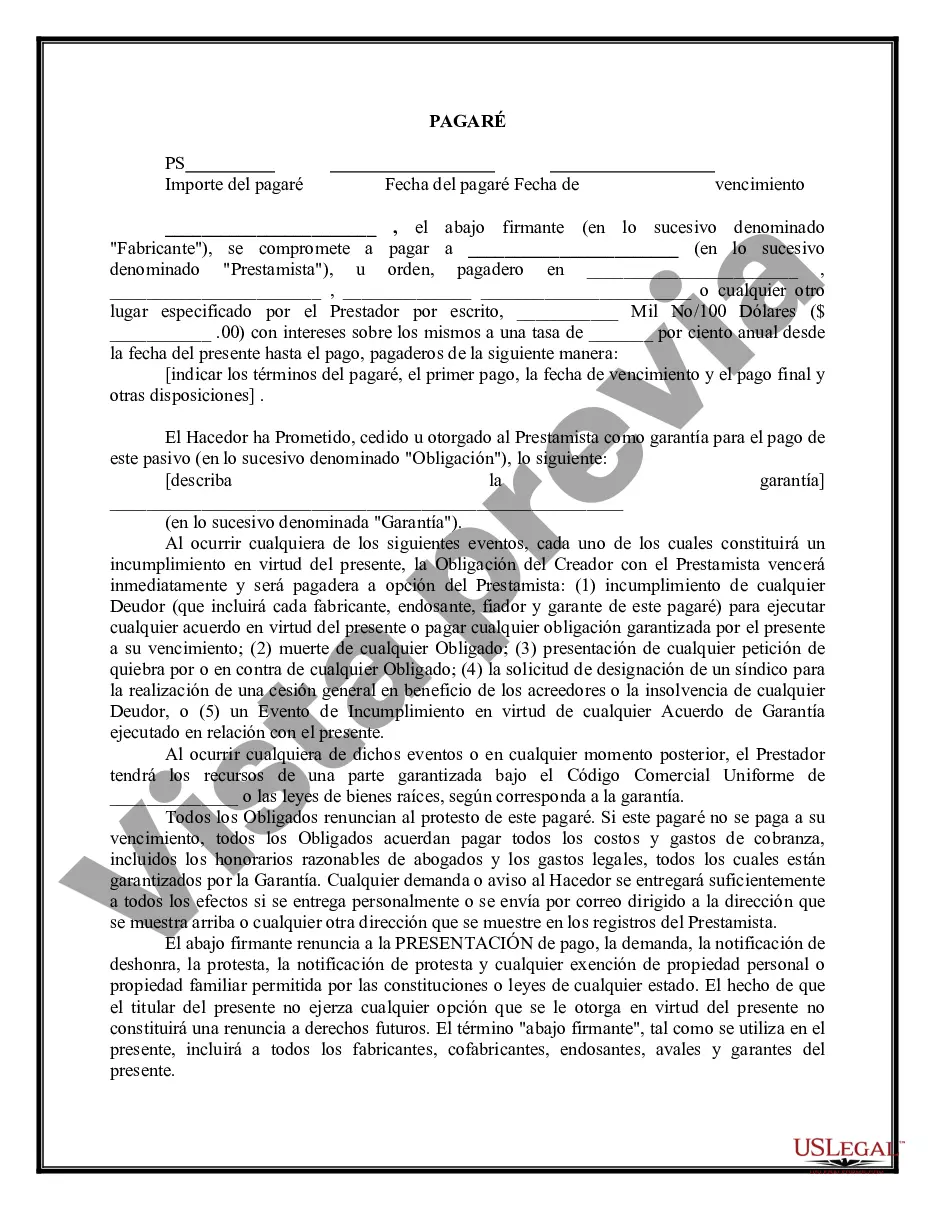

A Fairfax Virginia Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower, specifically in the context of Fairfax, Virginia. This promissory note provides a clear understanding of the repayment terms and the security interest held by the lender in case of default. In Fairfax, Virginia, there are several types of Secured Promissory Notes that borrowers and lenders can utilize depending on the specific circumstances. Some common types include: 1. Real Estate Secured Promissory Note: This type of note is used when the loan is secured by a real estate property in Fairfax, Virginia. The note details the property's description and includes a mortgage or deed of trust, providing the lender with collateral in case of default. 2. Vehicle Secured Promissory Note: When the loan is secured by a vehicle, such as a car or motorcycle, this specific type of promissory note is used. It includes the vehicle's make, model, VIN, and other relevant details to substantiate the security interest. 3. Personal Property Secured Promissory Note: In cases where personal property, excluding real estate or vehicles, is used as collateral, a personal property secured promissory note is employed. This note specifies the type of property, its value, and any additional security measures agreed upon. Regardless of the type of Secured Promissory Note used in Fairfax, Virginia, there are common elements found in each. These include the principal loan amount, interest rate, repayment schedule, late payment penalties, and events of default. Additionally, clauses related to acceleration, prepayment, and the default resolution process may also be included based on the specific needs and requirements of the lender and borrower. It is crucial for both parties involved in a Fairfax Virginia Secured Promissory Note to thoroughly review the document and seek legal advice to ensure compliance with local and federal laws, and to protect their interests in case of any disputes or default situations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia pagaré garantizado - Secured Promissory Note

Description

How to fill out Fairfax Virginia Pagaré Garantizado?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Fairfax Secured Promissory Note.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Fairfax Secured Promissory Note will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Fairfax Secured Promissory Note:

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Fairfax Secured Promissory Note on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!