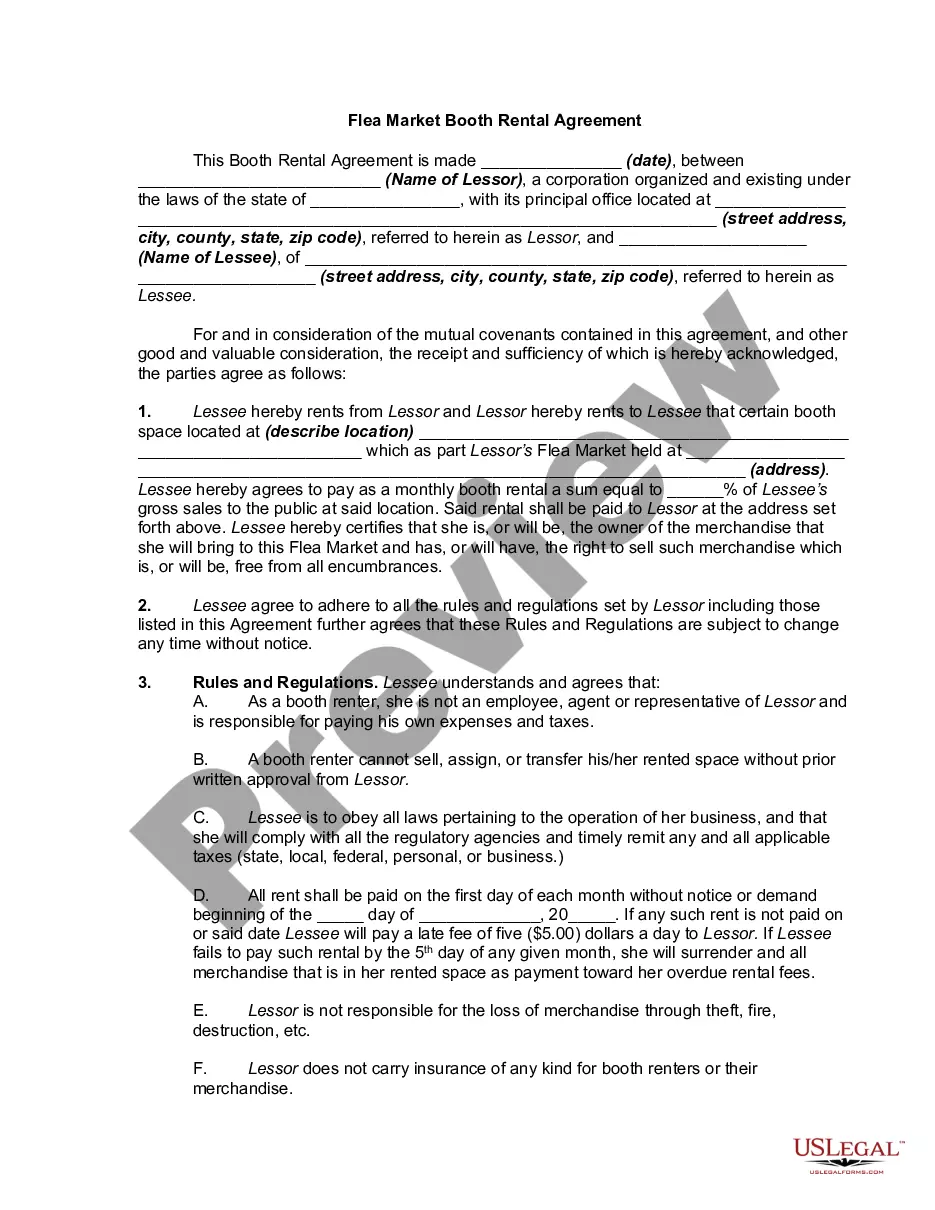

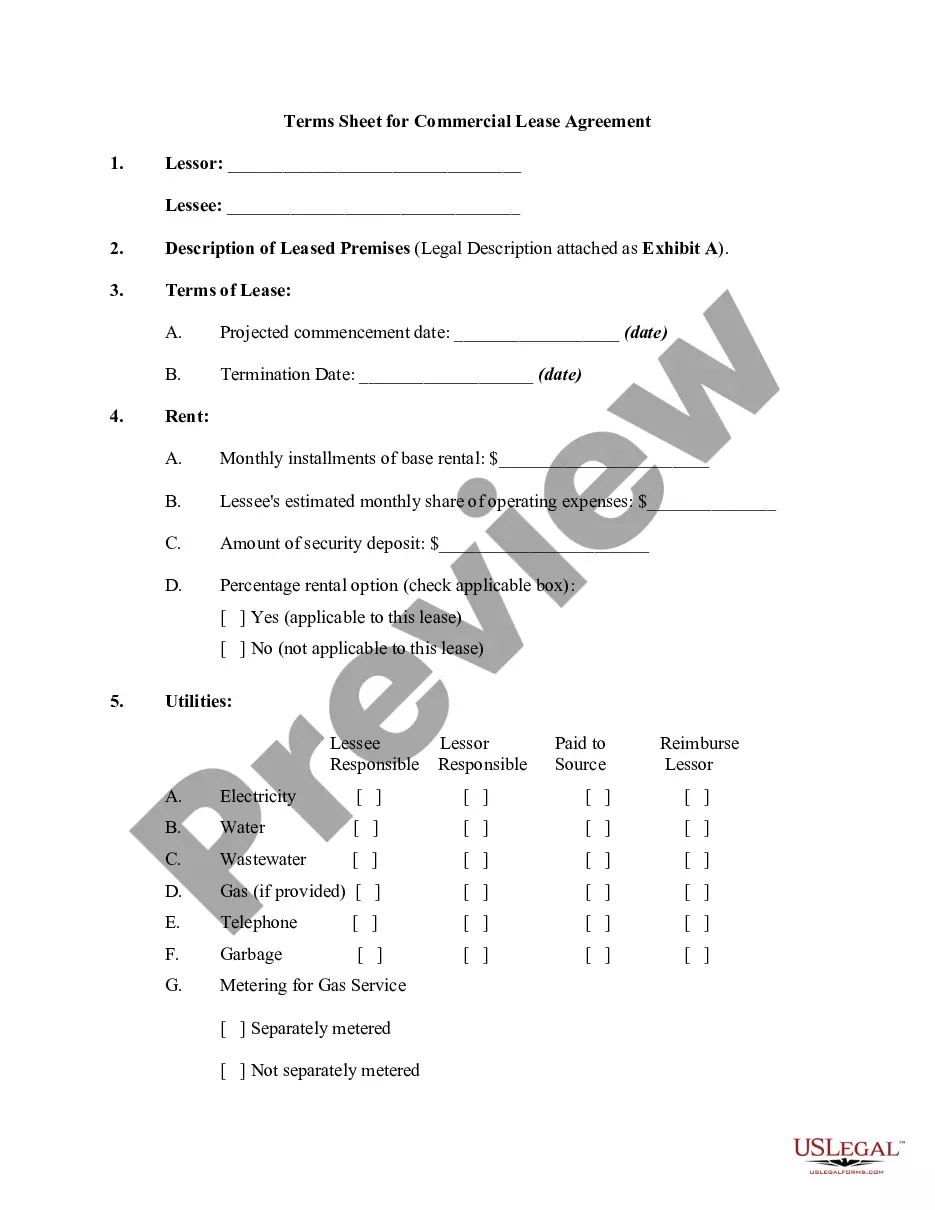

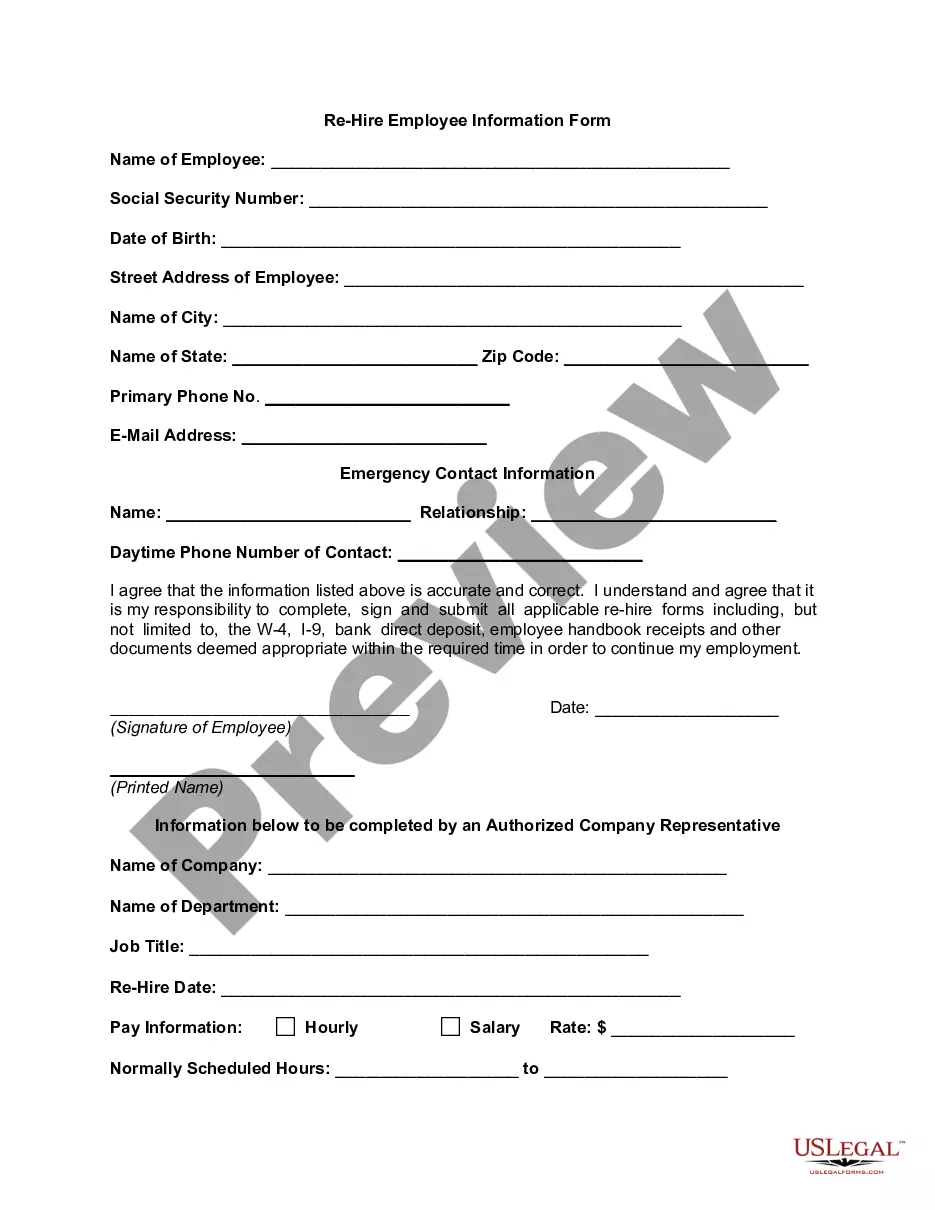

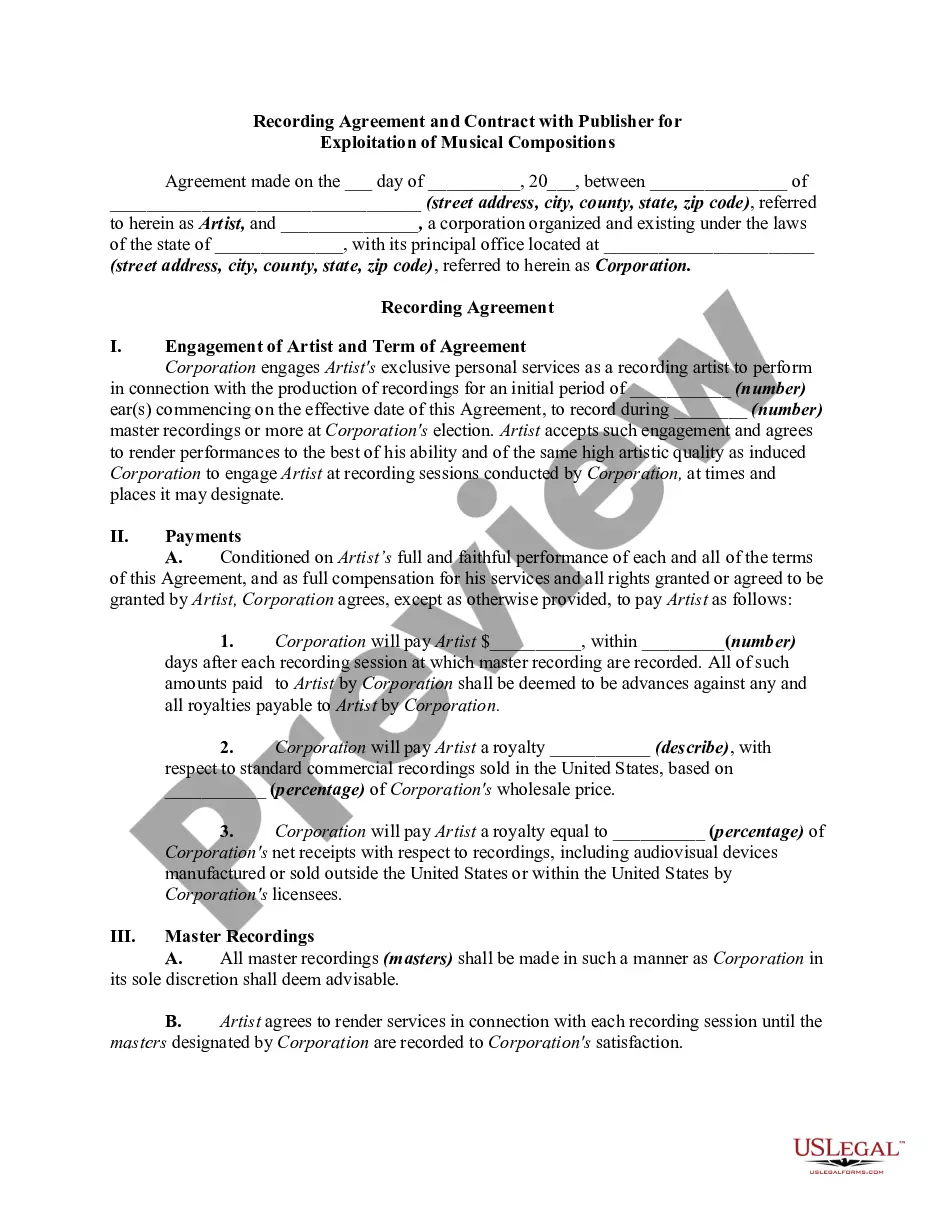

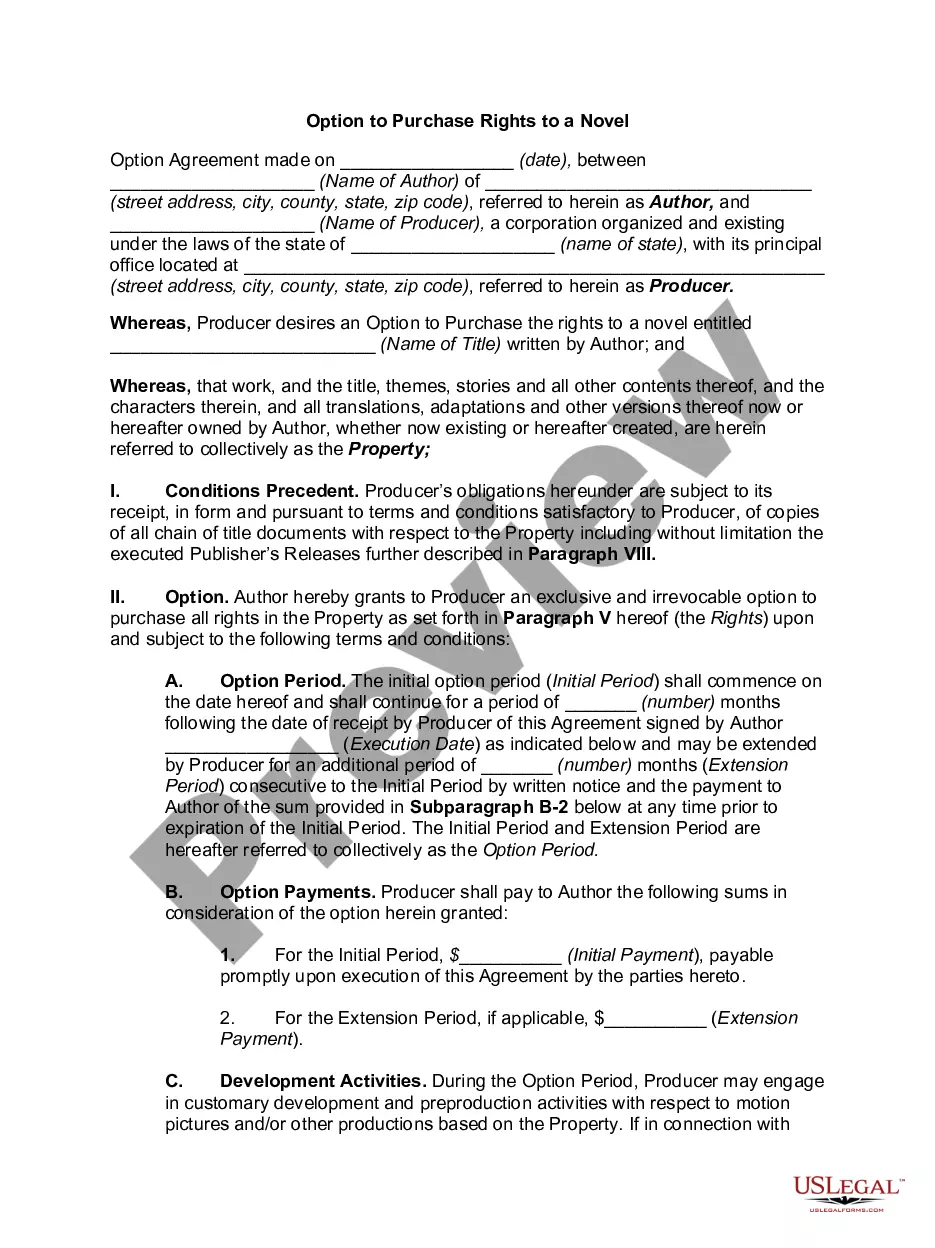

Travis Texas Multi-state Promissory Note — Unsecure— - Signature Loan is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of loan does not require any collateral, and it solely depends on the borrower's signature and promise to repay the borrowed amount plus interest. The Travis Texas Multi-state Promissory Note — Unsecure— - Signature Loan is designed to offer individuals in Travis, Texas, and other states a flexible