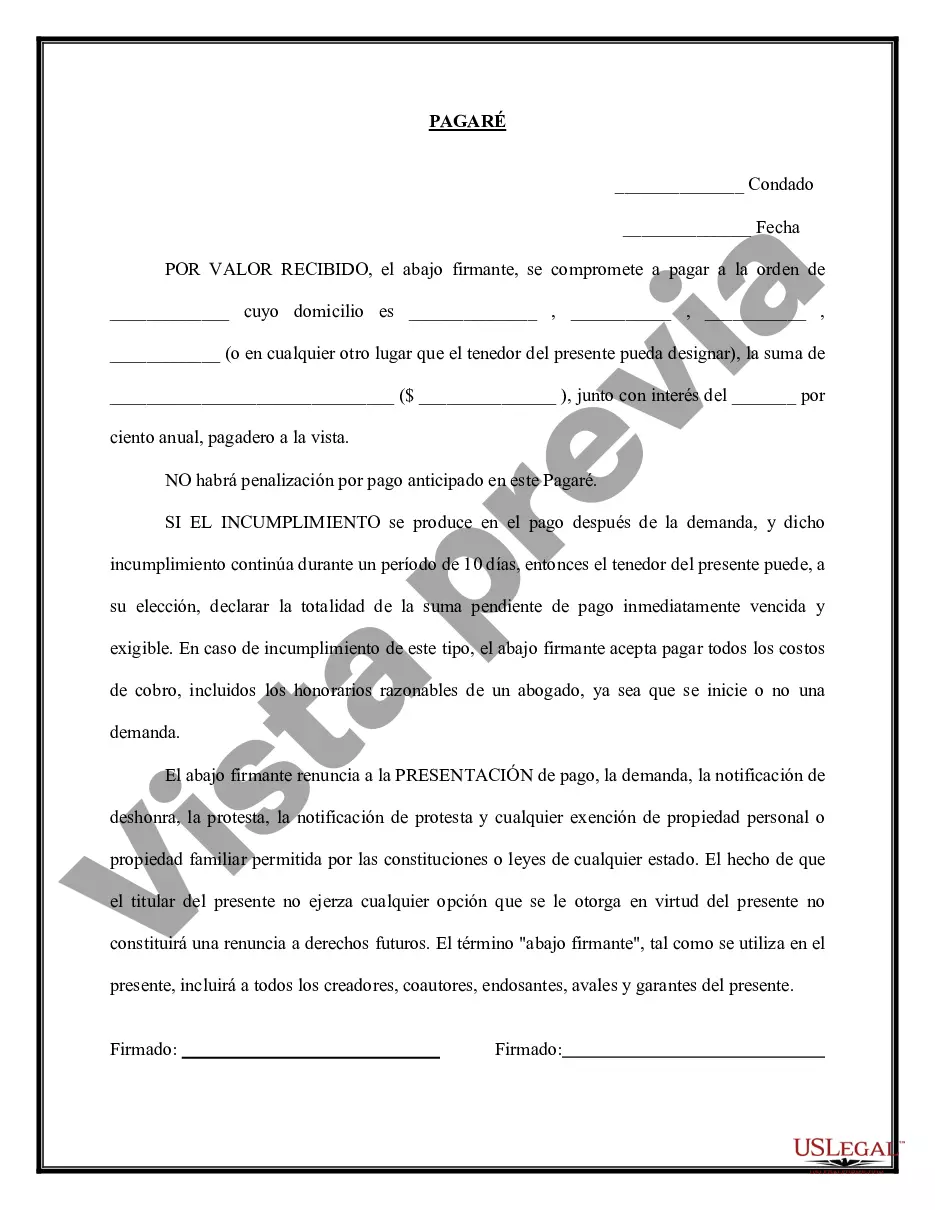

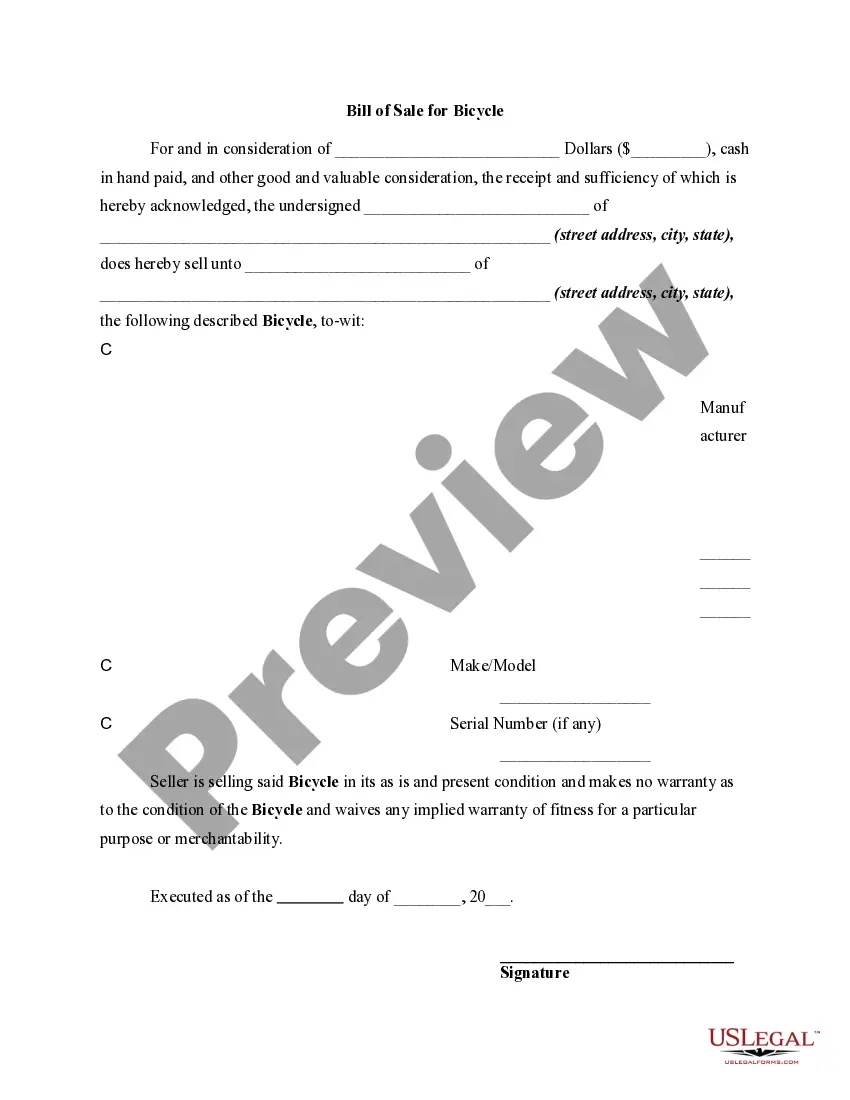

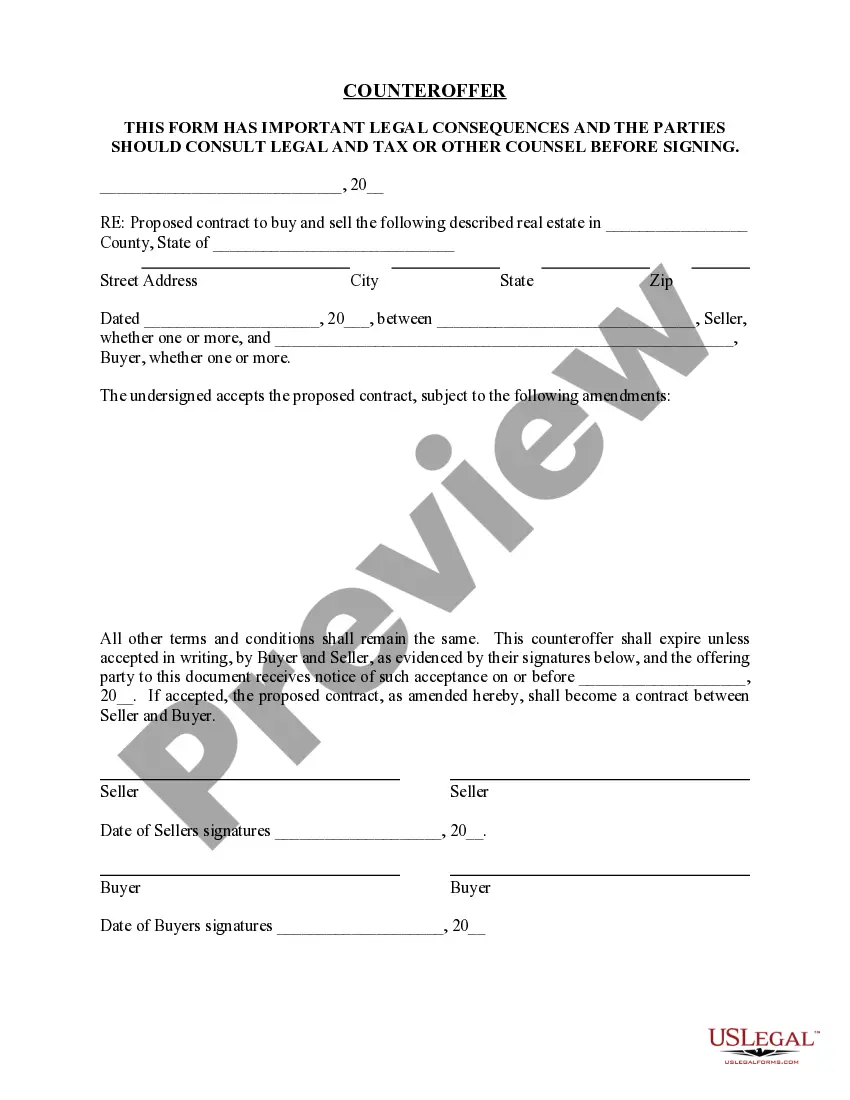

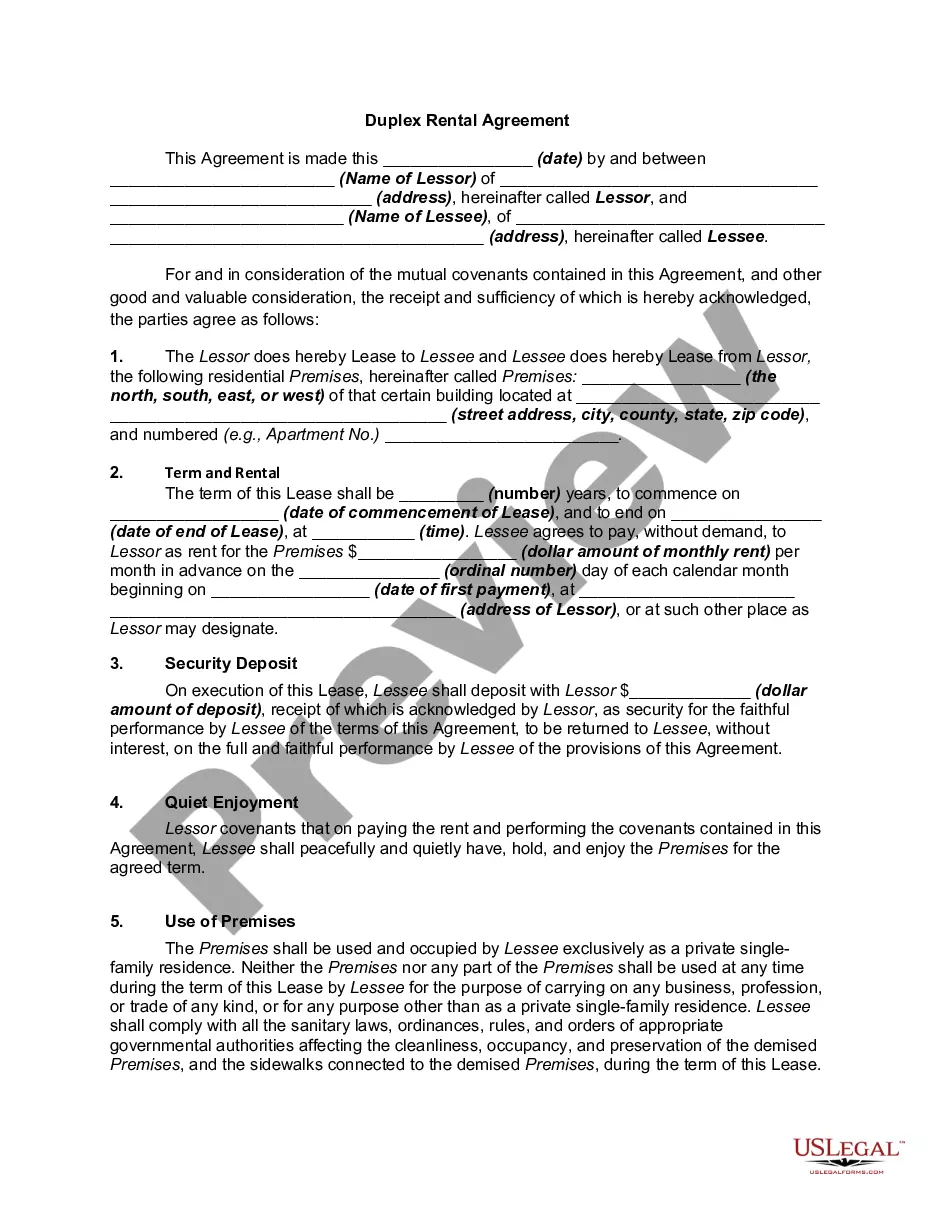

A Chicago Illinois Promissory Note — Payable on Demand is a legally binding document that outlines the terms of a loan agreement between a borrower and a lender. It serves as a written promise by the borrower to repay a specified amount of money to the lender, typically with interest, within a specified timeframe upon the lender's demand. This type of promissory note is commonly used in financial transactions in Chicago, Illinois. The Chicago Illinois Promissory Note — Payable on Demand is a straightforward agreement that offers flexibility and convenience for both parties involved. It guarantees the lender the right to request full repayment of the loan at any time, while the borrower