A Middlesex Massachusetts Security Agreement for Promissory Note is a legal document that serves to protect the lender's interests when lending money or extending credit to a borrower. It establishes a security interest in the borrower's assets as collateral for the loan, providing an added layer of protection in case of default or non-payment. Keywords: Middlesex Massachusetts, Security Agreement, Promissory Note, lender, borrower, collateral, protection, default, non-payment. In Middlesex Massachusetts, there are a few different types of Security Agreements for Promissory Notes that are commonly used, depending on the specific circumstances of the loan. These include: 1. Real Property Security Agreement: This type of agreement is used when the borrower pledges real estate, such as a house or land, as collateral for the loan. The Security Agreement establishes the lender's lien against the property, outlining the rights and obligations of both parties in case of default. 2. Personal Property Security Agreement: When the borrower pledges personal property assets, such as vehicles, equipment, inventory, or accounts receivable, as collateral, a Personal Property Security Agreement is utilized. This agreement specifies the details of the collateral, including its description, location, and value, and grants the lender a security interest in those assets. 3. Fixtures Financing Statement: In situations where the borrower utilizes fixtures, such as appliances, machinery, or other assets attached to real estate, as collateral, a Fixtures Financing Statement is typically used. This agreement provides the lender with a security interest in the fixtures, ensuring that they can be seized in case of default. 4. Intellectual Property Security Agreement: In cases where the borrower's assets include intellectual property rights, such as patents, copyrights, trademarks, or trade secrets, an Intellectual Property Security Agreement is employed. This agreement grants the lender a security interest in the intellectual property, allowing them to recover their investment if the borrower fails to repay the loan. A Middlesex Massachusetts Security Agreement for Promissory Note is a crucial legal document that allows lenders to protect their investments by securing collateral against a borrower's loan. It is essential for both parties involved to understand the terms and obligations outlined in the agreement to ensure a smooth and fair lending transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Contrato de Garantía para Pagaré - Security Agreement for Promissory Note

Description

How to fill out Middlesex Massachusetts Contrato De Garantía Para Pagaré?

Are you looking to quickly create a legally-binding Middlesex Security Agreement for Promissory Note or probably any other form to handle your own or business affairs? You can select one of the two options: contact a professional to draft a valid paper for you or create it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Middlesex Security Agreement for Promissory Note and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, carefully verify if the Middlesex Security Agreement for Promissory Note is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Middlesex Security Agreement for Promissory Note template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the paperwork we offer are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

La garantia puede ser de cuatro tipos: Garantia personal: como, por ejemplo, un aval. Mediante la garantia personal una persona garantiza el pago de una deuda comprometiendose a pagar ella en el caso de que el deudor principal no cumpliese con su obligacion. Garantia real: como la prenda o la hipoteca.

Es un documento, expedido por una compania de aeronavegacion, que constituye la prueba de un contrato de transporte de carga, siendo, al mismo tiempo, el comprobante de la recepcion de las mercancias a ser transportadas, con indicacion del importe correspondiente en concepto de flete.

Las garantias se usan comunmente para cubrir el riesgo de incumplimiento de las condiciones acordadas por parte de una de las partes contratantes (p. ej., falta de pago o falla en la fecha de entrega).

Los tipos de garantias mas comunes son: Garantia de sostenimiento de oferta. Garantia de buen uso de anticipo. Garantia de cumplimiento de contrato. Garantia de buen funcionamiento y/o mantenimiento del bien o del servicio vendido u otorgado.

El diccionario de la Real Academia Espanola (RAE) define a la garantia como el efecto de afianzar lo estipulado. Se trata de algo (simbolico o concreto) que protege y asegura una determinada cosa.

Un deposito de garantia es todo el dinero que el propietario recibe del inquilino ademas del pago por adelantado del alquiler. El deposito de garantia sirve para proteger al propietario en caso de que el inquilino no cumpla o viole los terminos del contrato o acuerdo de alquiler.

Una extension de garantia ofrece una continuacion de la garantia estandar del producto dado por el fabricante. Este no es un seguro y no cubre el mal uso, ni el desgaste normal, ni danos accidentales.

Este tipo de garantia tiene como finalidad asegurar un pago al comprador para el caso de que el vendedor incumpla con sus obligaciones contractuales, bien en la forma o bien en el tiempo. Por ello, es posiblemente el tipo de garantia mas utilizado en el comercio internacional.

