The Alameda California Multistate Promissory Note — Unsecure— - Signature Loan is a legal document that outlines the terms and conditions of a personal loan between a lender and a borrower in the state of California. This particular type of loan is unsecured, meaning it does not require any collateral, and is solely based on the borrower's signature as a promise to repay the loan. Key features of the Alameda California Multistate Promissory Note — Unsecure— - Signature Loan: 1. Loan Amount: The document specifies the amount of money borrowed by the borrower from the lender. 2. Loan Term: This section details the duration of the loan, including the start date and end date of the repayment period. 3. Interest Rate: The interest rate charged on the loan is clearly mentioned in the note, and it determines the additional cost the borrower will bear for borrowing the funds. 4. Repayment Schedule: The document outlines the repayment schedule, describing the frequency (monthly, quarterly, etc.) and the number of payments. 5. Late Payment and Default: Terms for late payment and default are provided, including any penalties or additional fees that may be charged in case of non-payment or delayed payment. 6. Governing Law: This section specifies that the laws of the state of California will govern the agreement, ensuring legal compliance. Different types of Alameda California Multistate Promissory Note — Unsecure— - Signature Loans can be categorized based on specific variations in the terms or borrower's requirements. Some potential types include: 1. Fixed-Rate Signature Loan: This type of loan offers a fixed interest rate throughout the loan term, providing borrowers with a predictable repayment structure. 2. Variable-Rate Signature Loan: In this case, the interest rate is subject to change over the loan term based on an agreed-upon index, such as the prime rate or LIBOR. 3. Consolidation Signature Loan: This type of loan is designed to help borrowers consolidate multiple existing debts into one loan for easier management and potentially lower interest rates. 4. Personal Line of Credit: Unlike traditional installment loans, a personal line of credit allows borrowers to access funds up to a pre-approved credit limit, with interest charged only on the amount borrowed. 5. Student Signature Loan: These loans are specifically tailored for students to cover education-related expenses such as tuition fees, books, and living expenses without collateral requirements. It is crucial to note that the specific terms and conditions of Alameda California Multistate Promissory Note — Unsecure— - Signature Loans may vary based on the agreement between the lender and borrower, and it is advisable for both parties to seek legal counsel before finalizing the loan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Como Redactar Un Pagare Ejemplo - Multistate Promissory Note - Unsecured - Signature Loan

Description como hacer un pagare escrito

How to fill out Alameda California Pagaré De Varios Estados - Sin Garantía - Préstamo De Firma?

Whether you intend to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Alameda Multistate Promissory Note - Unsecured - Signature Loan is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Alameda Multistate Promissory Note - Unsecured - Signature Loan. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

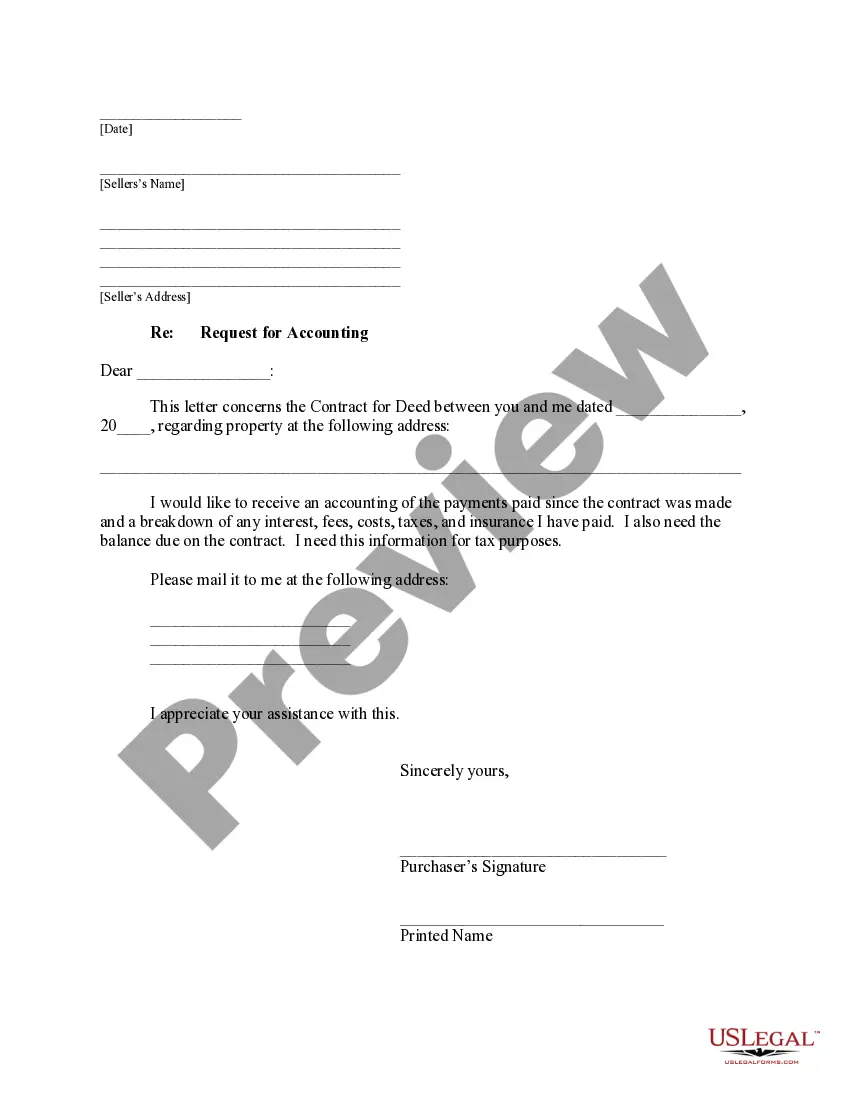

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Multistate Promissory Note - Unsecured - Signature Loan in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!