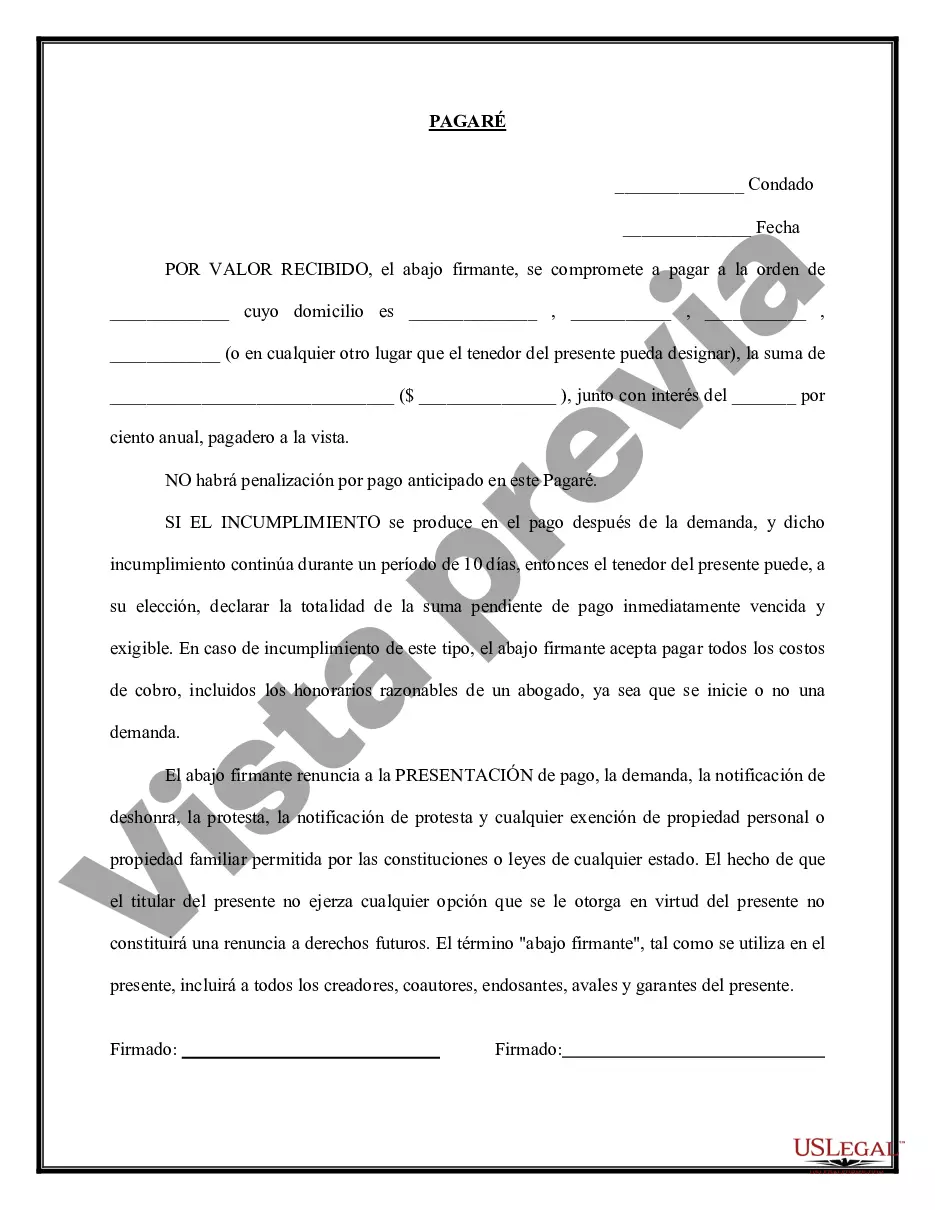

A Travis Texas Promissory Note — Payable on Demand is a legal document used to record a promise to repay a certain amount of money borrowed. This type of promissory note is specifically created and executed in accordance with the laws and regulations of Travis County, Texas. Keywords: Travis Texas, Promissory Note, Payable on Demand, legal document, repay, borrowed, laws, regulations, Travis County. Travis Texas Promissory Note — Payable on Demand is a versatile financial instrument commonly used for various transactions such as personal loans, small business financing, or any situation where the lender requires repayment upon demand. This type of promissory note provides a clear framework for both parties involved, stating the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and consequences of default. Different types of Travis Texas Promissory Note — Payable on Demand may include: 1. Unsecured Promissory Note: This note does not require any collateral to secure the loan. It solely relies on the borrower's creditworthiness and reputation. 2. Secured Promissory Note: Unlike the unsecured note, this type of promissory note is backed by collateral, such as real estate, vehicles, or other valuable assets. If the borrower fails to repay the loan as agreed, the lender has the right to claim the collateral to cover the outstanding debt. 3. Revolving Promissory Note: This note allows the borrower to request multiple draw downs from the lender within a specific period. As the borrower repays the drawn funds, they become available for borrowing again, similar to a credit line. 4. Demand Promissory Note: As opposed to installment-based promissory notes, this type of note requires immediate repayment upon the lender's request. The lender has the authority to demand full repayment on demand or at any agreed-upon time. When drafting a Travis Texas Promissory Note — Payable on Demand, it is crucial to consult with legal professionals to ensure compliance with local laws and regulations. Both parties should have a thorough understanding of the terms and obligations established within the note to facilitate a smooth borrowing and repayment experience.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out Travis Texas Pagaré - Pagadero A La Vista?

Creating documents, like Travis Promissory Note - Payable on Demand, to take care of your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for a variety of scenarios and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Travis Promissory Note - Payable on Demand form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before getting Travis Promissory Note - Payable on Demand:

- Ensure that your template is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Travis Promissory Note - Payable on Demand isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to start using our service and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!