Title: Exploring Mecklenburg, North Carolina Promissory Notes with Installment Payments Introduction: In Mecklenburg County, North Carolina, a promissory note with installment payments is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of note allows borrowers to repay their debt in regular installments over a specified period. Mecklenburg County offers several variations of promissory notes with installment payments, each catering to different borrower needs. Let's dive into the details of these notes and understand their significance. 1. Mecklenburg North Carolina Unsecured Promissory Note with Installment Payments: This type of promissory note is commonly used when the borrower does not provide collateral or security for the loan. It specifies the amount borrowed, interest rate, repayment schedule, and other relevant terms. The lender relies on the borrower's creditworthiness and trust rather than any asset or property. 2. Mecklenburg North Carolina Secured Promissory Note with Installment Payments: This promissory note is used when the borrower pledges property or assets as collateral to secure the loan. The collateral serves as security for the lender, reducing the risk involved. In case of default, the lender has the right to seize and sell the collateral to recover the outstanding amount. 3. Mecklenburg North Carolina Demand Promissory Note with Installment Payments: A demand promissory note allows the lender to demand full repayment of the loan at any given time. However, by opting for an installment payment option under this note, the borrower can repay the debt in regular installments instead of a lump sum amount, adding convenience and flexibility. 4. Mecklenburg North Carolina Balloon Promissory Note with Installment Payments: This type of promissory note reduces the regular installment amount by deferring a significant portion of the principal payment to the end of the loan term, referred to as a balloon payment. Borrowers can enjoy lower monthly payments initially, but they must be prepared to make a larger final payment to clear the remaining outstanding balance. 5. Mecklenburg North Carolina Adjustable Rate Promissory Note with Installment Payments: An adjustable rate promissory note establishes an interest rate that fluctuates over time, which directly affects the installment payments. This type of note is suitable for borrowers who can bear the risk of changing interest rates. It often comes with a fixed initial rate period, after which the rate adjusts periodically based on an index or market conditions. Conclusion: Mecklenburg, North Carolina, offers various promissory note options with installment payments tailored to meet diverse borrower requirements. Whether you seek an unsecured, secured, demand, balloon, or adjustable rate note, consult legal professionals to ensure compliance with local laws and regulations. Before signing any promissory note, carefully review and understand the terms and obligations to make informed financial decisions.

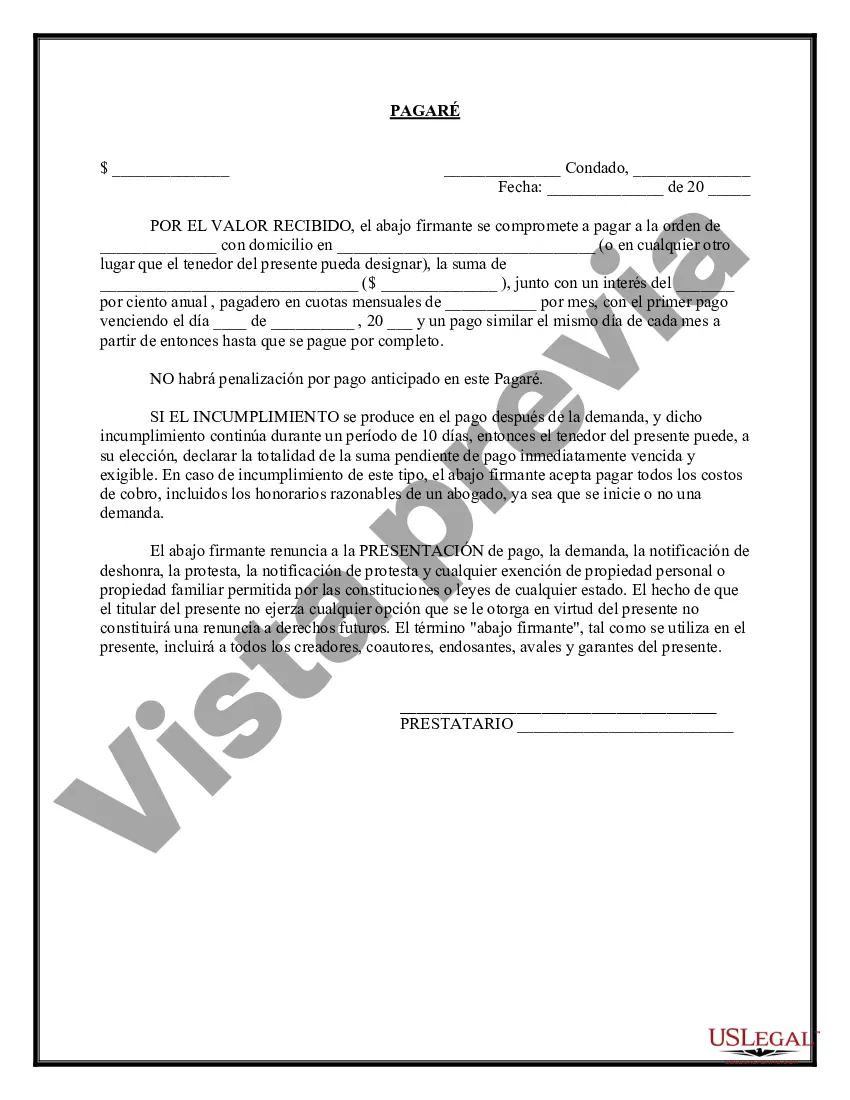

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Mecklenburg North Carolina Pagaré Con Pagos A Plazos?

Preparing documents for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Mecklenburg Promissory Note with Installment Payments without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Mecklenburg Promissory Note with Installment Payments on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Mecklenburg Promissory Note with Installment Payments:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!