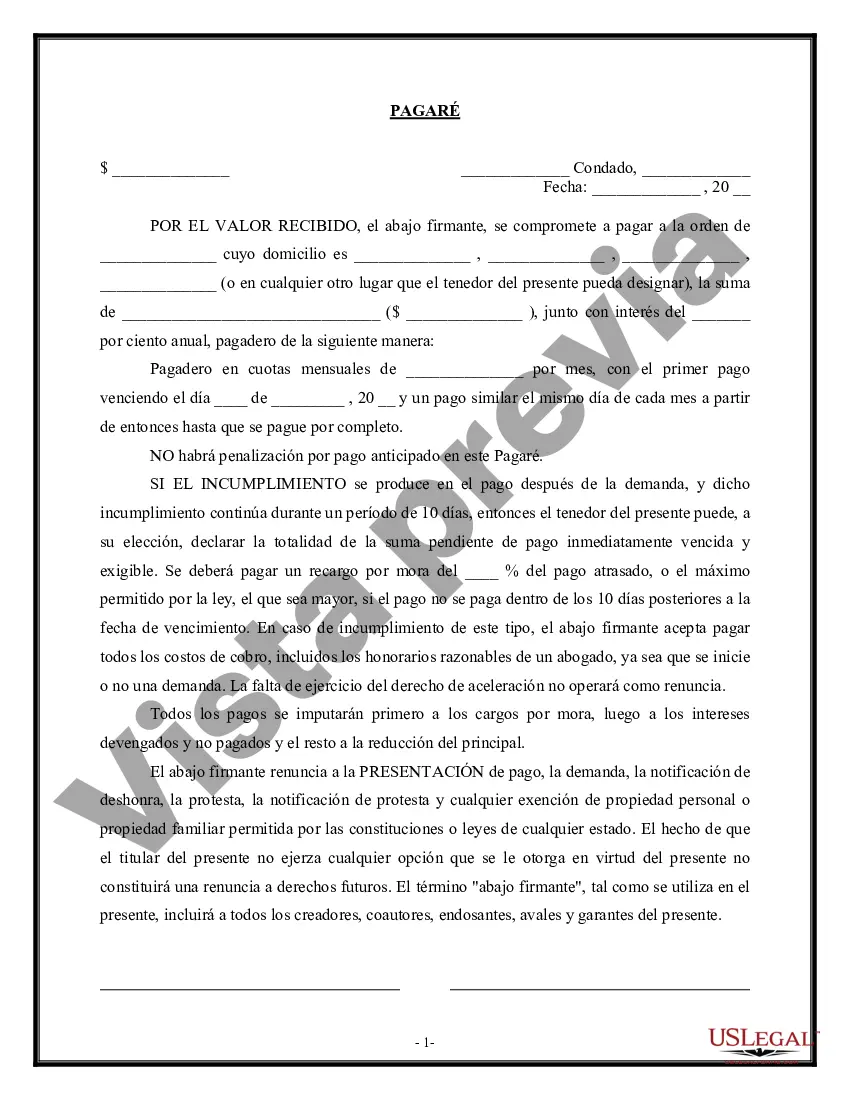

Orange, California is a vibrant city located in Orange County, California known for its rich history, diverse community, and thriving business scene. If you are considering a sale of business in Orange, California and are interested in exploring the option of a Promissory Note — Asset Purchase Transaction, it is crucial to understand the key aspects and types of such transactions available. A Promissory Note — Asset Purchase Transaction refers to a legal agreement between a buyer and a seller, where the buyer agrees to purchase the assets of a business from the seller in exchange for a promissory note. This note outlines the terms of payment, including the principal amount, interest rate, and repayment period. This type of transaction is commonly used when the buyer does not want to assume existing liabilities or debts of the seller's business and prefers to focus solely on acquiring the assets. There are several types of Promissory Note — Asset Purchase Transactions commonly seen in Orange, California: 1. Full Asset Purchase: In this type of transaction, the buyer purchases all the assets of the business, including tangible assets such as inventory, equipment, and property, as well as intangible assets like goodwill, customer lists, and intellectual property. 2. Partial Asset Purchase: A partial asset purchase refers to the buyer acquiring only specific assets of the business, instead of taking over the entire business. This could include purchasing only certain product lines, equipment, or a specific customer base. 3. Distressed Asset Purchase: Distressed asset purchases often occur when the seller is facing financial difficulties or bankruptcy. In such cases, the buyer purchases the assets at a discounted price, offering a benefit to the seller in distress while allowing the buyer to acquire assets at a reduced cost. 4. Stock Sale Transaction: Though not strictly a Promissory Note — Asset Purchase Transaction, it is worth mentioning stock sale transactions. In this type of deal, the buyer purchases the seller's shares of stock, becoming the owner of the entire business, including its assets and liabilities. In Orange, California, the sale of business — promissory not— - asset purchase transactions are common due to the city's favorable business environment and growing economy. It is essential for both buyers and sellers to consult legal professionals experienced in these types of transactions to ensure compliance with local laws and to protect their interests. Whether you are a buyer looking for assets to expand your business or a seller looking to capitalize on your hard work, Orange, California offers numerous opportunities for successful business transactions through Promissory Note — Asset Purchase Transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Venta de negocio - Pagaré - Transacción de compra de activos - Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Orange California Venta De Negocio - Pagaré - Transacción De Compra De Activos?

