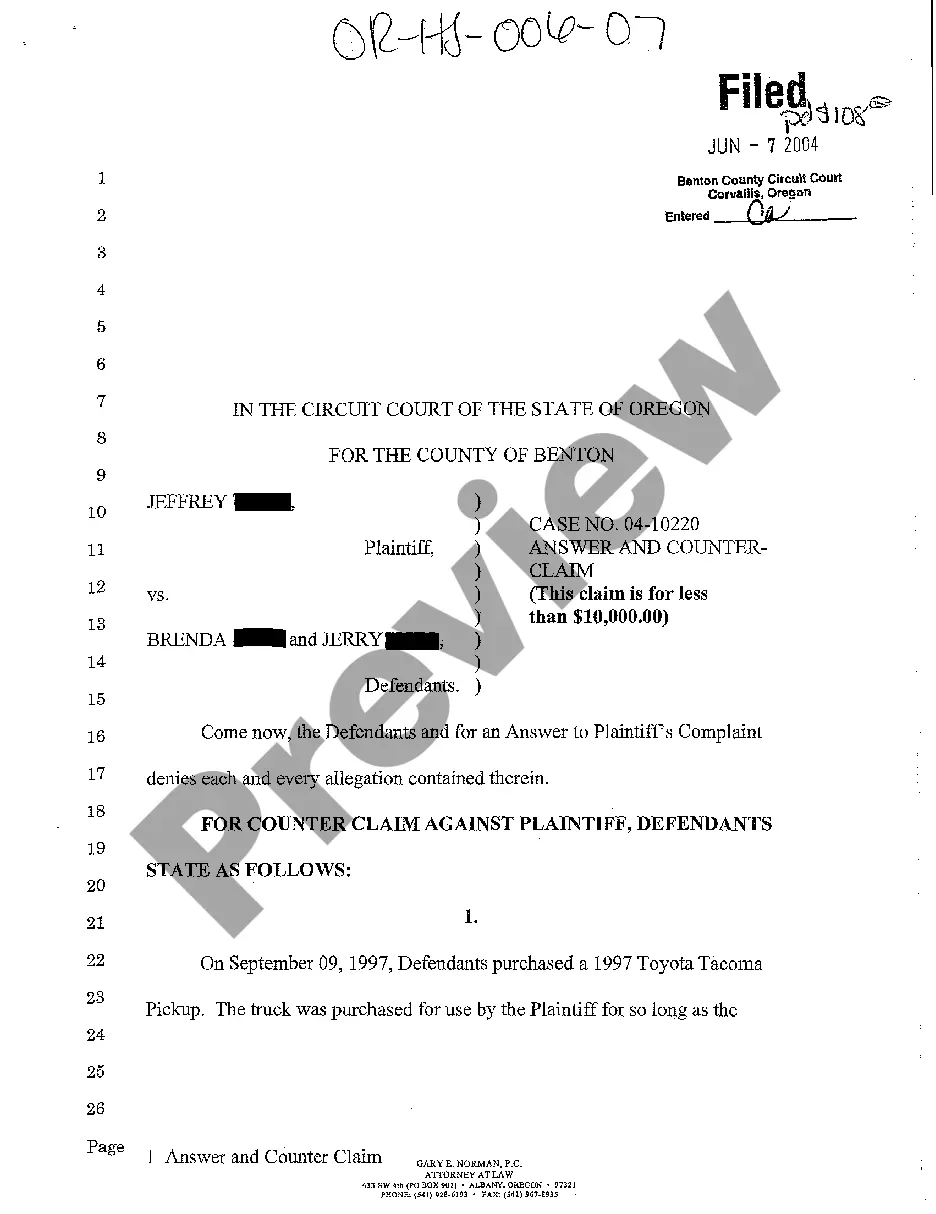

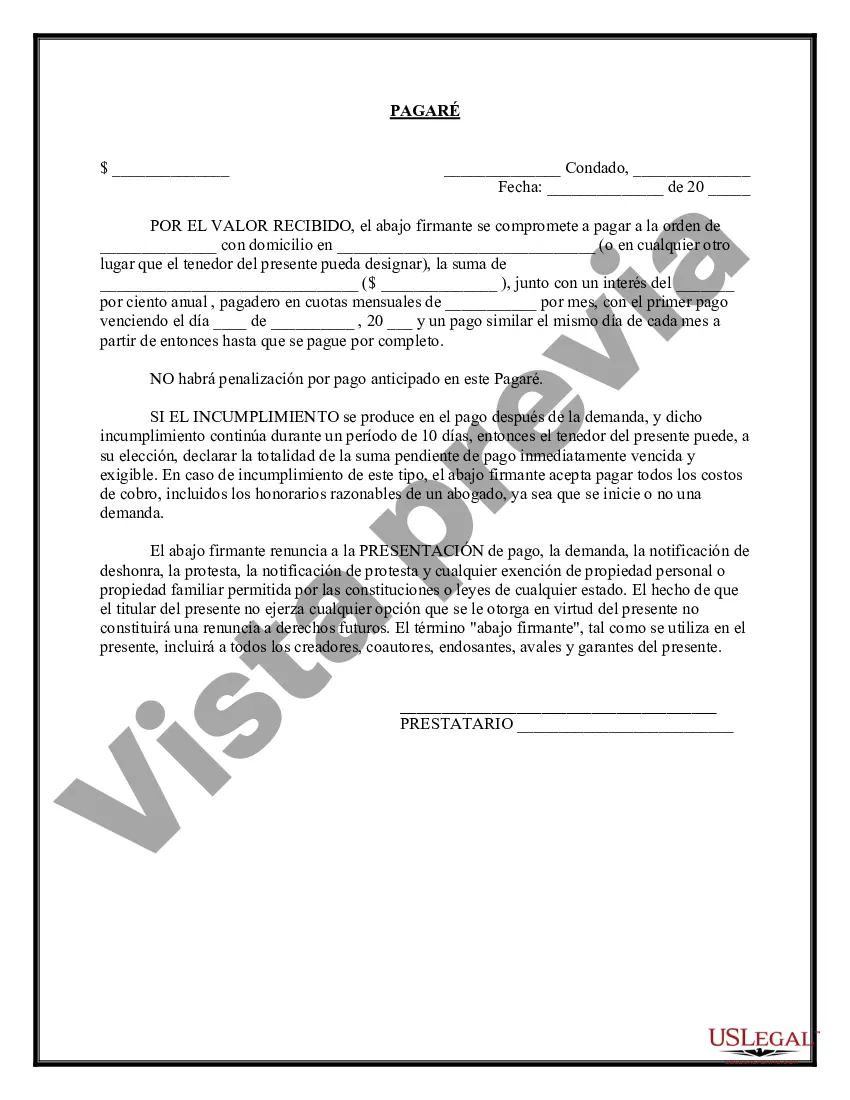

Miami-Dade Florida Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Miami-Dade County, Florida. This type of promissory note is specifically designed for installment payments, allowing the borrower to repay the loan in fixed, periodic installments over a specified period. The Miami-Dade Florida Promissory Note with Installment Payments serves as a record of the loan transaction and establishes the obligations of both the borrower and the lender. It includes necessary details such as the principal loan amount, interest rate, repayment schedule, payment amounts, due dates, late payment penalties, and any additional terms agreed upon by both parties. This promissory note offers borrowers in Miami-Dade County various options to structure their loan repayment, making it more flexible and manageable. Different types of Miami-Dade Florida Promissory Note with Installment Payments include: 1. Fixed Installment Promissory Note: This type entails equal, regular installment payments throughout the loan period. The payment amounts remain constant, making budgeting and financial planning easier for the borrower. 2. Graduated Installment Promissory Note: With this type, the repayment schedule starts with smaller installment payments in the initial period, gradually increasing over time. This structure is beneficial when the borrower expects their income to increase throughout the loan term. 3. Balloon Installment Promissory Note: Balloon payments involve regular installment payments for a predetermined period, and a large final payment, often referred to as a balloon payment, due at the end of the term. This type may be suitable for borrowers who anticipate a significant influx of cash or refinancing options near the loan's maturity. It is crucial to understand the terms and provisions of the Miami-Dade Florida Promissory Note with Installment Payments before signing, as it legally binds both parties to fulfill their obligations. Consulting a legal professional or seeking financial advice might be advisable to ensure compliance with applicable laws and to protect the rights and interests of all involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Pagaré con pagos a plazos - Promissory Note with Installment Payments

State:

Multi-State

County:

Miami-Dade

Control #:

US-00598

