Chicago, Illinois Charitable Remainder Inter Vivos Annuity Trust is a legal and financial arrangement that allows individuals to make a charitable contribution while still retaining income during their lifetime. This type of trust is commonly used by individuals or couples who wish to donate a significant portion of their assets to a charitable organization while ensuring ongoing financial stability. The Chicago, Illinois Charitable Remainder Inter Vivos Annuity Trust is a specific type of charitable remainder trust (CRT) that serves as an effective estate planning tool. By establishing this trust, donors can receive a charitable income tax deduction while also enjoying the advantage of minimizing capital gains tax on appreciated assets. This trust provides a way to contribute to the betterment of society or support causes close to one's heart while simultaneously maximizing financial benefits. There are several variations or subtypes of the Charitable Remainder Inter Vivos Annuity Trust available in Chicago, Illinois: 1. Standard Charitable Remainder Annuity Trust: This type of trust pays the donor a fixed annuity payment each year, which is typically a fixed percentage (ranging from 5% to 8%) of the initial trust value. This fixed payment ensures a stable income stream for the donor. 2. Net Income Charitable Remainder Annuity Trust: With this type of trust, the annuity payment is based on the trust's net income. The donor receives the least of the trust's net income or the stated annuity amount. If the trust's income fluctuates, the annuity payment may vary accordingly. 3. Flip Charitable Remainder Annuity Trust: This trust structure allows for a change in the payment method after a certain triggering event. For example, the trust may initially function as a net income annuity trust and then flip to a standard annuity trust if a specified event occurs, such as the sale of a particular asset. This flexibility can provide additional benefits based on unique circumstances. 4. Deferred Charitable Remainder Annuity Trust: In this type of trust, the annuity payments are deferred until a specified future date. This allows the trust assets to grow tax-free during the deferral period, potentially resulting in larger annuity payments when distributions commence. By establishing a Chicago, Illinois Charitable Remainder Inter Vivos Annuity Trust, individuals can support charitable causes that align with their values, while securing financial benefits for themselves and their loved ones. It is advisable to consult with legal and financial professionals who specialize in charitable planning to ensure compliance with state-specific regulations and maximize the impact of the trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Remanente Caritativo Inter Vivos Anualidad Fideicomiso - Charitable Remainder Inter Vivos Annuity Trust

Description

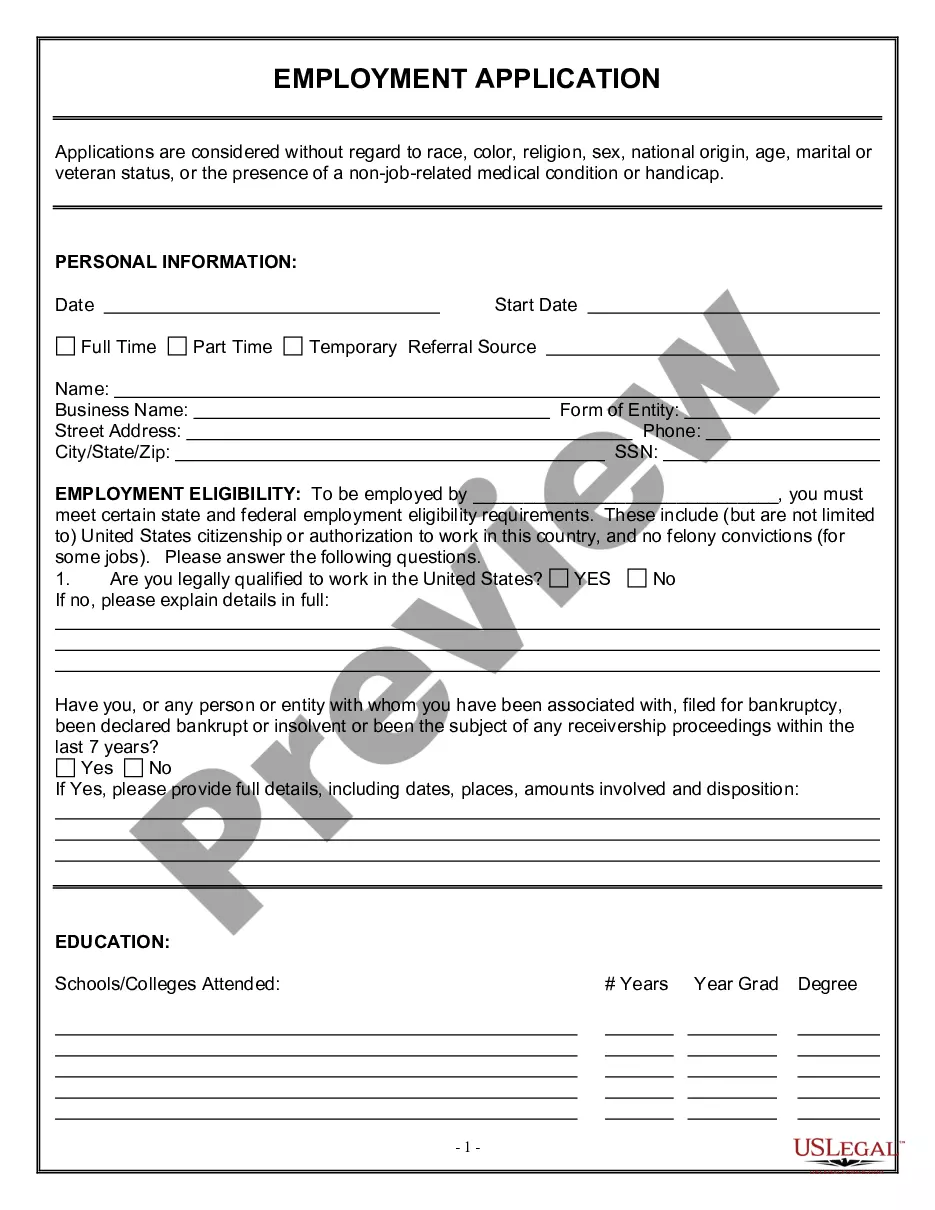

How to fill out Chicago Illinois Remanente Caritativo Inter Vivos Anualidad Fideicomiso?

If you need to get a trustworthy legal form supplier to find the Chicago Charitable Remainder Inter Vivos Annuity Trust, consider US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it simple to get and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Chicago Charitable Remainder Inter Vivos Annuity Trust, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Chicago Charitable Remainder Inter Vivos Annuity Trust template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less pricey and more affordable. Set up your first company, arrange your advance care planning, create a real estate agreement, or complete the Chicago Charitable Remainder Inter Vivos Annuity Trust - all from the convenience of your sofa.

Sign up for US Legal Forms now!