored to meet the needs of small businesses. This type of note may have flexible repayment terms, allowing businesses to repay the loan based on their cash flow or revenue projections. When drafting a King Washington Promissory Note with Installment Payments, various key elements are included. These include the loan amount, interest rate, repayment schedule, late payment fees, consequences of default, and any prepayment penalties. Both the borrower and lender must fully understand and agree upon these terms before signing the document. It is essential to consult legal professionals or financial advisors to ensure compliance with applicable laws and regulations and to protect the interests of both parties involved in the loan agreement. King Washington prides itself on offering transparent and comprehensive promissory note options, tailored to suit various financial needs, making the lending process smoother and more accessible for borrowers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out King Washington Pagaré Con Pagos A Plazos?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life situation, locating a King Promissory Note with Installment Payments suiting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the King Promissory Note with Installment Payments, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your King Promissory Note with Installment Payments:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the King Promissory Note with Installment Payments.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!