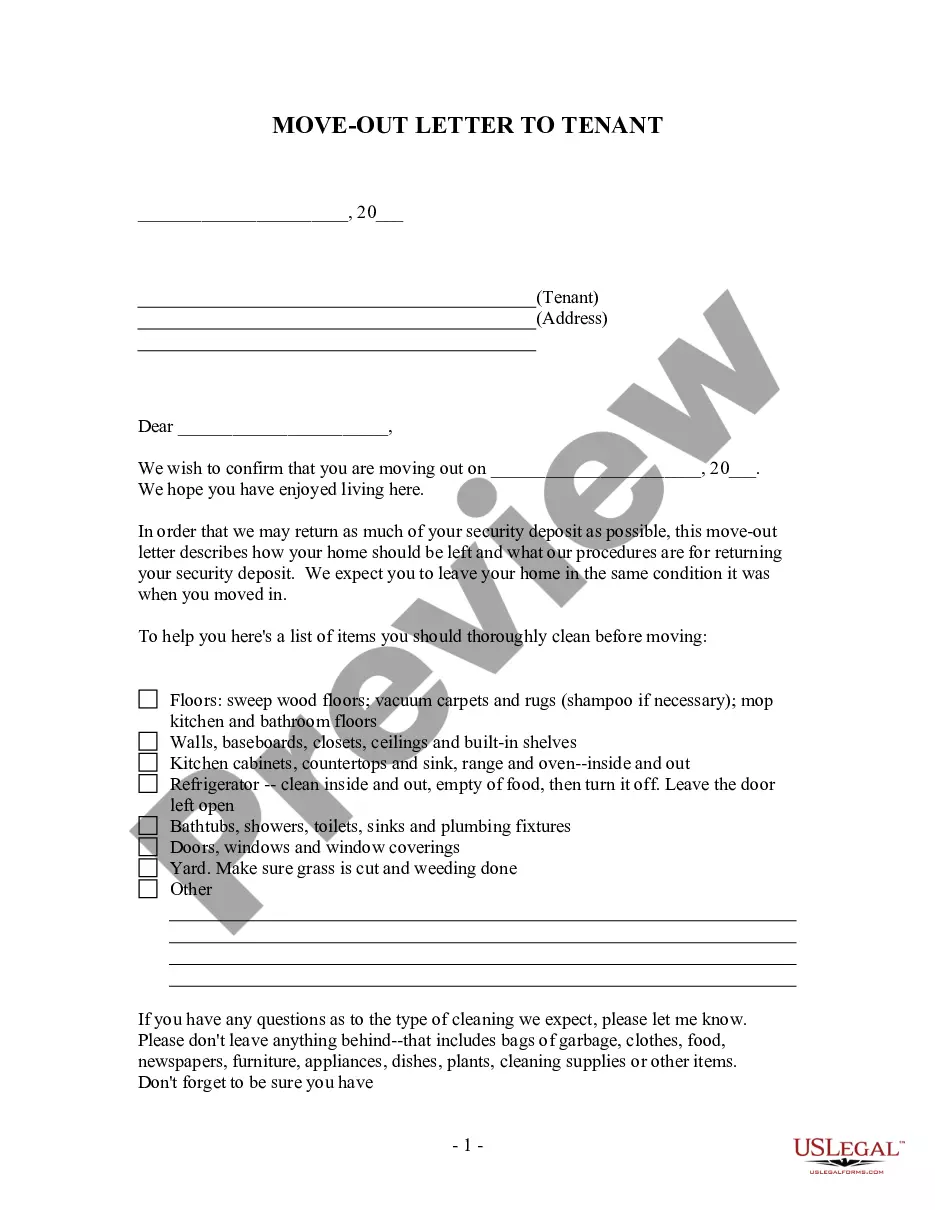

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from scratch, including Orange Sale of Business - Promissory Note - Asset Purchase Transaction, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how you can find and download Orange Sale of Business - Promissory Note - Asset Purchase Transaction.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Check the similar forms or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Orange Sale of Business - Promissory Note - Asset Purchase Transaction.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Orange Sale of Business - Promissory Note - Asset Purchase Transaction, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you have to deal with an extremely challenging case, we recommend using the services of an attorney to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

El libro diario, tambien conocido como libro de entrada original, registra diariamente todos los movimientos contables en orden cronologico es decir, en orden de fechas. Usted puede registrar las transacciones o los movimientos contables en un cuaderno dividido en cuatro columnas: u Fecha, detalle, debe y haber.

¿Como hacer asientos contables facilmente? Recoger los documentos justificativos de gastos.Realizar el registro en el libro correspondiente.Definir la informacion basica del asiento contable.Aplicar los principios contables.Contabilizar una factura de compra.Contabilizar una factura de venta.Contabilizar un descuento.

El Registro de transacciones es un documento de respaldo clave para la Lista 1. Incluye un registro de todos los ingresos recibidos y todos los gastos pagados durante el periodo de reporte contable.

