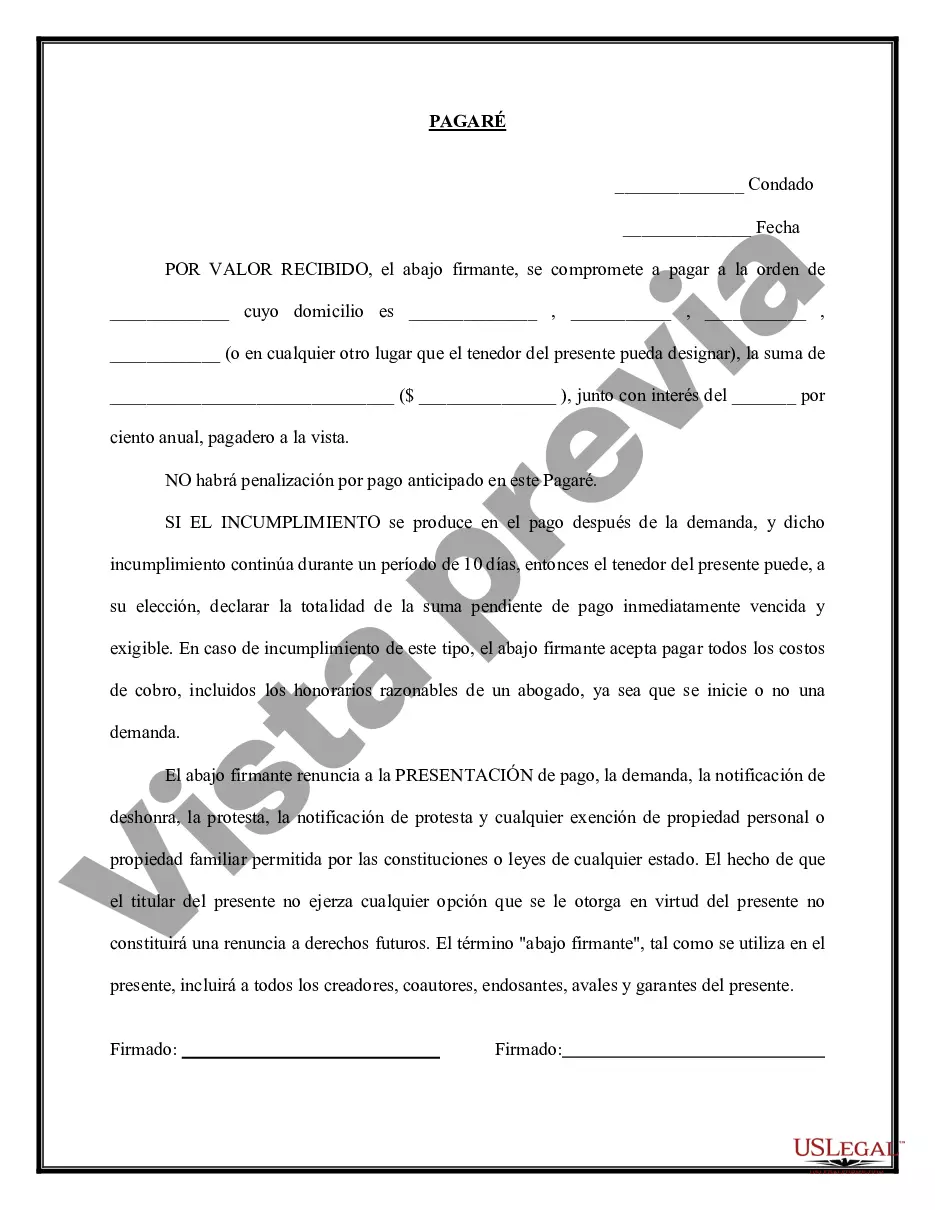

A Harris Texas Promissory Note — Payable on Demand is a legal document that establishes a formal agreement between a lender and a borrower for the repayment of a loan. This type of promissory note indicates that the borrower acknowledges their indebtedness to the lender and promises to repay the loan amount on demand. Key features of a Harris Texas Promissory Note — Payable on Demand include: 1. Parties Involved: The promissory note will clearly state the names and contact information of both the lender (often referred to as the payee) and the borrower (often referred to as the maker). 2. Loan Amount: The note will specify the exact amount of the loan provided by the lender to the borrower. This will typically be stated in both numerical and written form to avoid any confusion or disputes. 3. Payment Terms: The note will outline the repayment terms, including the interest rate (if any) applied to the outstanding balance. It will specify that the loan is payable on demand, indicating that the lender has the right to request full repayment at any time. 4. Repayment Schedule: If the lender requires specific repayment dates or installments, it will be stated in the note. However, since this particular promissory note is payable on demand, there may not be a fixed repayment schedule. 5. Default and Consequences: The note will outline the consequences of default, including late payment penalties, additional interest charges, or the possibility of legal action to recover the outstanding loan balance. Types of Harris Texas Promissory Notes — Payable on Demand: 1. Personal Loan Promissory Note — Payable on Demand: This type of promissory note is used for loans between individuals, such as friends or family members. It ensures that the borrower understands their obligation to repay the loan amount on demand. 2. Business Loan Promissory Note — Payable on Demand: This promissory note is used for loans involving businesses. It outlines the terms and conditions of the loan, including the repayment structure and any penalties for default. 3. Real Estate Promissory Note — Payable on Demand: A real estate promissory note is utilized when financing the purchase of property. This type of note will specify the repayment terms and conditions, as well as information regarding the property in question. In conclusion, a Harris Texas Promissory Note — Payable on Demand is a legally binding agreement between a lender and a borrower, ensuring the repayment of a loan amount on demand. Whether it's a personal, business, or real estate loan, this promissory note outlines the terms, payment schedule (if applicable), and consequences for non-payment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Harris Texas Pagaré - Pagadero A La Vista?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Harris Promissory Note - Payable on Demand, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Harris Promissory Note - Payable on Demand from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Harris Promissory Note - Payable on Demand:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!