Collin Texas Charitable Remainder Inter Vivos Unit rust Agreement is a legal agreement in the state of Texas that allows individuals to support charitable organizations while also benefiting from tax advantages. This agreement is established between a donor and a trustee, with the purpose of transferring assets to a trust, receiving income from the trust, and ultimately donating the remaining assets to a charity. Keywords: Collin Texas, charitable remainder, inter vivos unit rust agreement, legal agreement, charitable organizations, tax advantages, donor, trustee, transferring assets, income, trust, remaining assets, charity. There are various types of Collin Texas Charitable Remainder Inter Vivos Unit rust Agreements, including: 1. Charitable Remainder Annuity Trust (CAT): This agreement provides a fixed annual income to the donor, which is calculated based on a predetermined percentage of the initial value of the trust assets. The remaining assets are then donated to the chosen charitable organization. 2. Charitable Remainder Unit rust (CUT): In this type of agreement, the income to the donor is variable and is based on a fixed percentage of the trust assets' value, which is recalculated annually. As the trust assets' value fluctuates, the income received by the donor may increase or decrease accordingly. 3. Net Income with Makeup Charitable Remainder Unit rust (TIMEOUT): TIMEOUT allows for variations in income to the donor, depending on the trust's current net income. If the trust's net income is lower than the predetermined percentage, the trustee can accumulate the difference in makeup accounts, which can be distributed in future years when the income is higher. 4. Flip Charitable Remainder Unit rust: This type of unit rust allows the donor to initially receive a fixed income based on a lesser percentage of the trust assets' value. Once a triggering event occurs, such as the sale of a property held by the trust, the income percentage flips to a higher rate, potentially resulting in greater income for the donor. By establishing a Collin Texas Charitable Remainder Inter Vivos Unit rust Agreement, individuals can support causes they care about, receive income during their lifetime, and enjoy tax benefits. However, it is crucial to consult with legal and financial professionals to ensure that the agreement aligns with specific objectives and complies with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Remanente Caritativo Acuerdo Unitrust Inter Vivos - Charitable Remainder Inter Vivos Unitrust Agreement

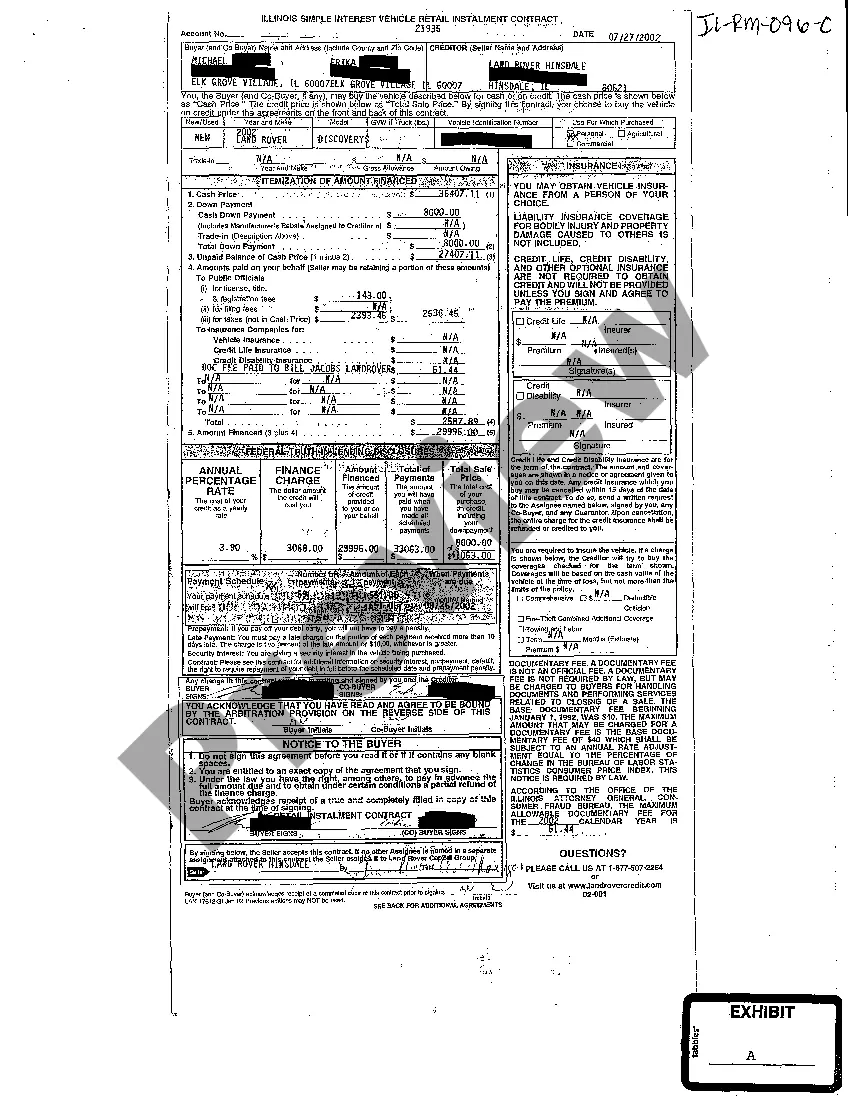

Description

How to fill out Collin Texas Remanente Caritativo Acuerdo Unitrust Inter Vivos?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the Collin Charitable Remainder Inter Vivos Unitrust Agreement.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Collin Charitable Remainder Inter Vivos Unitrust Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Collin Charitable Remainder Inter Vivos Unitrust Agreement:

- Make sure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Collin Charitable Remainder Inter Vivos Unitrust Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!