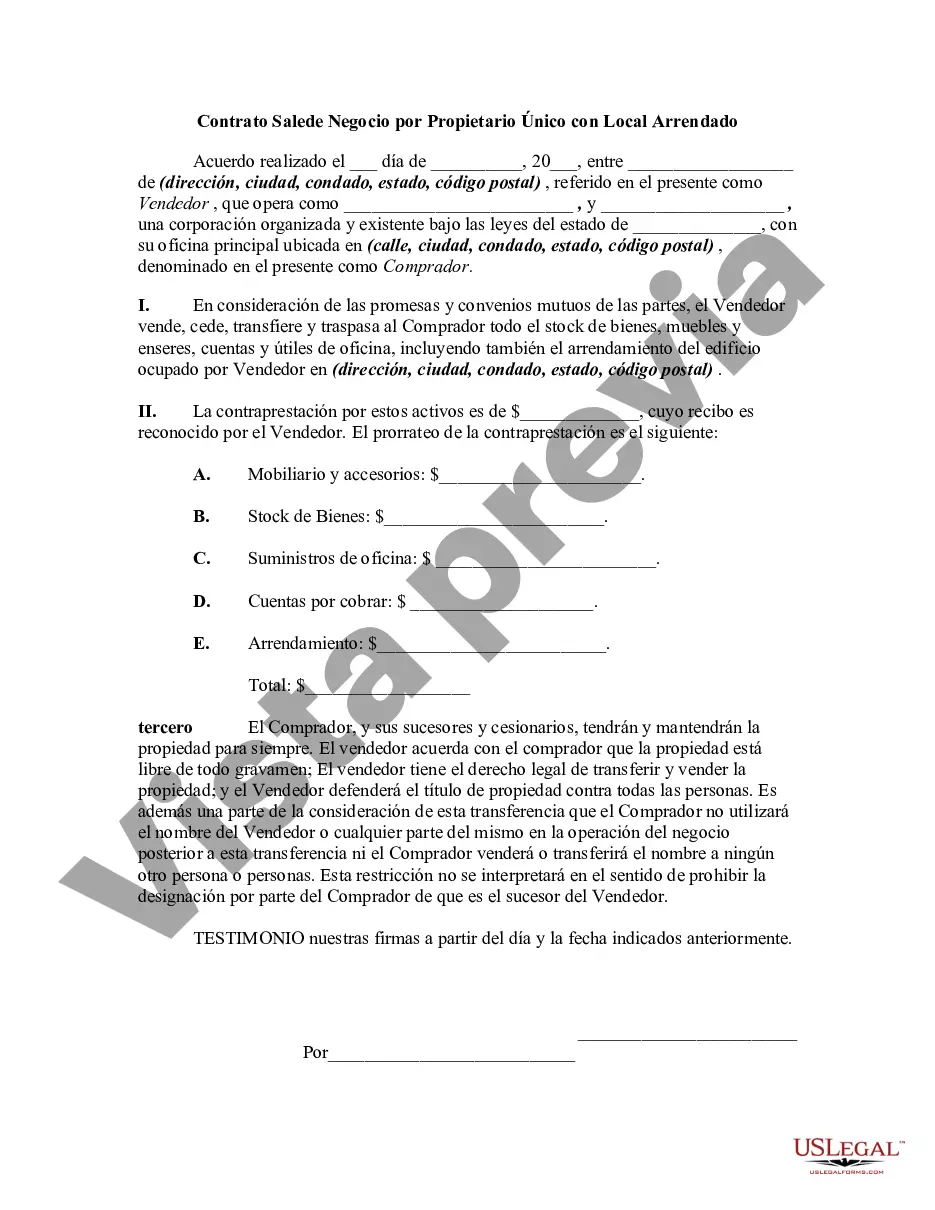

The Allegheny Pennsylvania Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for the sale of a business that is owned and operated by a sole proprietor in Allegheny, Pennsylvania. This agreement specifically pertains to businesses that operate in leased premises. This comprehensive agreement is crucial for both the buyer and the seller as it clearly defines their rights, obligations, and responsibilities throughout the sale process. By executing this agreement, both parties can ensure a smooth transaction while mitigating potential disputes or misunderstandings. The key elements typically included in the Allegheny Pennsylvania Agreement for Sale of Business by Sole Proprietorship with Leased Premises are as follows: 1. Identifying Information: The agreement includes the legal names and addresses of both the seller (sole proprietor) and the buyer. It may also involve the details of the leasing company and the leased premises. 2. Purchase Price and Payment Terms: The agreement specifies the total purchase price of the business and the payment terms agreed upon. It may also outline the acceptable methods of payment such as cash, check, or financing arrangements. 3. Assets Included in the Sale: This section lists all the assets that are part of the business being sold. It may include tangible assets like equipment, inventory, furniture, and fixtures, as well as intangible assets such as customer lists, trademarks, or patents. 4. Liabilities and Debts: The agreement clarifies the extent to which the buyer will assume any existing liabilities or debts of the business. It may state that the seller will be solely responsible for any outstanding debts or tax obligations. 5. Lease Agreement: As this agreement pertains to businesses operating in leased premises, it will include details about the lease agreement. It clarifies whether the buyer will be assuming the existing lease or if a new lease agreement will be negotiated with the landlord. 6. Closing Date and Transition: The agreement sets a specific closing date when the ownership and possession of the business will be transferred to the buyer. It may also outline any transition period during which the seller may provide training or assistance to the buyer to ensure a smooth transition of operations. 7. Representations and Warranties: This section outlines the representations and warranties provided by both the seller and the buyer. It ensures that both parties agree to disclose any material information about the business that may impact the sale. 8. Governing Law and Dispute Resolution: The agreement specifies the governing law—typically Allegheny, Pennsylvania—and the preferred method of dispute resolution in case any conflicts arise. Different types or variations of the Allegheny Pennsylvania Agreement for Sale of Business by Sole Proprietorship with Leased Premises may include the addition of specific clauses or modifications to cater to the unique circumstances of the particular business being sold. It is important for the parties involved to consult with legal professionals to ensure the agreement accurately reflects their intentions and protects their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Contrato de Venta de Negocio por Empresa Unipersonal con Local Arrendado - Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Allegheny Pennsylvania Contrato De Venta De Negocio Por Empresa Unipersonal Con Local Arrendado?

Are you looking to quickly draft a legally-binding Allegheny Agreement for Sale of Business by Sole Proprietorship with Leased Premises or maybe any other form to manage your own or business matters? You can go with two options: hire a professional to write a legal document for you or draft it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific form templates, including Allegheny Agreement for Sale of Business by Sole Proprietorship with Leased Premises and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Allegheny Agreement for Sale of Business by Sole Proprietorship with Leased Premises is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were hoping to find by using the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Allegheny Agreement for Sale of Business by Sole Proprietorship with Leased Premises template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!