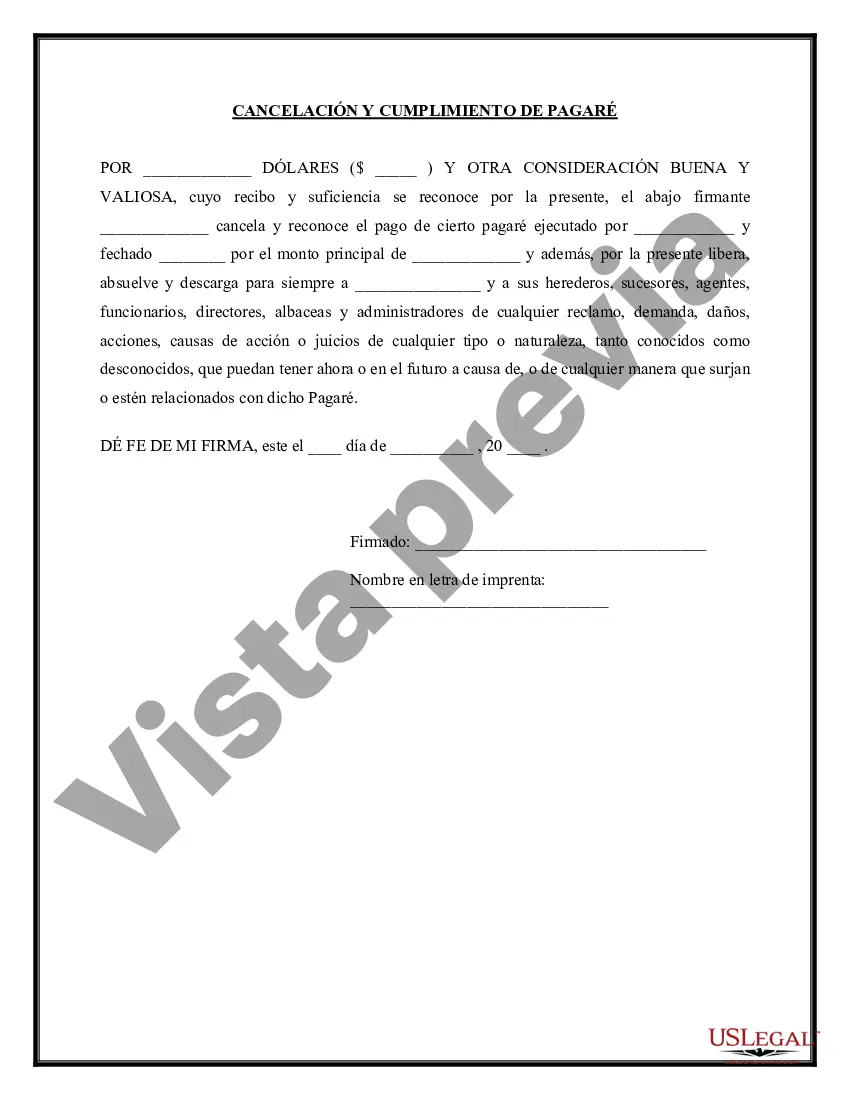

Chicago Illinois Promissory Note — Satisfaction and Release is a legal document used to acknowledge the full repayment of a promissory note and release the borrower from any further obligations. This document serves as proof that the lender has been satisfied with the repayment as agreed upon and declares that all terms of the promissory note have been fulfilled. The Chicago Illinois Promissory Note — Satisfaction and Release acts as a crucial record for both parties involved, providing protection and clarity in the event of future disputes or misunderstandings. When the borrower fully satisfies their debt, this document ensures that the lender acknowledges the satisfaction and releases any claims or rights against the borrower related to the promissory note. Different types of Chicago Illinois Promissory Note — Satisfaction and Release may include: 1. Full Satisfaction and Release: This type of release is utilized when the borrower has repaid the total amount owed in accordance with the terms of the promissory note. It absolves the borrower from any further liability and releases the lender from any claims related to the note. 2. Partial Satisfaction and Release: This variation applies when the borrower has made partial payments, reducing the outstanding balance of the promissory note. It releases the borrower from the obligation of the portion repaid while preserving the lender's rights to collect the remaining debt. 3. Amendment and Release: In some cases, the parties may mutually agree to modify the terms of the promissory note, such as adjusting the interest rate or repayment schedule. This type of satisfaction and release document reflects the revised terms and releases the borrower from the original obligations. When drafting a Chicago Illinois Promissory Note — Satisfaction and Release, it is vital to include key details such as: 1. Names and contact information of the lender and borrower 2. Date of the original promissory note 3. Amount borrowed 4. Terms of repayment, including interest rate, installments, and due dates 5. Declaration that the borrower has satisfied all obligations under the promissory note 6. Signature lines for both the lender and borrower, along with the date of signing 7. Notary acknowledgment to ensure the authenticity of the document Including these essential elements will help create a comprehensive and legally sound Chicago Illinois Promissory Note — Satisfaction and Release document that protects the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Pagaré - Satisfacción y Liberación - Promissory Note - Satisfaction and Release

Description

How to fill out Chicago Illinois Pagaré - Satisfacción Y Liberación?

Drafting documents for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to generate Chicago Promissory Note - Satisfaction and Release without expert assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Chicago Promissory Note - Satisfaction and Release by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Chicago Promissory Note - Satisfaction and Release:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!