Una transaccion comercial puede ser, por ejemplo, una venta, un pago, una compra, una devolucion, etc. el ente economico.

Las transacciones comerciales son aquellas que buscan suministrarnos la informacion necesaria para llevar un control mas ordenado de las operaciones realizadas en una empresa o negocio.

Estas son las transacciones habituales que una empresa realiza rutinariamente. Ejemplos de transacciones externas son: compras de bienes a proveedores, ventas de bienes a clientes, compra de activos fijos para uso comercial, pago de salarios a empleados, etc.

Las transacciones del negocio se resumen normalmente en libros llamados libros de diario y libro mayor. Puede comprarlos en su papeleria o tienda de suministros de oficina locales. Un libro de diario es un libro donde registra cada transaccion del negocio mostrada en sus documentos comprobantes.

El Registro de transacciones es un documento de respaldo clave para la Lista 1. Incluye un registro de todos los ingresos recibidos y todos los gastos pagados durante el periodo de reporte contable.

Ejemplo de transaccion comercial Comprar una entrada para ir al cine. Comprar un coche a un concesionario. Vender un objeto que ya no usas de segunda mano. Comprar comida en el supermercado. Cuando la empresa te paga el salario por tu trabajo. Cuando solicitamos un prestamo a un banco.

Registra todas las ventas del dia Una de las formas mas faciles de llevar el control es simplemente llevar un registro de todos los productos vendidos en el transcurso del dia para que al final del periodo (ya sea el mes, el semestre o el ano) puedas ver el total de ventas por producto.