is obligated to honor that request promptly. This type of promissory note is suitable for short-term loans, where the lender requires immediate access to the funds or wants to maintain the option of early repayment. Various types of Chicago Illinois Promissory Notes — Payable on Demand may exist to accommodate different lending scenarios and situations. Here are a few common variations: 1. Simple Promissory Note: This is the most basic type of promissory note, focusing solely on the borrower's promise to pay back the loan amount on demand. It includes essential details such as the principal amount, interest rate (if applicable), repayment terms, and the consequences of default. 2. Secured Promissory Note: This type of note involves collateral, such as real estate or personal property, offered by the borrower to secure the loan. If the borrower fails to repay the loan as stipulated, the lender may exercise their rights to seize and sell the collateral to recover the outstanding debt. 3. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not involve any collateral. The borrower relies solely on their creditworthiness and reputation to obtain the loan. In the case of default, the lender may have limited options for recovering the debt. 4. Revolving Line of Credit Promissory Note: This type of note establishes a pre-approved credit limit, allowing the borrower to withdraw funds as needed. The borrower can make multiple draw downs and repayments within the agreed terms, providing flexibility for short-term financing needs. When drafting a Chicago Illinois Promissory Note — Payable on Demand, it is crucial to consult a legal professional to ensure compliance with local and state laws. This document can protect both the borrower and lender by clearly documenting their obligations and expectations, thus reducing the risk of misunderstandings or disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Chicago Illinois Pagaré - Pagadero A La Vista?

If you need to find a trustworthy legal form provider to get the Chicago Promissory Note - Payable on Demand, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support team make it easy to find and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse Chicago Promissory Note - Payable on Demand, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Chicago Promissory Note - Payable on Demand template and take a look at the form's preview and description (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Chicago Promissory Note - Payable on Demand - all from the comfort of your sofa.

Join US Legal Forms now!