borrowing option without the need for collateral. This loan is commonly used for personal expenses such as medical bills, home improvements, or debt consolidation. Some key elements included in the Travis Texas Multi-state Promissory Note — Unsecure— - Signature Loan are: 1. Borrower's and lender's information: The document starts by listing the names, addresses, and contact information of both the borrower and the lender. 2. Loan details: It provides a detailed description of the loan amount, the interest rate, and the repayment terms. This includes the installment amount, repayment schedule, and the total loan term. 3. Late payment penalties: The note specifies the consequences of late or missed payments, which often include additional fees or an increase in interest rate. 4. Acceleration clause: This clause allows the lender to demand the full repayment of the loan if the borrower violates any terms of the agreement. 5. Governing law: The note includes a provision specifying that the agreement will be governed by the laws of the state of Texas or the state where the loan was originated. While the Travis Texas Multi-state Promissory Note — Unsecure— - Signature Loan generally refers to a standard loan agreement, there might be slight variations or additional types based on specific terms and conditions agreed upon by the lender and the borrower. These variations may include: 1. Variable interest rate note: This type of loan has an interest rate that can fluctuate over time, usually tied to an index such as the prime rate. 2. Balloon payment note: In this case, the borrower makes smaller monthly payments throughout the loan term but is required to make a large final payment (the balloon payment) to fully satisfy the loan. 3. Secured promissory note: This type of loan requires the borrower to offer collateral, such as a property or vehicle, to secure the loan. If the borrower fails to repay, the lender can seize the collateral as repayment. In conclusion, the Travis Texas Multi-state Promissory Note — Unsecure— - Signature Loan is a versatile loan agreement that offers borrowers in Travis, Texas, and other states a flexible borrowing option without requiring collateral. It is important for both the lender and the borrower to carefully review and understand the terms and conditions of this agreement before signing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Pagaré de varios estados - Sin garantía - Préstamo de firma - Multistate Promissory Note - Unsecured - Signature Loan

