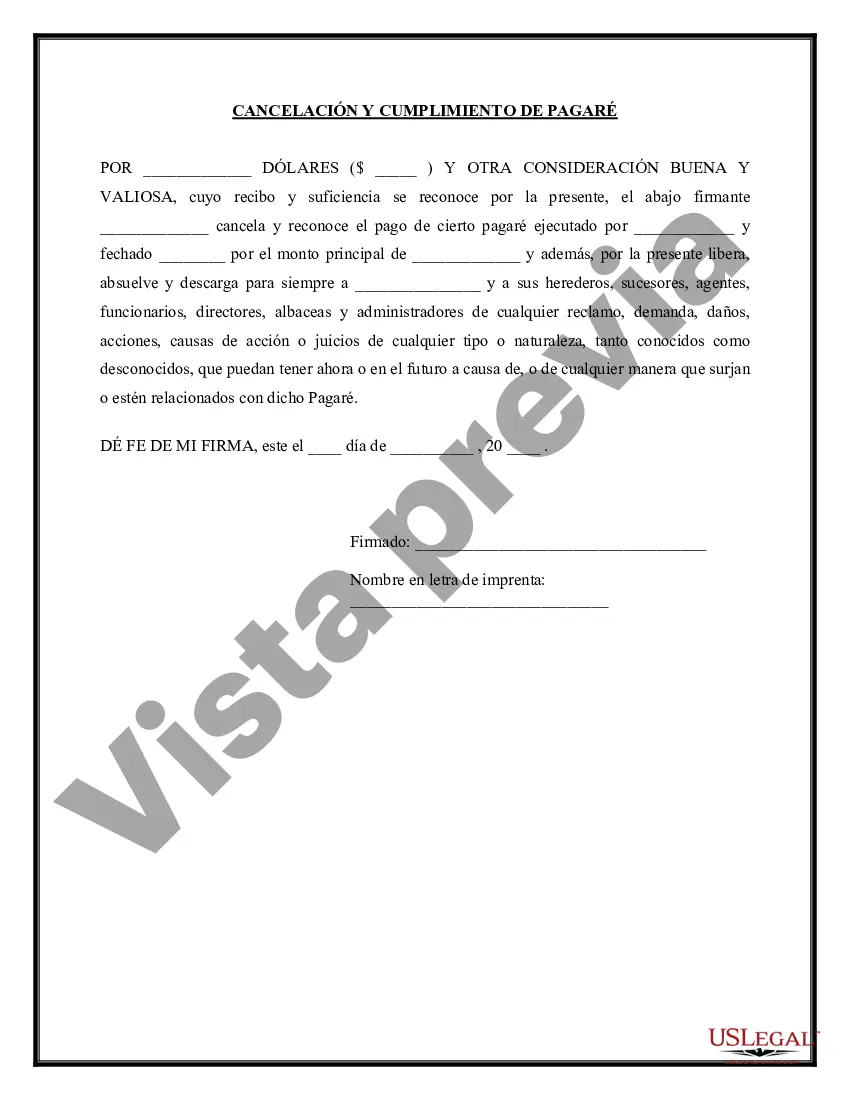

A Collin Texas Promissory Note — Satisfaction and Release is a legal document used in the state of Texas to settle a debt between a lender and borrower. This document serves as proof that the borrower has fulfilled their obligations outlined in the promissory note, thereby releasing them from any further liability. The Collin Texas Promissory Note — Satisfaction and Release is typically used when a borrower has successfully repaid the loan in full or completed all agreed-upon terms of the promissory note. It acknowledges that the lender has no further claims against the borrower and confirms the satisfaction of the debt. Keywords: Collin Texas, Promissory Note, Satisfaction and Release, debt settlement, lender, borrower, obligations, liability, repayment, completed terms, claims. Different types of Collin Texas Promissory Note — Satisfaction and Release include: 1. Full Satisfaction and Release: This type is used when the borrower has satisfied all obligations under the promissory note, either by repaying the loan amount in full or fulfilling any other agreed-upon terms. It releases the borrower from any further claims by the lender related to the loan. 2. Partial Satisfaction and Release: This type is utilized when the borrower has partially fulfilled their obligations as outlined in the promissory note. It provides a release for the portion of the debt that has been satisfied, while acknowledging that there is still an outstanding balance remaining to be repaid. 3. Mutual Release: This type of Collin Texas Promissory Note — Satisfaction and Release is used when both the lender and borrower agree to mutually release each other from any further claims or obligations related to the promissory note. It signifies a complete settlement between the parties involved, releasing them from any future disputes or liabilities. 4. Release of Collateral: In certain cases, a borrower may have provided collateral as security for the loan. This specific type of Collin Texas Promissory Note — Satisfaction and Release is used when the borrower has fully satisfied their debt and the lender releases any claims to the collateral. It acknowledges that the collateral is no longer encumbered by the debt and can be returned to the borrower. 5. Conditional Release: This type of Collin Texas Promissory Note — Satisfaction and Release is used when certain conditions need to be met by the borrower before they can be fully released from their obligations. It outlines these conditions and specifies that the release will only take effect once they have been fulfilled. Until such conditions are met, the borrower remains liable for the debt. In conclusion, a Collin Texas Promissory Note — Satisfaction and Release is a crucial document that provides legal proof of repayment or fulfillment of obligations outlined in a promissory note. It ensures that both the lender and borrower have a clear understanding of their rights and obligations, bringing a satisfactory resolution to the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Pagaré - Satisfacción y Liberación - Promissory Note - Satisfaction and Release

Description

How to fill out Collin Texas Pagaré - Satisfacción Y Liberación?

Are you looking to quickly draft a legally-binding Collin Promissory Note - Satisfaction and Release or maybe any other document to handle your personal or corporate matters? You can select one of the two options: contact a professional to write a valid document for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Collin Promissory Note - Satisfaction and Release and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Collin Promissory Note - Satisfaction and Release is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Collin Promissory Note - Satisfaction and Release template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Moreover, the documents we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!