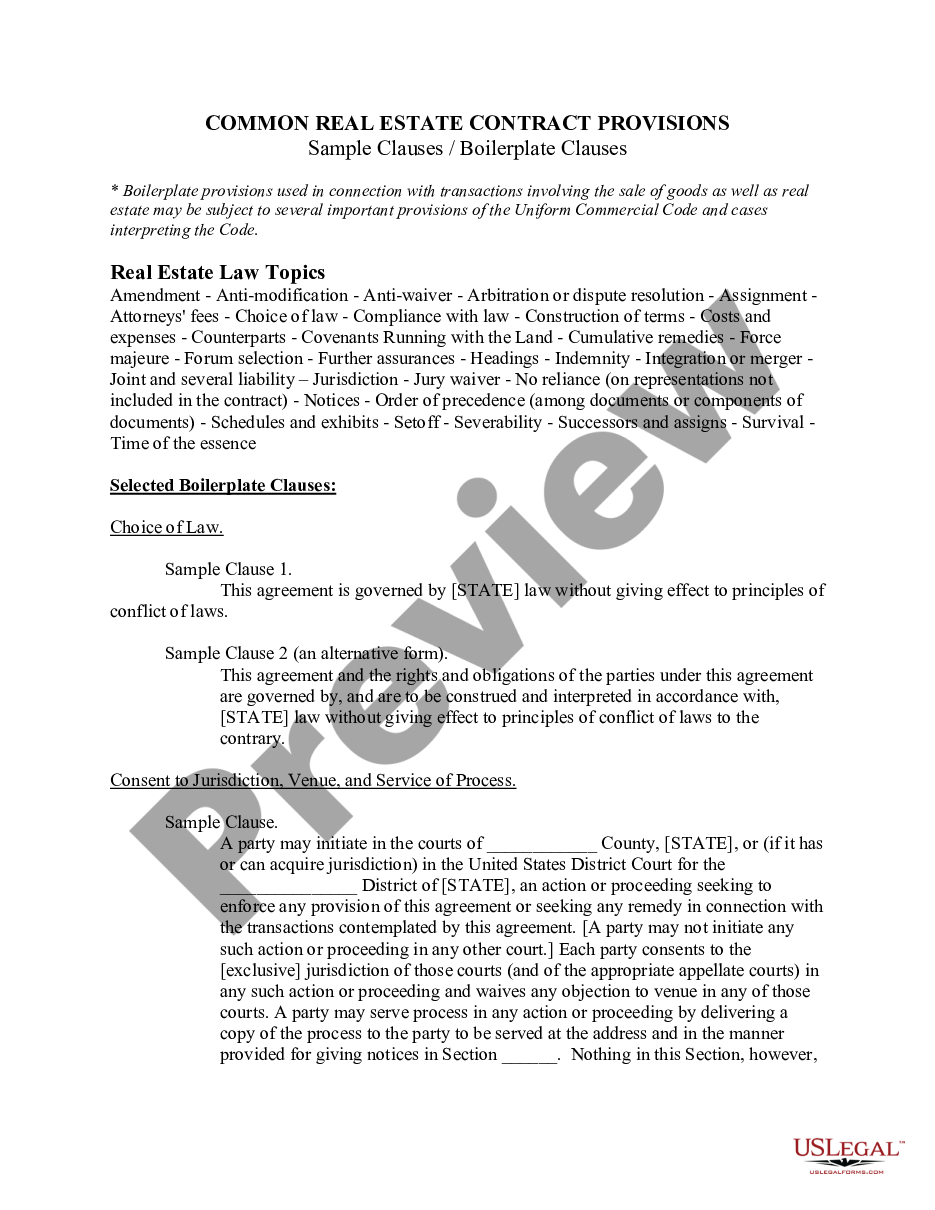

The Alameda California Multistate Promissory Note — Secured is a legal document used in the state of California to outline the terms and conditions of a loan agreement between a lender (often a financial institution or an individual) and a borrower (individual or business entity). This specific note is designed to be used in multiple states, including California and Alameda County. The promissory note serves as evidence of the debt and specifies the repayment terms. It is a legally binding agreement that ensures both parties are aware of their responsibilities and rights throughout the loan period. The note is secured, meaning that it is backed by collateral, typically in the form of real estate or other valuable assets belonging to the borrower. The Alameda California Multistate Promissory Note — Secured includes various crucial elements that are essential in creating a comprehensive agreement. These may include: 1. Parties Involved: The note clearly identifies the lender and borrower, stating their legal names and addresses. This information is crucial for establishing the legal relationship between the two parties. 2. Loan Details: The note specifies the loan amount, interest rate (fixed or variable), and the repayment schedule. It outlines the frequency of payment (monthly, quarterly) and the due dates. 3. Late Payment Penalties: The note may contain provisions for penalties that the borrower must pay if they fail to make timely payments. It also outlines the consequences of default, such as potential foreclosure or repossession of collateral. 4. Collateral Description: This section provides a detailed description of the collateral used to secure the loan. It includes information regarding the property's location, type, and condition. In the event of default, the lender has the right to take legal action to seize and sell the collateral to recover the outstanding debt. 5. Governing Law: The note specifies the state laws that govern the agreement, which in this case is California. This ensures that any dispute resolution or legal proceedings related to the note will be conducted according to California's laws. Different types of Alameda California Multistate Promissory Note — Secured may vary based on the specific loan terms, the type of collateral used, or any additional provisions added to the agreement. Some variants may include: 1. Fixed-Rate Multistate Promissory Note — Secured: In this type, the interest rate remains constant throughout the loan term. It provides a predictable repayment schedule for the borrower. 2. Adjustable-Rate Multistate Promissory Note — Secured: This type of note includes an interest rate that can fluctuate over time. The interest rate changes based on a predetermined index, offering potential advantages or risks for both the borrower and lender. 3. Commercial Multistate Promissory Note — Secured: This variant applies specifically to loans provided for commercial purposes, such as funding a business venture or purchasing commercial property. 4. Real Estate Multistate Promissory Note — Secured: This note is tailored for loans used for real estate purposes, including mortgages and property investments. It incorporates specific provisions related to real estate collateral and related legal considerations. When entering into a financial agreement, it is vital for both parties to seek legal advice and thoroughly understand the terms and conditions set forth in the Alameda California Multistate Promissory Note — Secured. Proper understanding and adherence to the note's provisions are crucial to maintaining a healthy lender-borrower relationship and ensuring the loan is repaid as agreed upon.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Pagaré Multiestado - Garantizado - Multistate Promissory Note - Secured

Description

How to fill out Alameda California Pagaré Multiestado - Garantizado?

If you need to find a trustworthy legal form supplier to find the Alameda Multistate Promissory Note - Secured, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support make it simple to get and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply type to look for or browse Alameda Multistate Promissory Note - Secured, either by a keyword or by the state/county the form is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Alameda Multistate Promissory Note - Secured template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less pricey and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Alameda Multistate Promissory Note - Secured - all from the convenience of your sofa.

Sign up for US Legal Forms now!