Format:

Word

Instant download

Description

This form is a Promissory Note. The form provides that the borrower promises to pay the lender in monthly installments. The agreement also provides that there will not be a pre-payment penalty on the note.

Miami-Dade Florida Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Miami-Dade County, Florida. This type of promissory note is specifically designed for installment payments, allowing the borrower to repay the loan in fixed, periodic installments over a specified period. The Miami-Dade Florida Promissory Note with Installment Payments serves as a record of the loan transaction and establishes the obligations of both the borrower and the lender. It includes necessary details such as the principal loan amount, interest rate, repayment schedule, payment amounts, due dates, late payment penalties, and any additional terms agreed upon by both parties. This promissory note offers borrowers in Miami-Dade County various options to structure their loan repayment, making it more flexible and manageable. Different types of Miami-Dade Florida Promissory Note with Installment Payments include: 1. Fixed Installment Promissory Note: This type entails equal, regular installment payments throughout the loan period. The payment amounts remain constant, making budgeting and financial planning easier for the borrower. 2. Graduated Installment Promissory Note: With this type, the repayment schedule starts with smaller installment payments in the initial period, gradually increasing over time. This structure is beneficial when the borrower expects their income to increase throughout the loan term. 3. Balloon Installment Promissory Note: Balloon payments involve regular installment payments for a predetermined period, and a large final payment, often referred to as a balloon payment, due at the end of the term. This type may be suitable for borrowers who anticipate a significant influx of cash or refinancing options near the loan's maturity. It is crucial to understand the terms and provisions of the Miami-Dade Florida Promissory Note with Installment Payments before signing, as it legally binds both parties to fulfill their obligations. Consulting a legal professional or seeking financial advice might be advisable to ensure compliance with applicable laws and to protect the rights and interests of all involved parties.