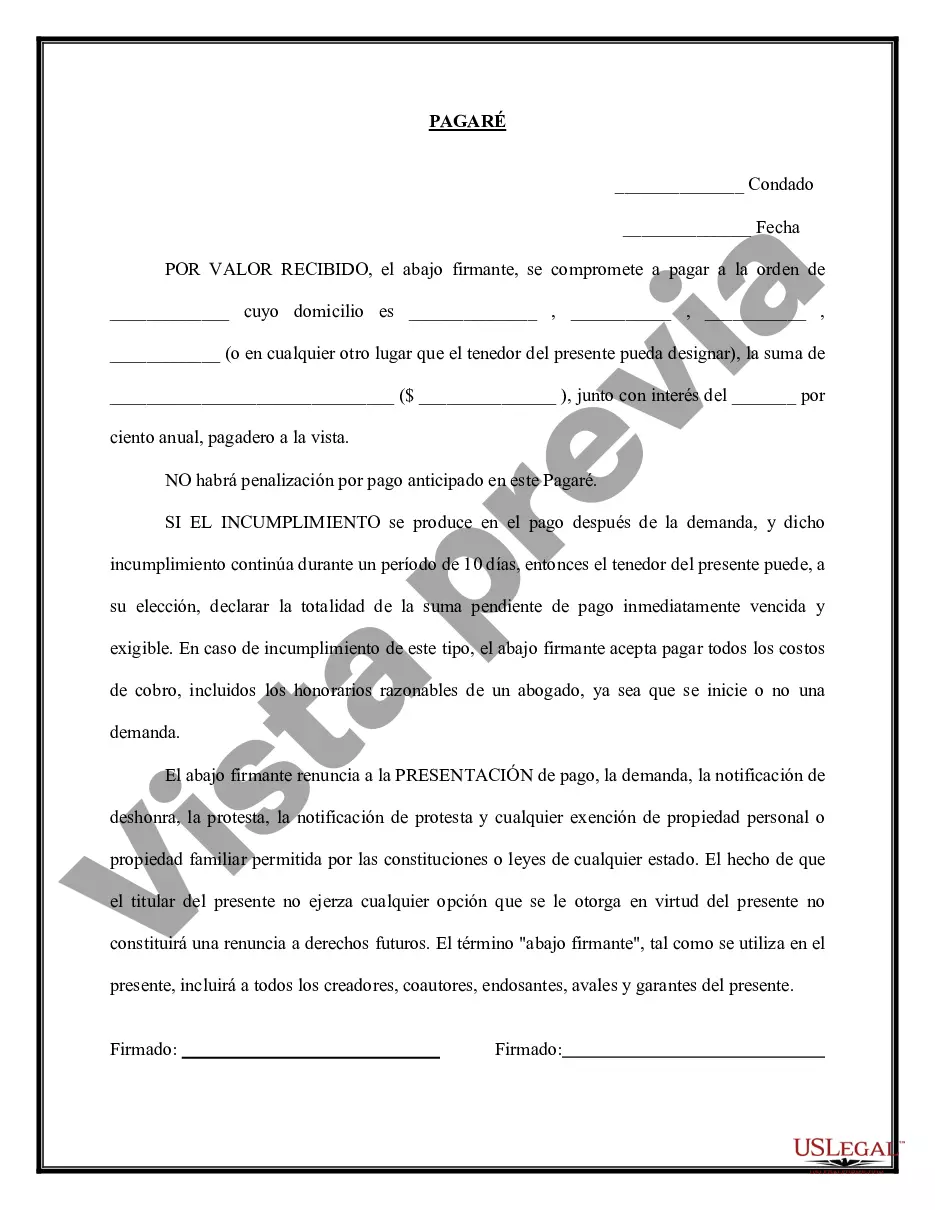

The Montgomery Maryland promissory note, specifically the "Payable on Demand" type, is a legally binding document that outlines an agreement between a borrower and a lender in Montgomery County, Maryland. It serves as evidence of a loan transaction, specifying the terms and conditions under which the borrowed funds are to be repaid. The "Payable on Demand" aspect refers to the lender's right to demand repayment of the loan at any time. This type of promissory note is commonly used in various financial transactions, such as personal loans, business loans, or real estate deals, where the lender requires immediate repayment flexibility. By incorporating the "Payable on Demand" clause, the lender maintains greater control over the borrowed funds, enabling them to require repayment without prior notice. The Montgomery Maryland promissory note — Payable on Demand typically includes essential components such as: 1. Parties Involved: It identifies the borrower(s) and lender(s) involved in the loan agreement, stating their full legal names and relevant contact information. 2. Loan Amount and Interest: The note specifies the total loan amount disbursed to the borrower, along with any accrued interest rate or fixed interest amount agreed upon by both parties. 3. Repayment Terms: This section outlines the payment terms, including the mode of repayment (cash, check, electronic transfer), scheduled dates, and frequency of payments. In the case of "Payable on Demand," it emphasizes the lender's right to request full repayment without prior notice. 4. Late Payment Penalties: The promissory note may entail penalties or charges for late payments, providing incentives for the borrower to make timely repayments. These penalties often include a percentage fee or additional interest levied on the outstanding balance. 5. Collateral and Security: If applicable, the note may list any assets or collateral that the borrower pledges as security in case of default. This ensures the lender's ability to recover funds if the borrower fails to repay the loan. It is important to note that variations or customized versions of the "Payable on Demand" promissory note may exist to cater to specific loan transactions or legal requirements. Some examples of the different types include: 1. Demand Loan Promissory Note: This type of promissory note explicitly emphasizes that the loan is payable upon request by the lender, providing flexibility and immediacy in repayment. 2. Open-End Promissory Note: In this case, the promissory note remains open and ongoing, allowing the borrower and lender to make multiple draws and repayments over time. The loan balance may fluctuate, but the lender retains the option to request repayment at any given time. 3. Acceleration Clause Promissory Note: This variation includes an acceleration clause that entitles the lender to demand immediate repayment if certain specified events take place, such as the borrower's bankruptcy or breach of the loan agreement. 4. Revolving Promissory Note: Similar to an open-end note, a revolving promissory note allows the borrower to borrow, repay, and re-borrow within a specified credit limit. The lender maintains the right to ask for repayment at any point within the agreed-upon terms. Overall, the Montgomery Maryland Promissory Note — Payable on Demand plays a crucial role in loan transactions, offering flexibility and control to the lender while establishing clear repayment terms that protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Montgomery Maryland Pagaré - Pagadero A La Vista?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Montgomery Promissory Note - Payable on Demand.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Montgomery Promissory Note - Payable on Demand will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Montgomery Promissory Note - Payable on Demand:

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Montgomery Promissory Note - Payable on Demand on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!