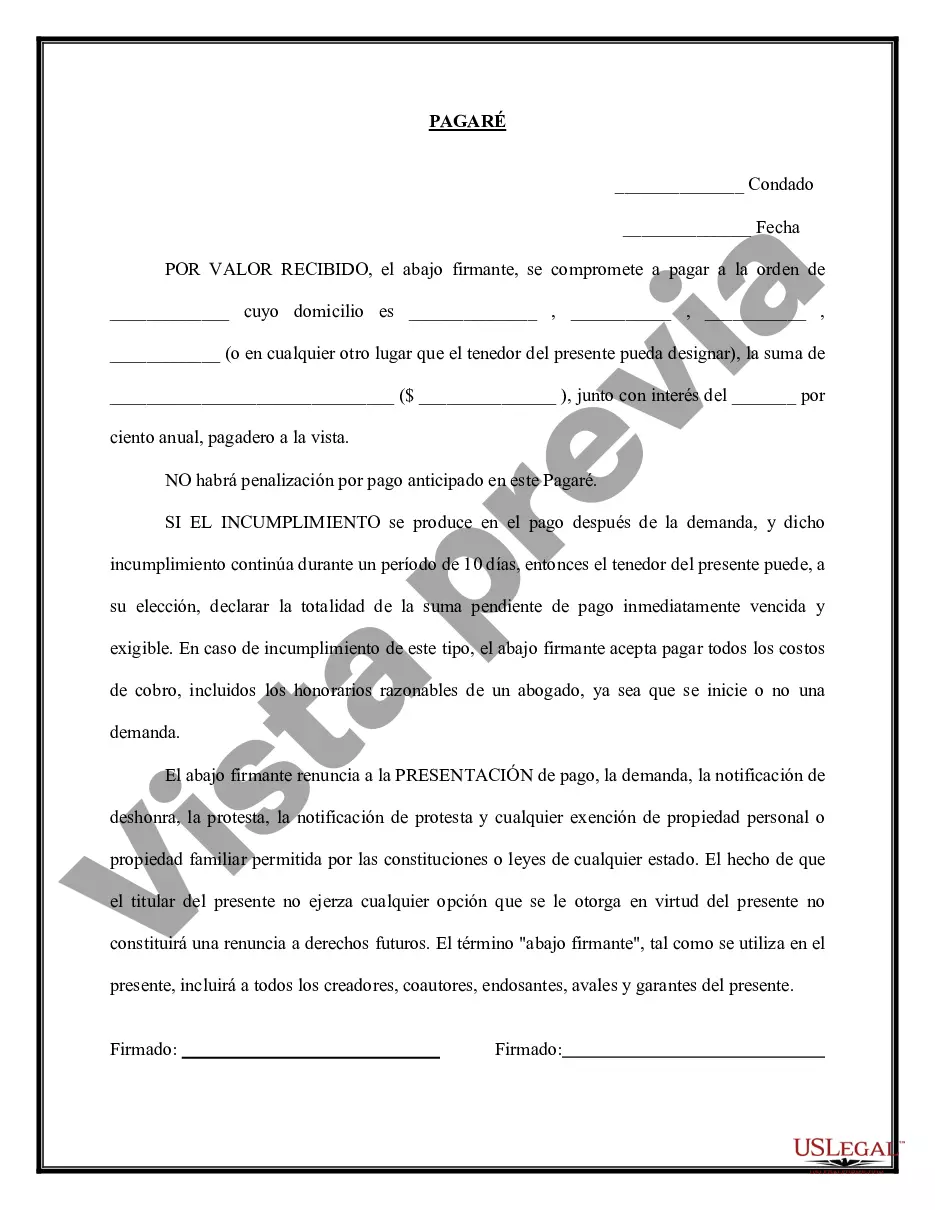

Los Angeles California Promissory Note — Payable on Demand is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Los Angeles, California. This type of promissory note is a written promise to repay a specified amount of money (principal) plus any interest within a designated timeframe. The Los Angeles California Promissory Note — Payable on Demand serves as proof of the debt owed by the borrower to the lender. It includes essential details such as the names and contact information of both parties involved, loan amount, interest rate, repayment schedule, and any additional terms. This document is legally binding, ensuring that both parties agree to comply with its terms. Different types of Los Angeles California Promissory Note — Payable on Demand may be categorized based on specific elements or variations in the terms. These variations can include: 1. Simple Promissory Note: This is the basic form of a promissory note, which includes the principal amount, interest rate, and repayment terms without any additional complexities. 2. Secured Promissory Note: This type of promissory note includes collateral provided by the borrower to secure the loan. In case of default, the lender can seize the collateral to satisfy the debt. 3. Demand Promissory Note: Unlike installment-based promissory notes, a demand promissory note allows the lender to demand repayment in full at any time without giving prior notice. It provides more flexibility in repayment options. 4. Revolving Promissory Note: This type of promissory note grants the borrower the freedom to borrow, repay, and borrow again within a specified credit limit, similar to a line of credit. 5. Bridge Loan Promissory Note: Bridge loan promissory notes are temporary loans that bridge the financial gap between the borrower's immediate needs and a future long-term loan. They are often used in real estate transactions. When drafting a Los Angeles California Promissory Note — Payable on Demand, it is crucial to consult with a legal professional to ensure compliance with state laws and to address any specific requirements or agreements between the lender and borrower.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pagare A La Vista - Promissory Note - Payable on Demand

Description

How to fill out Los Angeles California Pagaré - Pagadero A La Vista?

Creating documents, like Los Angeles Promissory Note - Payable on Demand, to manage your legal affairs is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for different cases and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Los Angeles Promissory Note - Payable on Demand template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before downloading Los Angeles Promissory Note - Payable on Demand:

- Ensure that your document is specific to your state/county since the regulations for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Los Angeles Promissory Note - Payable on Demand isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our website and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!