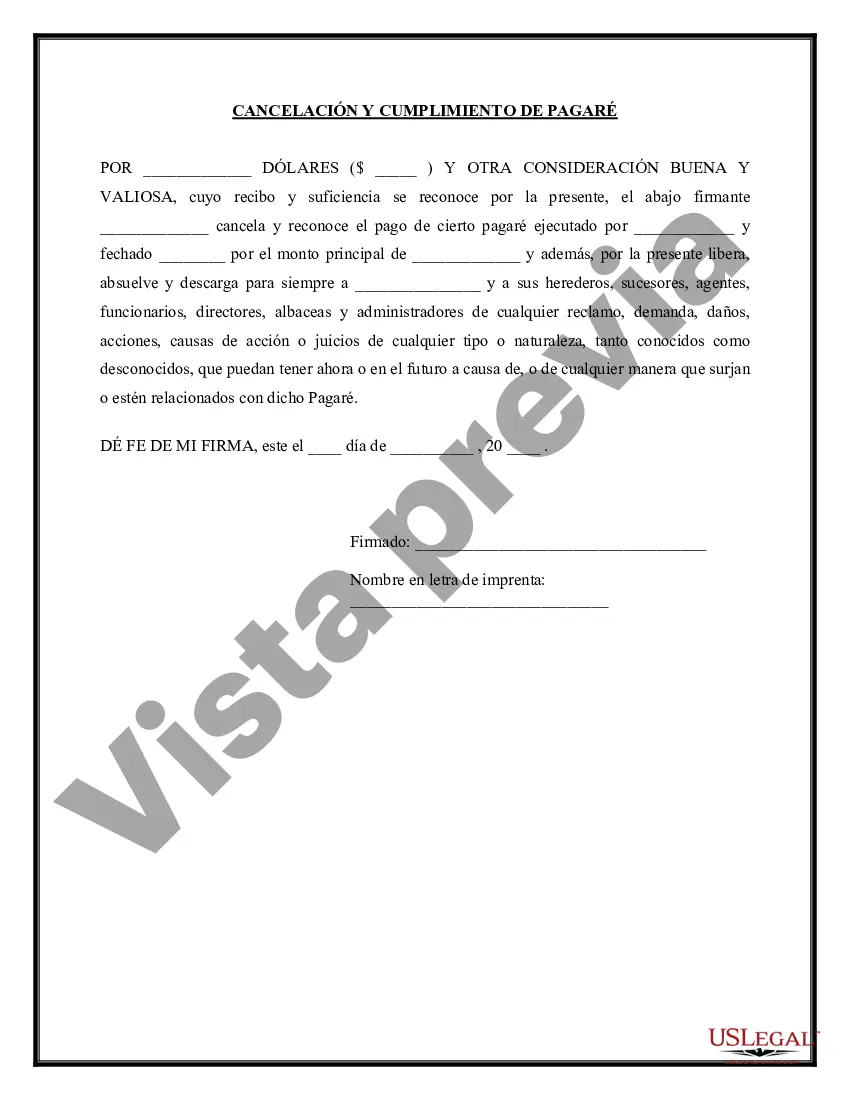

Oakland County, Michigan, is a vibrant region known for its diverse communities and thriving economy. Within this context, a promissory note is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower in Oakland County. The Oakland Michigan Promissory Note — Satisfaction and Release serves as proof that the borrower has fulfilled their financial obligations and has satisfied the terms of the loan. It signifies the completion of the loan repayment process and allows the borrower to be released from any further obligations related to the loan. This document is crucial for both parties involved as it provides a written acknowledgment of the borrower's payment of the loan principal, interest, and any other agreed-upon fees. It ensures that the lender has received full compensation and releases any liens or claims they may have had against the borrower's assets. In Oakland County, there are several types of Promissory Note — Satisfaction and Release documents that cater to various loan scenarios, including: 1. Personal Loan Satisfaction and Release: This document is used when an individual borrows money from a friend, family member, or acquaintance, and successfully repays the loan. It releases the borrower from any outstanding obligations and ensures there are no lingering financial disputes. 2. Mortgage Loan Satisfaction and Release: This type of satisfaction and release document is utilized in real estate transactions when a loan (typically a mortgage) has been fully paid off. It confirms that the borrower has fulfilled their obligations, allowing them to clear their title from any encumbrances. 3. Business Loan Satisfaction and Release: When a business borrows funds from a financial institution or private lender, this document is employed to acknowledge the complete repayment of the loan. It releases the business from any lingering liabilities and demonstrates their financial integrity. 4. Student Loan Satisfaction and Release: Student loans, often taken to finance education expenses, require a satisfaction and release document once all the loan amounts, including principal and interest, have been paid in full. This document provides proof that the borrower has successfully fulfilled their educational debt obligations. It is imperative for parties engaging in promissory note agreements in Oakland County, Michigan, to execute a Promissory Note — Satisfaction and Release upon loan fulfillment. This document solidifies and safeguards the legal rights and interests of both the lender and the borrower, ensuring a transparent and undisputed completion of the loan relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Pagaré - Satisfacción y Liberación - Promissory Note - Satisfaction and Release

Description

How to fill out Oakland Michigan Pagaré - Satisfacción Y Liberación?

If you need to find a trustworthy legal form provider to obtain the Oakland Promissory Note - Satisfaction and Release, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support team make it easy to locate and complete various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Oakland Promissory Note - Satisfaction and Release, either by a keyword or by the state/county the document is created for. After locating needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Oakland Promissory Note - Satisfaction and Release template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less pricey and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Oakland Promissory Note - Satisfaction and Release - all from the convenience of your sofa.

Join US Legal Forms now!