A San Jose California Promissory Note — Payable on Demand is a legally binding document that records a written promise made by one party, known as the "borrower," to repay a specific amount of money to another party, known as the "lender," on demand or within a specific timeframe. This type of promissory note is commonly used in San Jose, California, to facilitate loans between individuals, businesses, or entities. The San Jose California Promissory Note — Payable on Demand serves as an instrument to memorialize the terms and conditions of the loan agreement, including the principal amount borrowed, the interest rate (if applicable), repayment terms, and any collateral or security provided by the borrower. There are various types of San Jose California Promissory Notes — Payable on Demand that individuals or businesses may encounter. Some of these may include: 1. Personal Promissory Note: This type of promissory note is used when an individual borrows money from another individual, often for personal or non-commercial purposes. It outlines the agreed-upon terms, including repayment schedules and any interest or late fees imposed. 2. Business Promissory Note: These promissory notes are commonly used for commercial purposes, where businesses borrow money from individuals, financial institutions, or other businesses. The terms of the note usually include repayment schedules, interest rates, and provisions for default or late payments. 3. Secured Promissory Note: This is a type of promissory note that includes a collateral agreement between the borrower and the lender. In the event of default, the lender can claim ownership of the specified asset(s) used as collateral to recover their investment. 4. Unsecured Promissory Note: Unlike secured promissory notes, unsecured promissory notes do not involve collateral or any specific assets. These notes rely solely on the borrower's promise to repay the loan and are typically used when the borrower does not have assets to offer as collateral. 5. Demand Promissory Note: As the name suggests, this type of promissory note allows the lender to demand repayment of the loan at any time. It provides flexibility and convenience to the lender, as they can request the repayment immediately upon demand, typically without granting any grace period. San Jose California Promissory Notes — Payable on Demand play a vital role in facilitating loans and defining the terms of repayment in San Jose, ensuring both lenders and borrowers have a clear understanding of their obligations and rights. It is always advisable to consult legal professionals or financial advisors to ensure the proper drafting and execution of these documents to avoid any legal disputes or complications in the future.

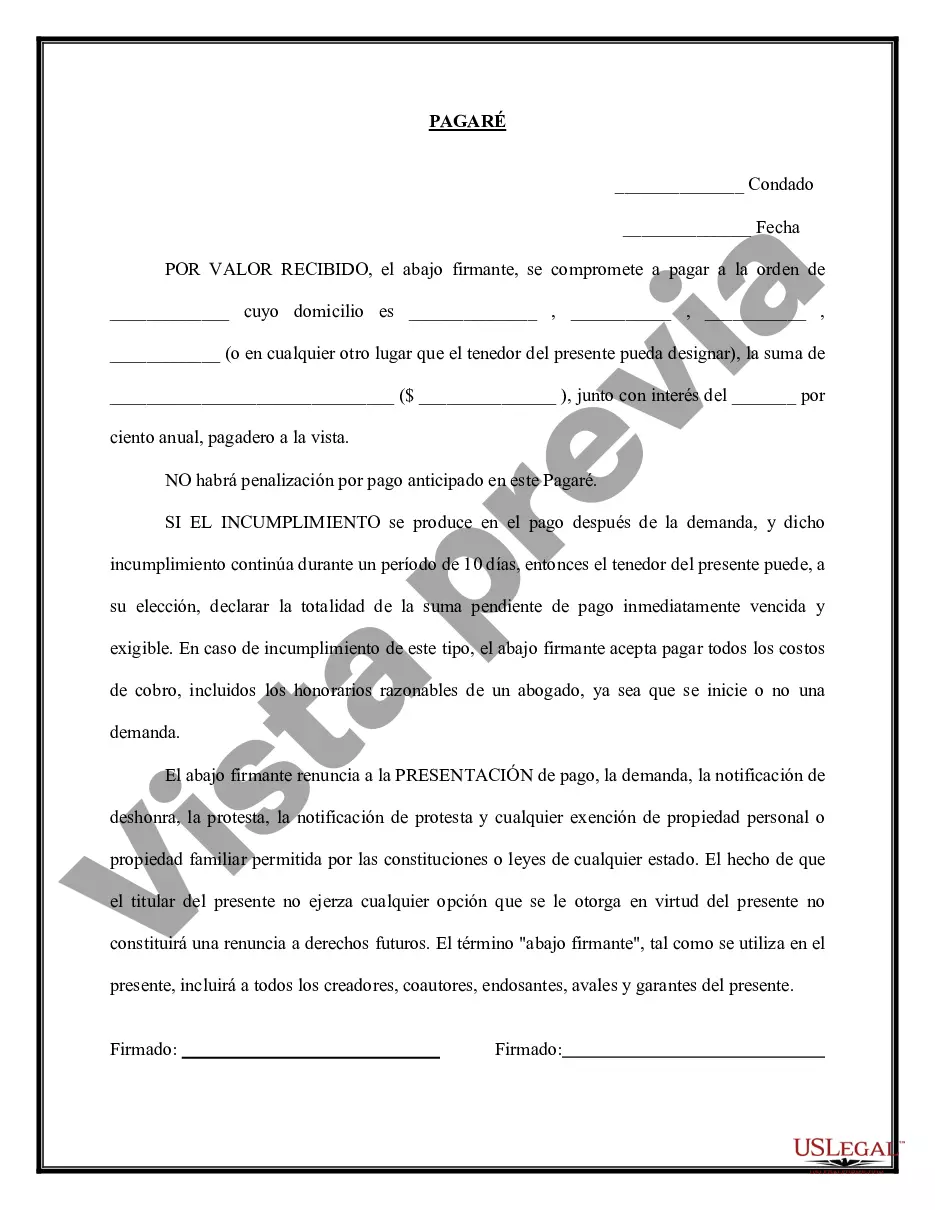

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out San Jose California Pagaré - Pagadero A La Vista?

If you need to find a trustworthy legal document provider to find the San Jose Promissory Note - Payable on Demand, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting materials, and dedicated support make it simple to find and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to look for or browse San Jose Promissory Note - Payable on Demand, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the San Jose Promissory Note - Payable on Demand template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the San Jose Promissory Note - Payable on Demand - all from the comfort of your sofa.

Sign up for US Legal Forms now!