A Riverside California Multistate Promissory Note is a legally binding document that outlines the terms and conditions of an unsecured signature loan in the state of California. This type of loan is commonly used for personal or business purposes and can be obtained without the need for collateral. The Riverside California Multistate Promissory Note serves as an agreement between the borrower and the lender, clearly specifying the loan amount, the interest rate, and the repayment schedule. It establishes the borrower's obligation to repay the loaned amount with interest over a set period. This type of loan is considered unsecured, meaning it does not require any collateral to secure the funds. Instead, the lender evaluates the borrower's creditworthiness, income, and financial history to determine the loan's terms. As there is no collateral involved, the lender relies heavily on the borrower's signature as a promise to repay the loan. It is essential to understand the different types of Riverside California Multistate Promissory Note — Unsecure— - Signature Loans. While the basic structure and purpose remain the same, specific variations may exist depending on the lender's policies or the borrower's requirements. 1. Standard Unsecured Signature Loan: This type of promissory note covers general personal or business loans where no collateral is required. The borrower is solely responsible for repaying the loan amount and any interest accrued. 2. Small Business Unsecured Signature Loan: Tailored specifically for small business owners, this type of Promissory Note provides funds to finance business expansion, working capital, or other business-related needs. The borrower's personal and business creditworthiness may affect the loan terms. 3. Personal Unsecured Signature Loan: Aimed at individuals, this type of promissory note provides funds for personal expenses, such as education, medical bills, home improvements, or debt consolidation. The borrower's creditworthiness and income play a significant role in determining loan availability and terms. 4. Emergency Unsecured Signature Loan: Designed to provide immediate financial assistance during emergencies, this type of loan is typically processed quickly, allowing borrowers to access funds promptly. Interest rates may be higher than standard loans due to the expedited nature of the loan process. In conclusion, the Riverside California Multistate Promissory Note — Unsecure— - Signature Loan is a versatile financing option commonly used for personal or business purposes in Riverside, California. Various types of these loans cater to different needs, such as personal expenses, small business financing, and emergency funding. It is crucial for borrowers to thoroughly read and understand the terms and conditions outlined in the promissory note before agreeing to the loan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Pagaré de varios estados - Sin garantía - Préstamo de firma - Multistate Promissory Note - Unsecured - Signature Loan

Description

How to fill out Riverside California Pagaré De Varios Estados - Sin Garantía - Préstamo De Firma?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Riverside Multistate Promissory Note - Unsecured - Signature Loan, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any activities related to document completion simple.

Here's how to find and download Riverside Multistate Promissory Note - Unsecured - Signature Loan.