Description

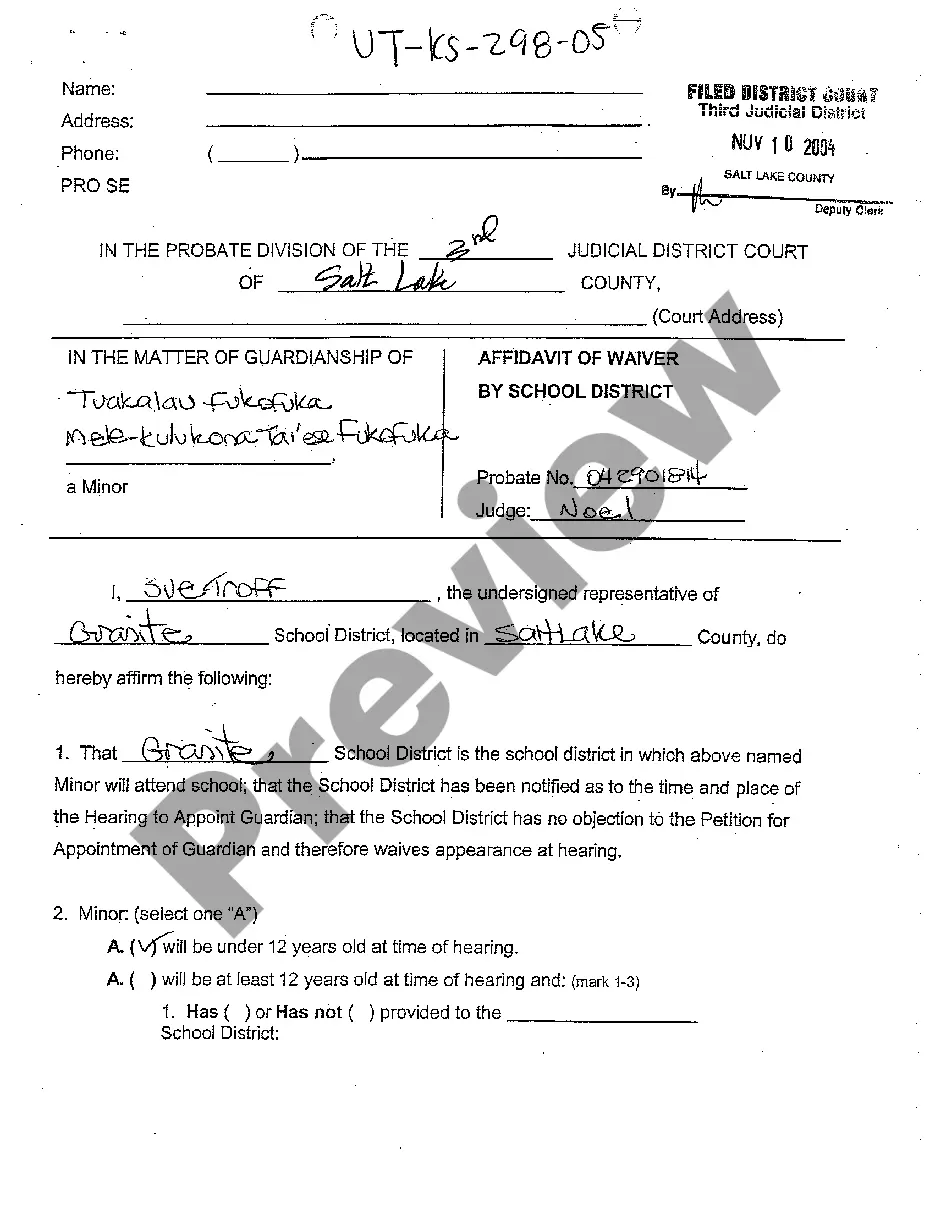

How to fill out Pagaré De Varios Estados - Sin Garantía - Préstamo De Firma?

How long does it typically take you to create a legal document.

Since each state has its own laws and regulations for various aspects of life, locating a Travis Multistate Promissory Note - Unsecured - Signature Loan that meets all regional criteria can be exhausting, and hiring a professional lawyer is frequently expensive.

