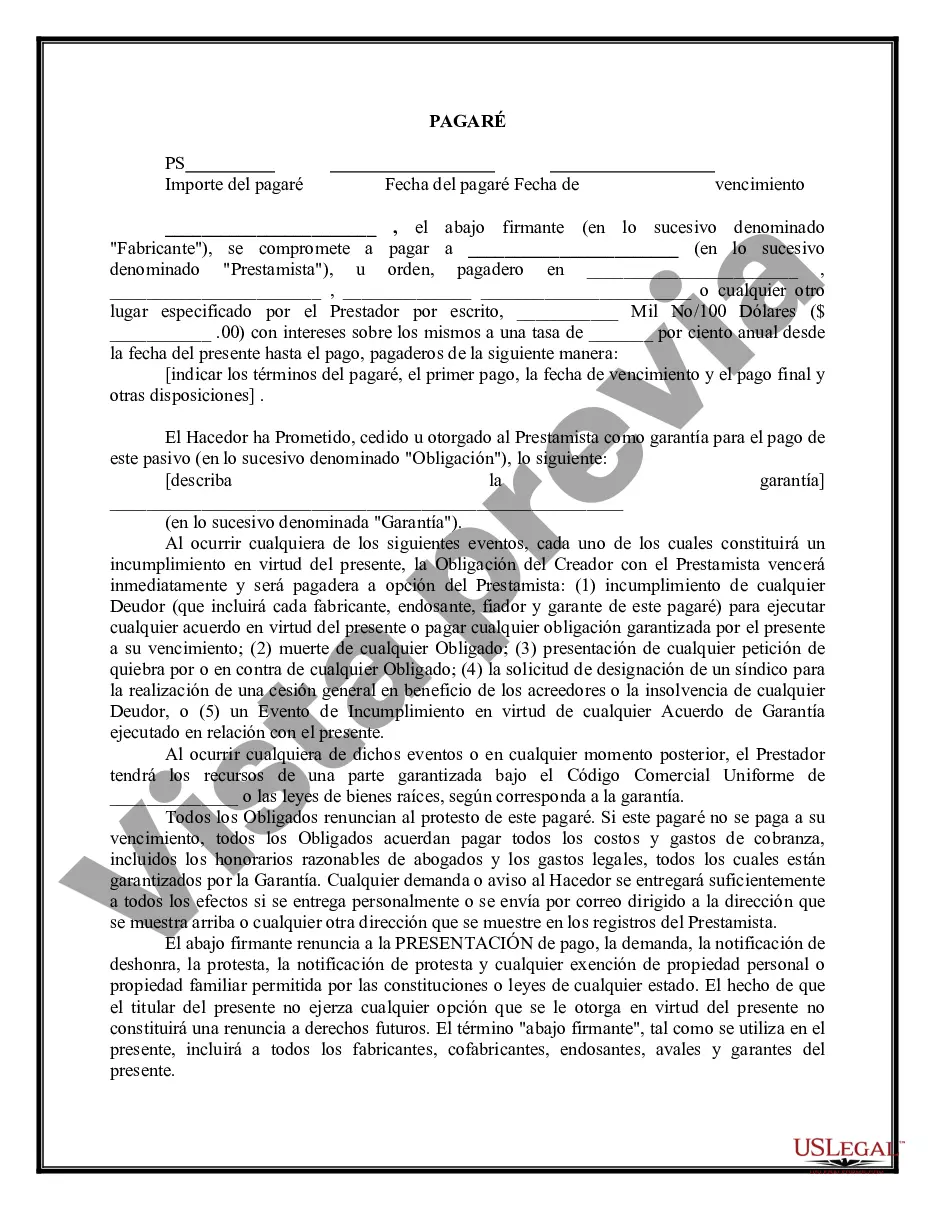

A Lima Arizona Secured Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Lima, Arizona. This note serves as a binding contract that ensures the borrower's promise to repay the loan, along with any agreed-upon interest, within a specified timeframe. The term "secured" indicates that the note is backed by collateral, which can be a valuable asset owned by the borrower. By securing the loan, the lender has a legal claim to the collateral if the borrower defaults on the payment. This provides the lender with a level of protection in case of non-payment. There may be different types of Lima Arizona Secured Promissory Notes, each tailored to meet specific requirements or situations. These variations can include: 1. Mortgage Secured Promissory Note: This type of note is secured by a mortgage on real estate owned by the borrower. In case of default, the lender has the right to foreclose on the property and sell it to recover the outstanding debt. 2. Vehicle Secured Promissory Note: Here, the borrower uses a vehicle, such as a car or motorcycle, as collateral for the loan. If the borrower fails to repay the loan, the lender can repossess and sell the vehicle. 3. Personal Property Secured Promissory Note: This type of note involves the borrower pledging personal property, such as jewelry, electronics, or valuable possessions, as collateral. If the borrower defaults, the lender has the right to take possession and sell the pledged assets. 4. Business Asset Secured Promissory Note: This note is specifically designed for business loans, with the borrower using business assets or equipment as collateral. In the event of default, the lender can seize and liquidate the assets to recover the loan amount. It is crucial for both parties to carefully review and understand the terms laid out in the Lima Arizona Secured Promissory Note before entering into the agreement. Seeking legal advice can also provide clarity on the specific legalities and requirements associated with such notes in Lima, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona pagaré garantizado - Secured Promissory Note

Description

How to fill out Pima Arizona Pagaré Garantizado?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Pima Secured Promissory Note.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Pima Secured Promissory Note will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Pima Secured Promissory Note:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Pima Secured Promissory Note on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!