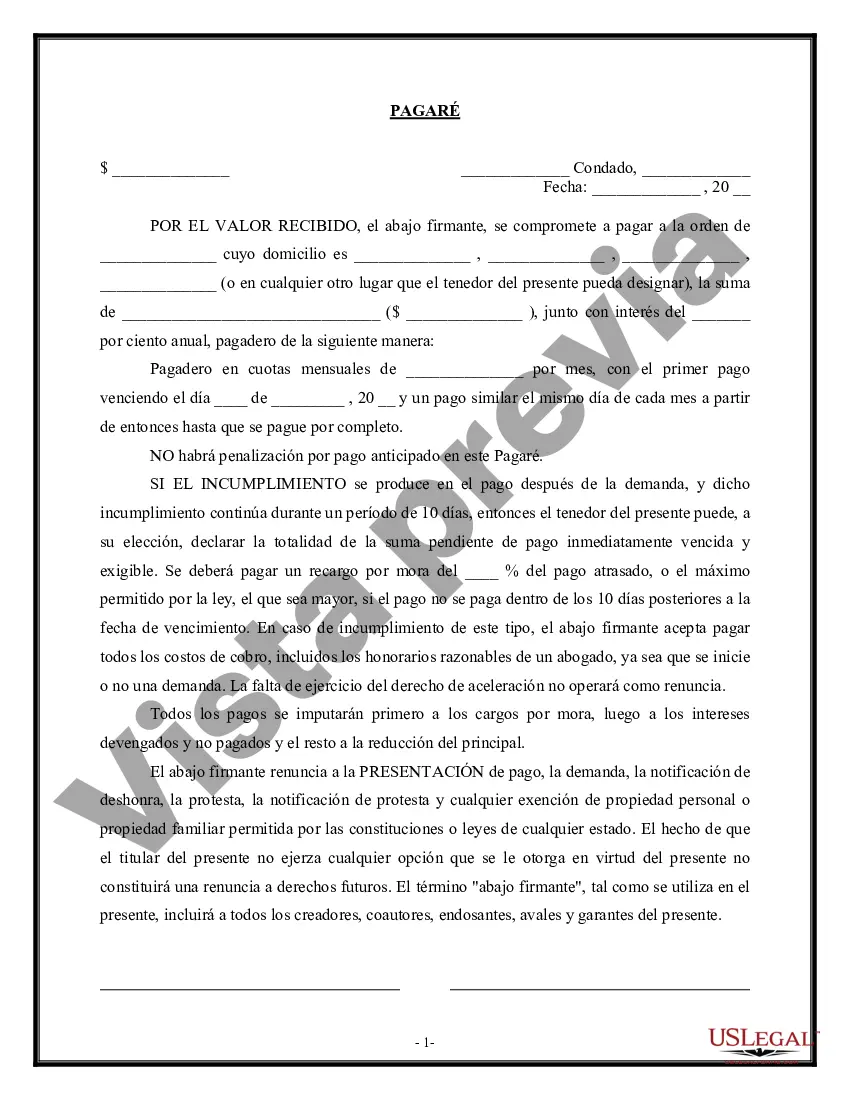

The Suffolk County, located in New York, offers various types of Sale of Business — Promissory Not— - Asset Purchase Transactions. These transactions are legal arrangements in which a business is sold and purchased using a promissory note as a form of payment. Here is a detailed description of what this transaction entails: 1. Sale of Business: The Sale of Business — Promissory Not— - Asset Purchase Transaction in Suffolk New York involves the transfer of ownership and control of a business from the seller to the buyer. This transaction encompasses all the assets, liabilities, and intellectual property associated with the business. 2. Promissory Note: A promissory note is a legal document that outlines the buyer's promise to pay the seller a specified amount of money over a predetermined period. It includes details such as the principal amount, interest rate, repayment schedule, and any collateral securing the note. 3. Asset Purchase: In this type of transaction, the buyer acquires the assets of the business, including tangible assets (inventory, equipment, etc.) and intangible assets (customer contracts, brand name, patents, etc.). The liabilities of the business, such as loans or debts, may or may not be assumed by the buyer. 4. Types of Sale of Business — Promissory Not— - Asset Purchase Transactions a. Complete Sale: This type of transaction involves the sale of an entire business, including all its assets and liabilities, through a promissory note. The buyer agrees to assume all debts and obligations associated with the business. b. Partial Sale: In this type of transaction, only a portion or specific assets of the business are sold using a promissory note. The buyer and seller negotiate which assets are included, and the buyer may or may not assume any liabilities. c. Installment Sale: An installment sale involves splitting the purchase price into multiple payments over time. The buyer pays the seller in predetermined installments, typically with interest, until the full amount is paid. This type of transaction allows the buyer to acquire the business while spreading out the financial burden. d. Secured vs. Unsecured Sale: A secured sale involves the buyer providing collateral as security for the promissory note, such as real estate or other valuable assets. In an unsecured sale, no collateral is pledged, and the buyer's promise to pay is solely based on their creditworthiness and trust. Suffolk New York Sale of Business — Promissory Not— - Asset Purchase Transactions play a vital role in facilitating the transfer of businesses within the county. These transactions offer flexibility in terms of payment structure, assets included, and assumption of liabilities, allowing both buyers and sellers to customize the terms to meet their specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Venta de negocio - Pagaré - Transacción de compra de activos - Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Suffolk New York Venta De Negocio - Pagaré - Transacción De Compra De Activos?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Suffolk Sale of Business - Promissory Note - Asset Purchase Transaction, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Suffolk Sale of Business - Promissory Note - Asset Purchase Transaction from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Suffolk Sale of Business - Promissory Note - Asset Purchase Transaction:

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!