Many online platforms provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most beneficial.

Regardless of how many times you need to utilize the acquired document, you can find all the samples you’ve ever downloaded in your account by accessing the My documents section. Give it a try!

- US Legal Forms is the largest online collection of templates, organized by states and usage areas.

- Besides the Travis Multistate Promissory Note - Unsecured - Signature Loan, you can access any particular document necessary to manage your business or personal affairs, adhering to your local specifications.

- Experts validate all samples for their legality, ensuring that you can prepare your documents accurately.

- Utilizing the service is incredibly straightforward.

- If you already possess an account on the platform and your subscription is current, you simply need to Log In, choose the required sample, and download it.

- You can store the file in your account at any time in the future.

- Alternatively, if you are new to the site, there will be a few additional steps to complete before acquiring your Travis Multistate Promissory Note - Unsecured - Signature Loan.

- Review the content of the page you are on.

- Examine the description of the sample or Preview it (if available).

- Look for another document using the appropriate option in the header.

- Press Buy Now when you are confident in the chosen file.

- Choose the subscription plan that fits you best.

- Establish an account on the platform or Log In to proceed to payment methods.

- Complete the transaction via PayPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Travis Multistate Promissory Note - Unsecured - Signature Loan.

- Print the document or use any chosen online editor to complete it electronically.

Form popularity

FAQ

¿Como llenar un pagare? Importe a pagar: Escribe tanto en numeros como en letras el importe que queda pendiente de pago.Fecha de vencimiento: Es importante indicar la fecha en que se realizara el pago.Nombre del beneficiario:Lugar de pago:Porcentaje de interes:La palabra pagare:Firma:Barra de truncabilidad:

La Primera Sala de la Suprema Corte de Justicia de la Nacion (SCJN) valido que la accion para cobrar un pagare prescribe a los tres anos, a partir de la fecha de su vencimiento.

Un pagare es un acuerdo escrito para devolver dinero a una persona o a un negocio. El pagare debe detallar cuando y como se paga el dinero, si la cantidad que es debida tiene interes, y que pasara si no devuelve el dinero. Los pagares tambien son conocidos como las cuentas por pagar o los titulos negociables.

Requisitos del Pagare La mencion de ser pagare inserta en el texto del documento. La promesa incondicional de pagar una suma determinada de dinero. El nombre de la persona a quien ha de hacerse el pago. La epoca y lugar del pago. La fecha y el lugar en que se suscribe el documento.

Partes de un pagare Fecha y lugar de emision del pagare Nombre de la entidad y oficina librada. Nombre completo o razon social del beneficiario (puede ser una persona fisica o juridica) Importe expresado en numeros y letras. Fecha y lugar de vencimiento. Numero de cuenta y Codigo IBAN de la cuenta del emisor.

En un pagare se deben diligenciar los siguientes conceptos: El valor o monto del pago. La fecha en que se debe pagar. Los intereses si los hay. Nombre del beneficiario (a quien se paga) Lugar en que se pagara. Firma del otorgante (quien se compromete a pagar).

De acuerdo con la Ley General de Titulos y Operaciones de Credito, el pagare debera de contener: La mencion de ser pagare inserta en el texto del documento. La promesa incondicional de pagar una suma determinada de dinero. El nombre de la persona a quien ha de hacerse el pago. La epoca y lugar del pago.

A) Por no haberse presentado el pagare para su pago en el lugar y direccion senalados. b) Por no haberse presentado en tiempo. c) Por no haberse levantado el protesto. d) Por no haber ejercitado la accion dentro de los tres meses que sigan a la fecha del protesto.

En caso de firmar un pagare y no poder pagar la cantidad establecida en el plazo acordado, debes saber que existen dos vias a traves de las cuales el beneficiario puede proceder al cobro, la via prejudicial o extrajudicial y la via judicial.

Si usted le debe dinero a alguien y no lo paga, el acreedor lo puede demandar. Si un acreedor lo demanda y gana, la corte registrara un fallo (tambien llamado una orden) en su contra que dice que usted debe pagar la deuda. Sin embargo, si su dinero y sus bienes estan protegidos, sus acreedores no podran quitarselos.