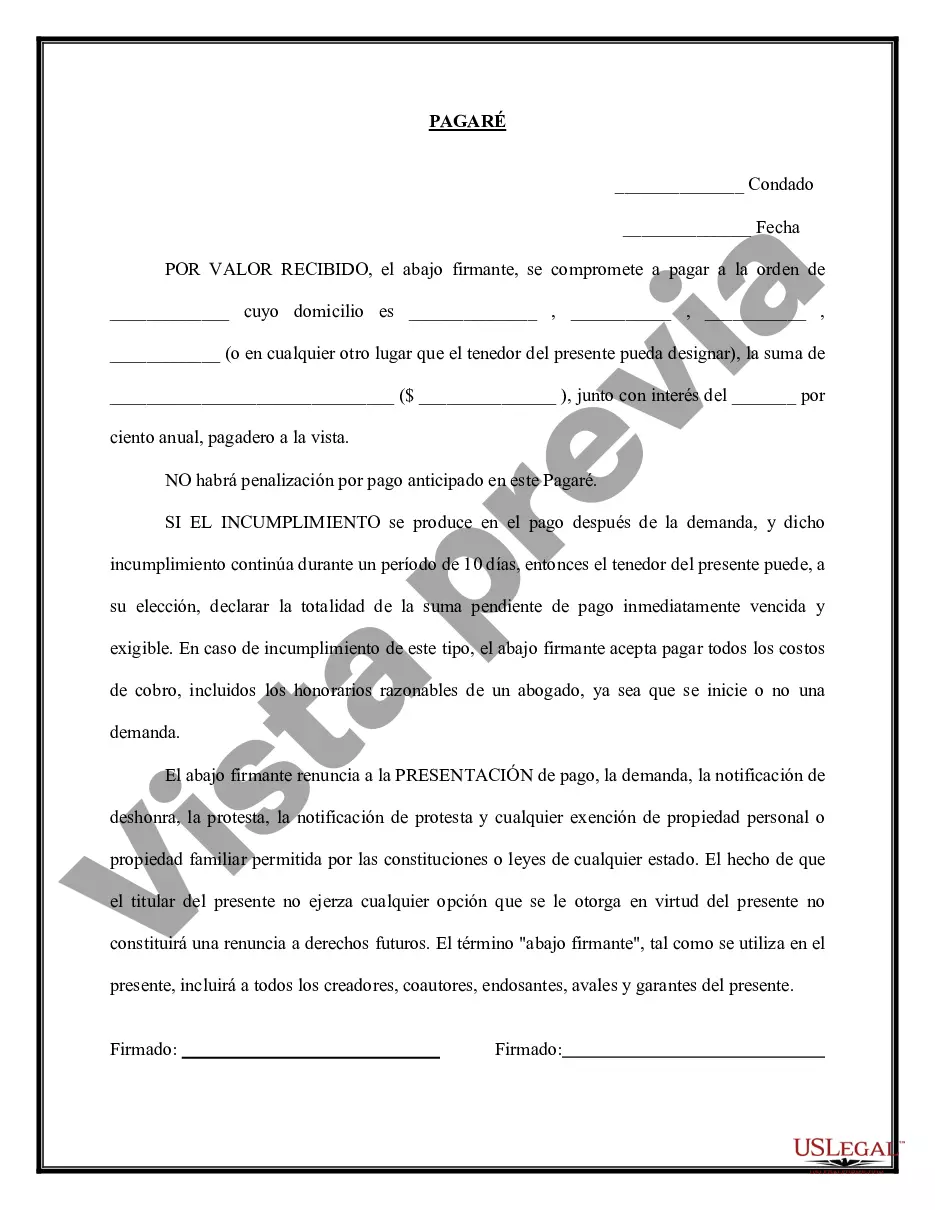

A Hennepin Minnesota Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Hennepin County, Minnesota. This type of promissory note is specifically designed to be payable on demand, meaning that the lender can demand repayment at any time. The Hennepin Minnesota Promissory Note — Payable on Demand is commonly used for both personal and business loans, providing a formal framework that protects the rights and obligations of both parties involved. It is important to note that this type of promissory note does not have a fixed repayment schedule, unlike other forms of promissory notes. In Hennepin County, Minnesota, there are several types of Hennepin Minnesota Promissory Note — Payable on Demand that can be used, depending on the specific requirements of the lenders and borrowers involved: 1. Unsecured Promissory Note — Payable on Demand: This type of promissory note does not require any collateral or security from the borrower. It is commonly used for small personal loans or loans between trusted parties. 2. Secured Promissory Note — Payable on Demand: This type of promissory note requires the borrower to provide collateral or security to the lender. The collateral serves as a guarantee for repayment in case the borrower defaults on the loan. 3. Demand Revolving Line of Credit Promissory Note: This type of promissory note is typically used in business transactions. It allows the borrower to access a predetermined credit limit on demand, with interest accrual and repayment terms specified in the note. 4. Demand Bridge Loan Promissory Note: This type of promissory note is commonly used in real estate transactions. It provides short-term financing to bridge the gap between buying a new property and selling an existing one. Regardless of the specific type, a Hennepin Minnesota Promissory Note — Payable on Demand should include important details such as the principal amount of the loan, interest rate, repayment terms, and any applicable penalties for late or missed payments. It is highly recommended that both parties involved seek legal advice to ensure the document reflects their intentions accurately and provides adequate protection for their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Hennepin Minnesota Pagaré - Pagadero A La Vista?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Hennepin Promissory Note - Payable on Demand, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the recent version of the Hennepin Promissory Note - Payable on Demand, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Hennepin Promissory Note - Payable on Demand:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Hennepin Promissory Note - Payable on Demand and save it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!