The Hennepin Minnesota Charitable Remainder Inter Vivos Unit rust Agreement is a legal document that allows individuals to make a charitable gift to a nonprofit organization while still retaining an income stream from the donated assets. This agreement is applicable in Hennepin County, Minnesota, and offers various benefits to both the donor and the chosen charitable organization. In this type of agreement, the donor transfers assets, such as real estate, stocks, or bonds, into a trust. The trust is managed by a trustee who is responsible for investing the assets and distributing a percentage of the trust income to the donor, known as the income beneficiary. The income received can be fixed or variable, depending on the terms of the agreement. The purpose of the Hennepin Minnesota Charitable Remainder Inter Vivos Unit rust Agreement is to provide financial support for both the donor and the chosen charitable organization. By donating assets to the trust, the donor can receive a charitable income tax deduction based on the present value of the remainder interest passing to the charity. This can result in significant tax savings for the donor. Additionally, the donor can potentially avoid capital gains tax on the donated assets, as they are transferred to the trust and not directly sold. This feature makes the agreement an attractive option for individuals who hold highly appreciated assets and wish to avoid tax implications. There are a few variations of the Hennepin Minnesota Charitable Remainder Inter Vivos Unit rust Agreement, depending on the specific terms and conditions. Some common types include: 1. Standard Unit rust: In this agreement, the income beneficiary receives a fixed percentage of the trust assets' fair market value, which is revalued annually. This means that if the trust assets appreciate, the income beneficiary's income also increases, providing a potential hedge against inflation. 2. Net Income with Makeup Unit rust (TIMEOUT): Unlike the standard unit rust, a TIMEOUT allows for periods in which the trust's income may be less than the fixed percentage. However, it includes a makeup provision, allowing the trustees to make up for any previously unpaid income in future years when the trust's income exceeds the fixed percentage. This variation provides more flexibility to the income beneficiary. 3. Flip Unit rust: A flip unit rust allows for the trust to start as a standard unit rust and then "flip" to a fixed payout at a predetermined trigger event, such as the sale of a specific asset. This variation provides more control over income distribution and can be particularly useful in cases where a high-income asset is anticipated to be sold. In conclusion, the Hennepin Minnesota Charitable Remainder Inter Vivos Unit rust Agreement is a powerful tool for individuals in Hennepin County, Minnesota, who wish to support charitable causes while maintaining an income stream. By utilizing the different types of unit rust agreements available, individuals can tailor the agreement to their specific needs and financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Remanente Caritativo Acuerdo Unitrust Inter Vivos - Charitable Remainder Inter Vivos Unitrust Agreement

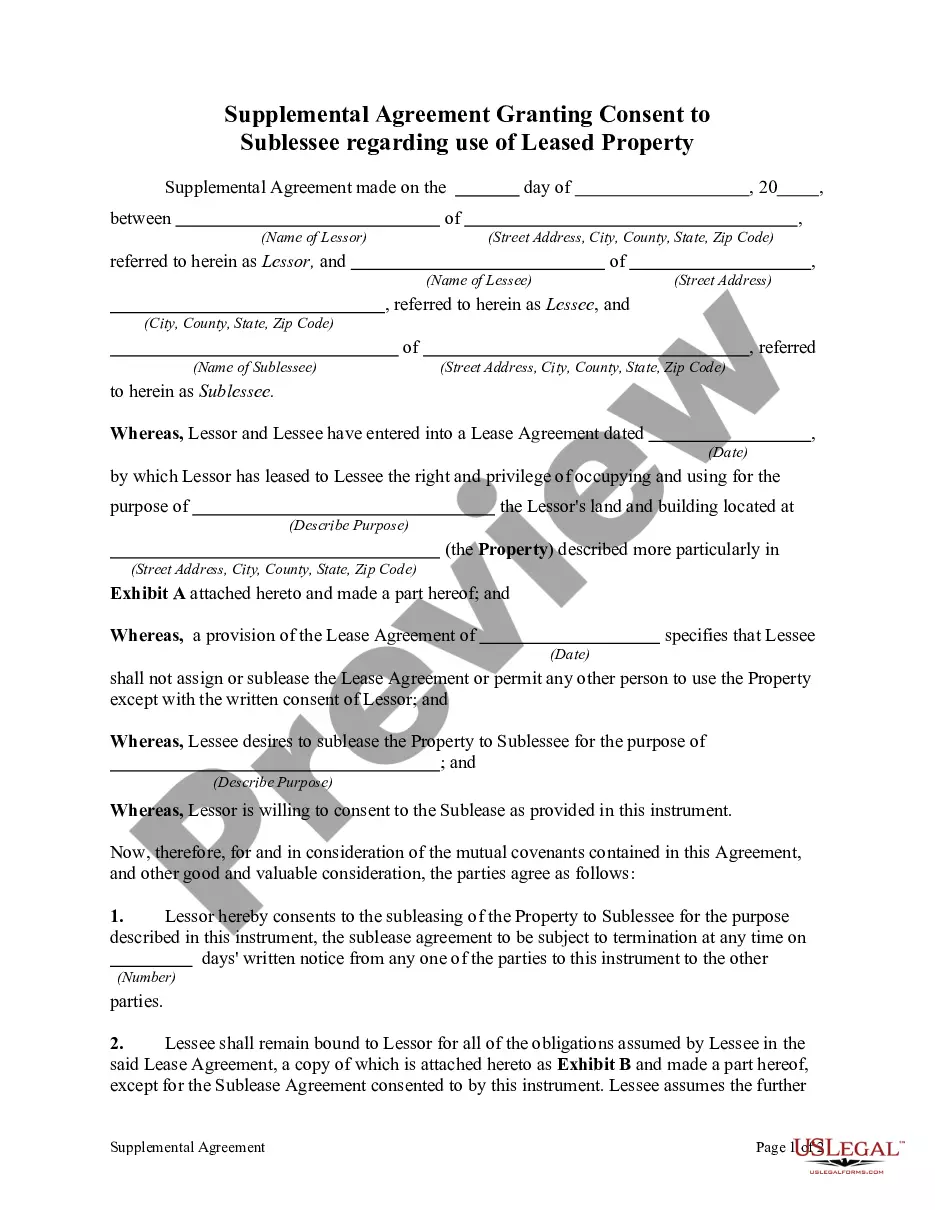

Description

How to fill out Hennepin Minnesota Remanente Caritativo Acuerdo Unitrust Inter Vivos?

Do you need to quickly draft a legally-binding Hennepin Charitable Remainder Inter Vivos Unitrust Agreement or probably any other document to handle your own or business affairs? You can select one of the two options: hire a professional to draft a legal document for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Hennepin Charitable Remainder Inter Vivos Unitrust Agreement and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the Hennepin Charitable Remainder Inter Vivos Unitrust Agreement is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Hennepin Charitable Remainder Inter Vivos Unitrust Agreement template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!