-La garantia es un acuerdo que se pone por escrito, donde el proveedor se compromete a reparar o reponer el bien o servicio sin costo extra durante un periodo minimo de 60 dias. -La garantia puede ser exigida tanto al proveedor, distribuidor, asi como el productor o importador.

Suggested clip · 58 seconds Como hacer una carta de garantia de producto - YouTube YouTube Start of suggested clip End of suggested clip

More info

Disclaimer

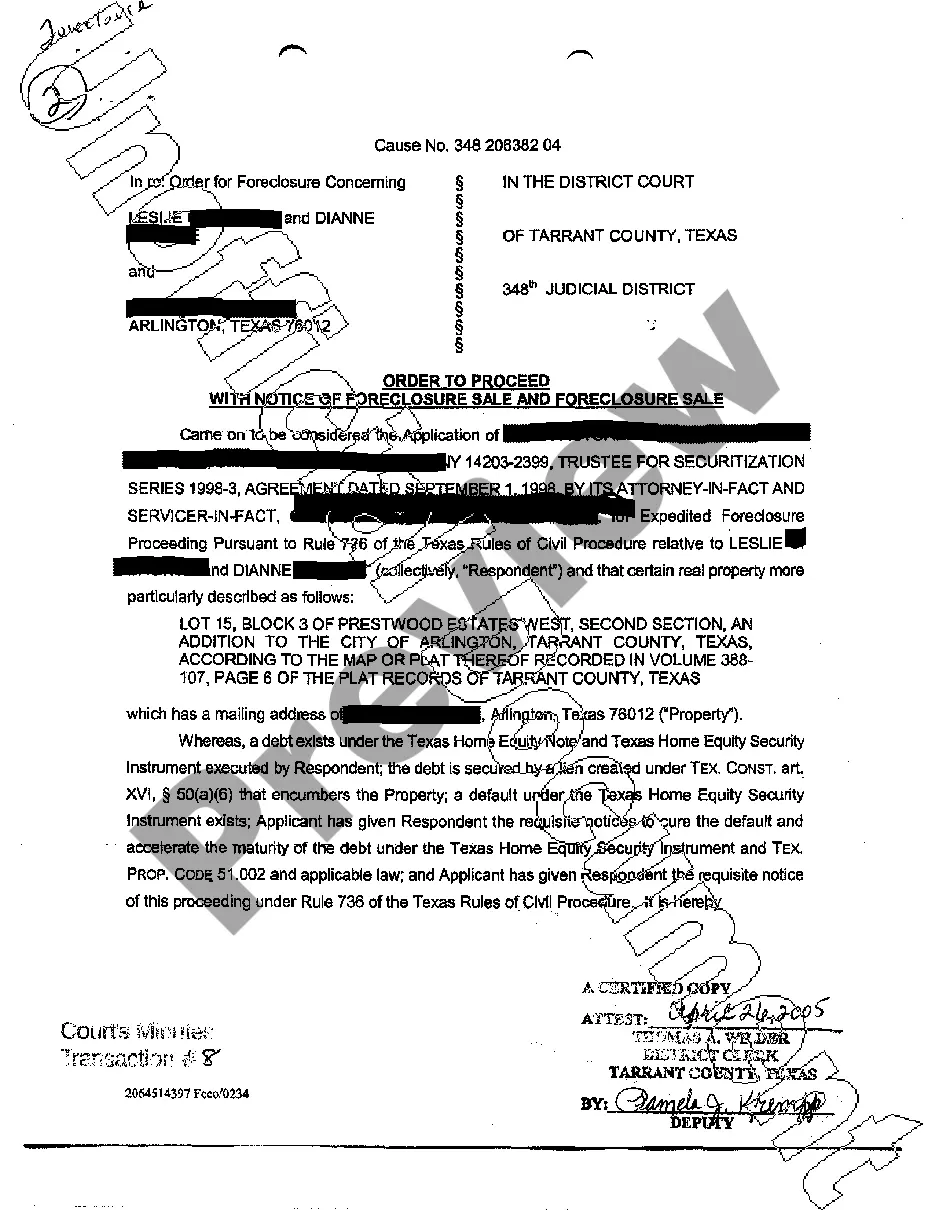

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.