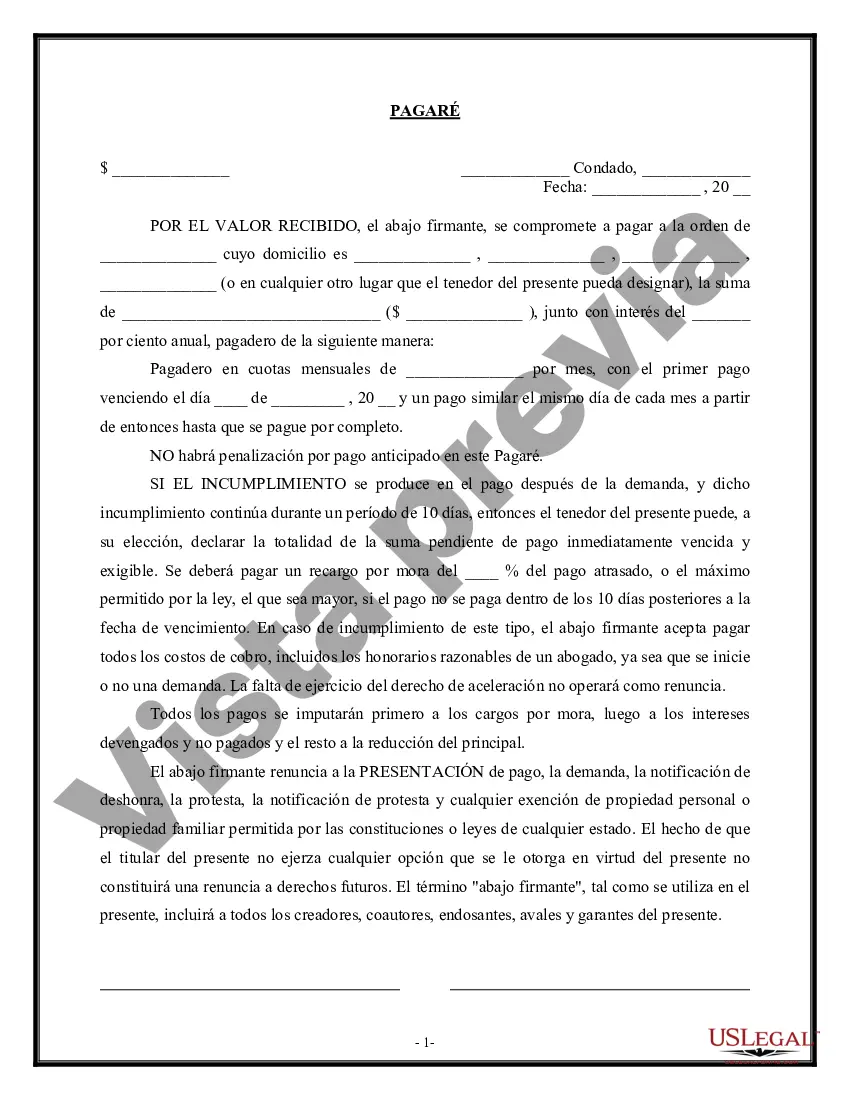

A Hillsborough Florida Sale of Business — Promissory Not— - Asset Purchase Transaction refers to a legal transaction where the ownership and control of a business located in Hillsborough County, Florida is transferred from the seller to the buyer through a promissory note and asset purchase agreement. This type of transaction involves the sale of a business as a whole or specific assets, rather than selling shares or stock of a company. It typically includes a promissory note, which is a written agreement where the buyer promises to pay the seller a specific amount of money in installments over a defined period. The Hillsborough Florida Sale of Business — Promissory Not— - Asset Purchase Transaction offers several types, which may include: 1. Sale of Business and Assets: This type involves the sale of the entire business along with all of its assets, such as inventory, equipment, customer lists, and intellectual property. The purchase price is usually paid in installments over time. 2. Asset Purchase: In this type of transaction, only specific assets of the business are sold. It could be inventory, equipment, patents, trademarks, copyrights, or customer contracts. The buyer acquires these assets and continues the business operations. 3. Real Estate Purchase: Sometimes, a Sale of Business — Promissory Not— - Asset Purchase Transaction includes the sale of the business property or real estate where the business operates. This allows the buyer to acquire the business along with the physical location. 4. Franchise Purchase: In some cases, the sale of a business in Hillsborough County, Florida involves a franchise. The buyer purchases an existing franchise business, including its assets and contracts, and continues running the business under the franchise agreement. Regardless of the type, a Hillsborough Florida Sale of Business — Promissory Not— - Asset Purchase Transaction is a complex process that requires careful consideration of various factors. This includes due diligence on the seller's financials, legal and contractual obligations, intellectual property rights, existing contracts, and potential liabilities. To proceed with such a transaction, both the buyer and the seller must negotiate and draft a comprehensive agreement that outlines the terms and conditions of the sale, payment schedule, warranties, representations, and any additional contingencies. It is crucial for both parties to seek legal and financial advice to ensure compliance with state and federal laws, protect their interests, and facilitate a smooth and successful transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Venta de negocio - Pagaré - Transacción de compra de activos - Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Hillsborough Florida Venta De Negocio - Pagaré - Transacción De Compra De Activos?

Are you looking to quickly create a legally-binding Hillsborough Sale of Business - Promissory Note - Asset Purchase Transaction or probably any other document to manage your personal or business matters? You can go with two options: contact a legal advisor to write a valid paper for you or draft it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Hillsborough Sale of Business - Promissory Note - Asset Purchase Transaction and form packages. We offer documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- First and foremost, double-check if the Hillsborough Sale of Business - Promissory Note - Asset Purchase Transaction is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the template isn’t what you were looking for by using the search box in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Hillsborough Sale of Business - Promissory Note - Asset Purchase Transaction template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. In addition, the paperwork we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!