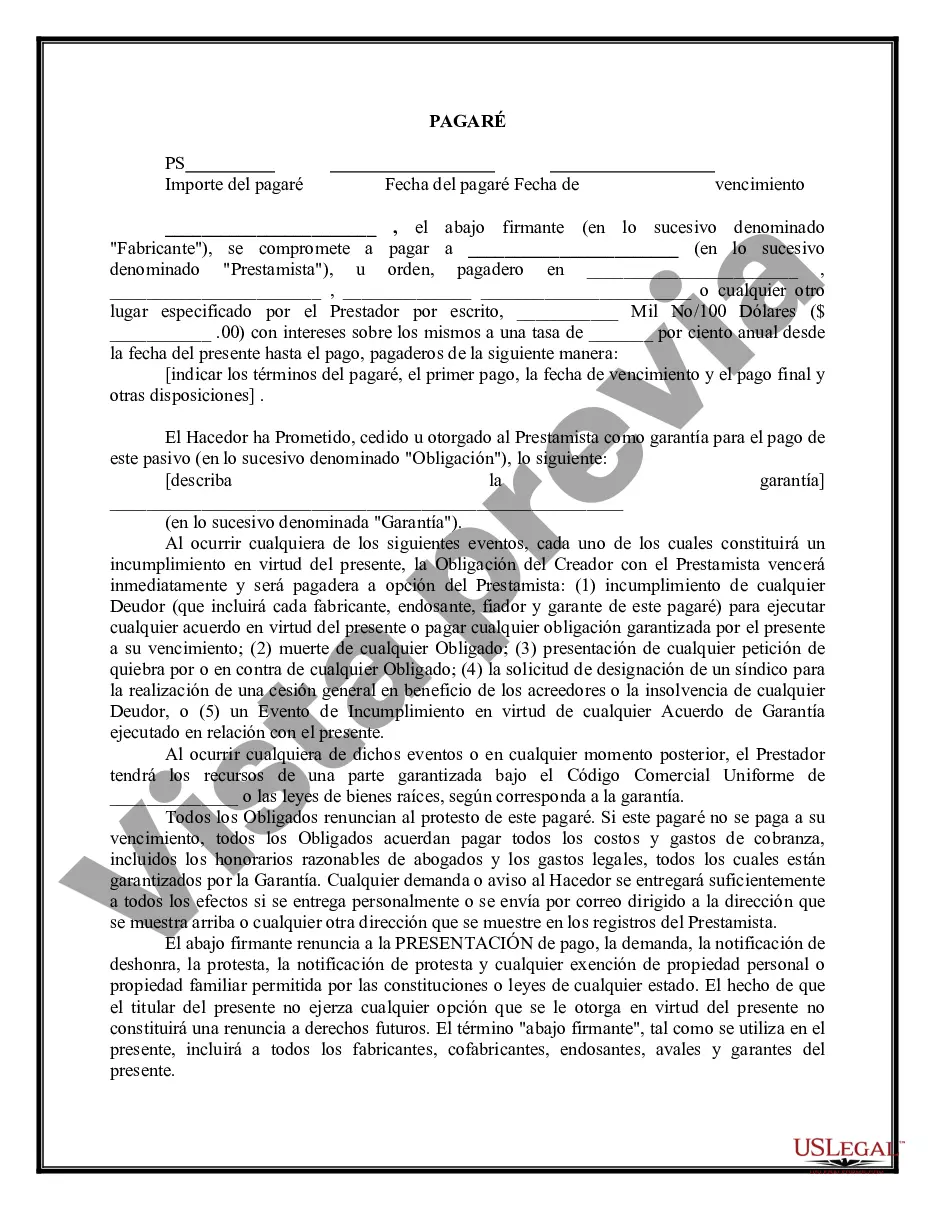

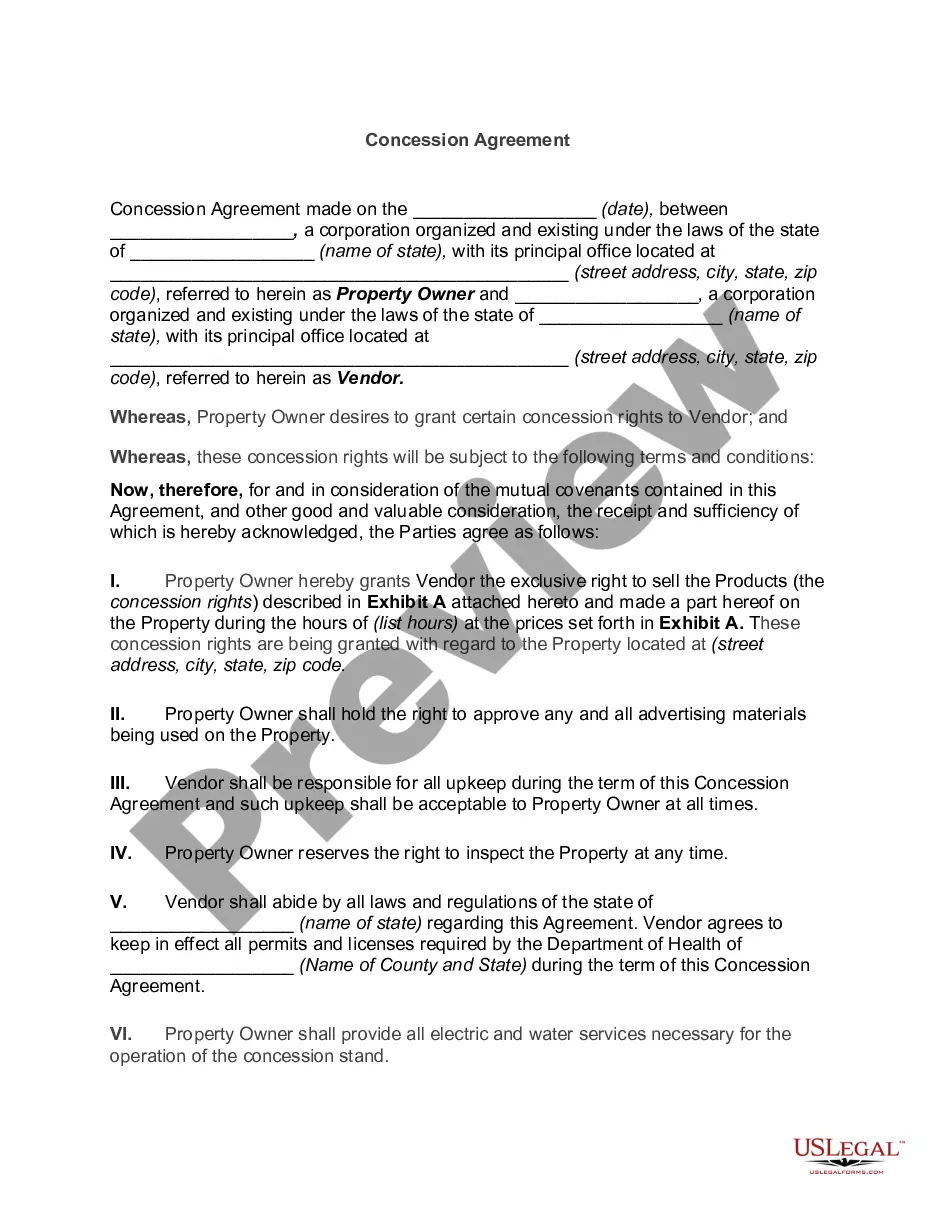

A San Antonio, Texas Secured Promissory Note is a legal document utilized in financial transactions to outline the terms and conditions of a loan agreement between a lender and a borrower. This note establishes a legally binding promise by the borrower to repay a certain amount of money borrowed, along with any agreed-upon interest, within a specified repayment period. Secured promissory notes in San Antonio, Texas are often used to protect lenders' interests by securing the loan with collateral. Collateral refers to an asset or property that the borrower pledges to the lender as a form of security, ensuring repayment of the loan. If the borrower defaults on the loan, the lender has the right to seize and sell the collateral to recover the outstanding debt. Different types of secured promissory notes in San Antonio, Texas include: 1. Real Estate Secured Promissory Note: This type of note is specifically used for loans where the borrowed money is secured against a real estate property. The property serves as collateral, setting terms and conditions for repayment and potential consequences if the borrower defaults. 2. Vehicle Secured Promissory Note: Similar to real estate, this type of note is used for loans where the borrower secures the borrowed amount against a vehicle title. In case of default, the lender can repossess and sell the vehicle to recover the outstanding debt. 3. Personal Property Secured Promissory Note: This note type is applicable when the borrower provides personal property, such as valuable assets like jewelry, electronics, or machinery, as collateral to secure the loan. If the borrower fails to repay, the lender has the right to seize and sell the agreed-upon collateral. 4. Commercial Property Secured Promissory Note: In commercial transactions, this note type is used when the borrowed amount is secured against a commercial property, like a building, office space, or retail space. The commercial property serves as collateral, providing security to the lender. San Antonio, Texas secured promissory notes play a vital role in both personal and business finance, ensuring lenders have some form of assurance when lending large sums of money. By specifying the terms and conditions, including repayment schedule, interest rates, late payment penalties, and any additional intricacies, secured promissory notes protect the rights of both lenders and borrowers in San Antonio, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas pagaré garantizado - Secured Promissory Note

Description

How to fill out San Antonio Texas Pagaré Garantizado?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including San Antonio Secured Promissory Note, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any tasks associated with document completion straightforward.

Here's how to find and download San Antonio Secured Promissory Note.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some records.

- Examine the related document templates or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase San Antonio Secured Promissory Note.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Antonio Secured Promissory Note, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you need to deal with an extremely difficult case, we advise using the services of a lawyer to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-specific documents effortlessly!