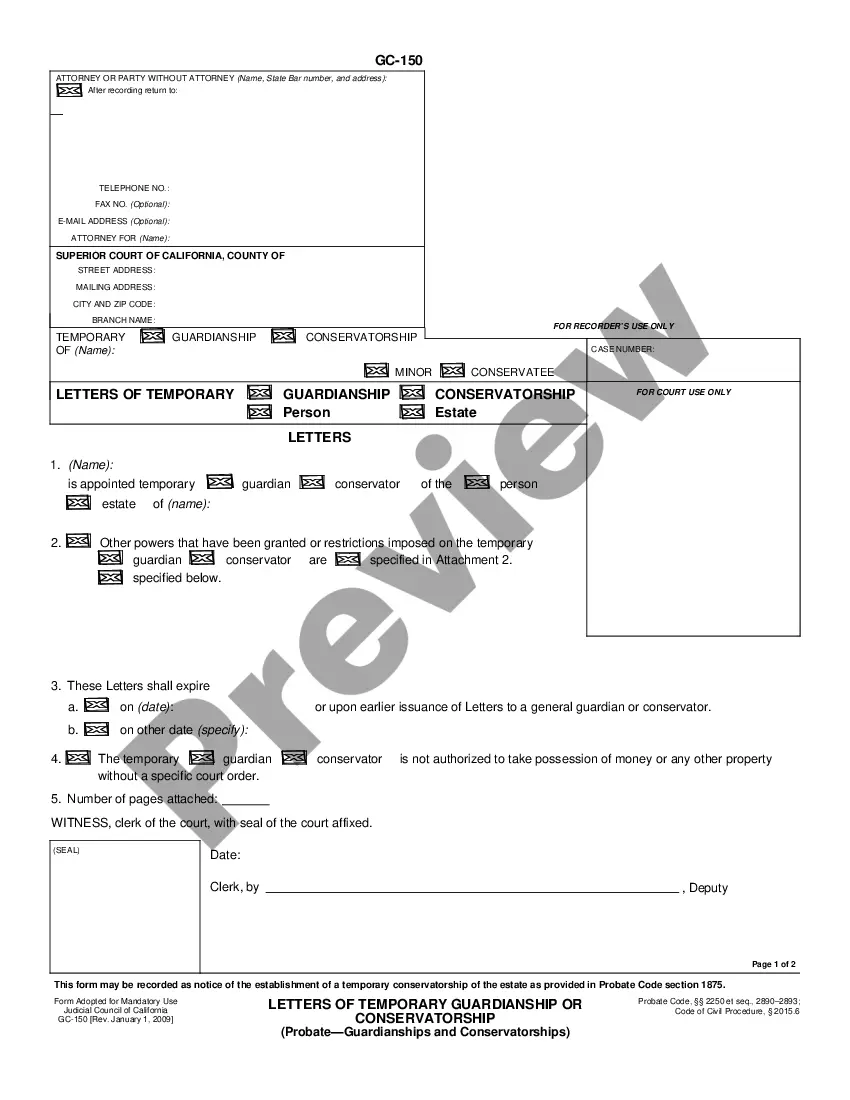

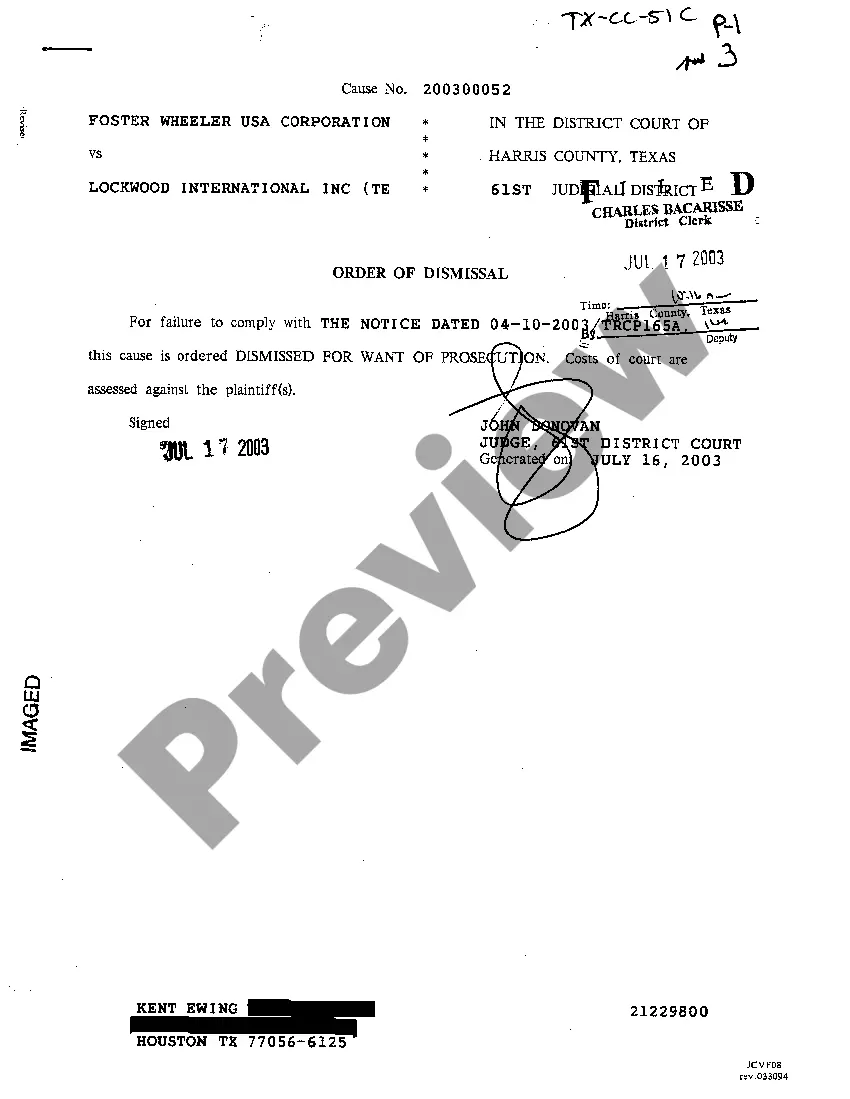

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Riverside Multistate Promissory Note - Unsecured - Signature Loan.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Riverside Multistate Promissory Note - Unsecured - Signature Loan, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you have to cope with an extremely difficult case, we recommend getting an attorney to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!