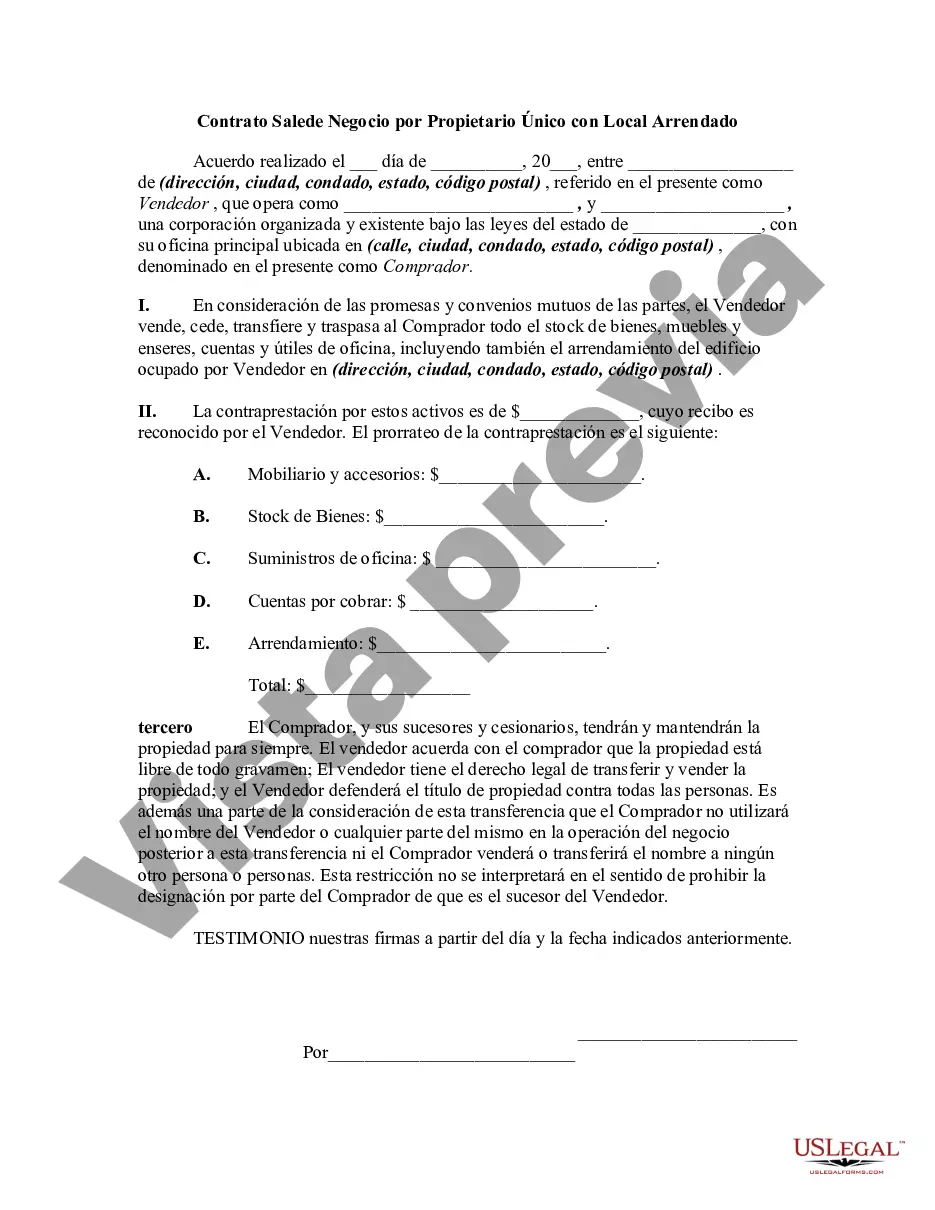

The Cuyahoga Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for selling a business owned by a sole proprietorship in Cuyahoga County, Ohio. This agreement specifically pertains to businesses that operate on leased premises. It is crucial to use appropriate keywords to clarify the different types of agreements under this category. Here are some examples: 1. Sale of Business Assets Agreement: This type of agreement focuses on the sale of the business assets, including inventory, equipment, intellectual property, and goodwill. It outlines the terms of the asset transfer and any related obligations or warranties provided by the seller. 2. Lease Transfer Agreement: In cases where the business operates on leased premises, this agreement addresses the transfer of the existing lease to the buyer. It includes provisions for assigning the lease, obtaining landlord consent, and transferring any related security deposits or lease obligations. 3. Non-Compete Agreement: To protect the buyer's investment and prevent the seller from competing with the sold business, a non-compete agreement may be included. This agreement restricts the seller from engaging in a similar business within a specific geographic area and time frame. 4. Transition Services Agreement: In situations where the seller will assist the buyer in transitioning the business smoothly, a transition services agreement may be necessary. This agreement outlines the specific services to be provided by the seller and the duration of the transitional support. 5. Purchase Price Allocation Agreement: This agreement helps both parties agree on the allocation of the purchase price across different business assets for tax and accounting purposes. It specifies the values assigned to tangible assets, intangible assets, and liabilities associated with the business. 6. Bill of Sale: The Bill of Sale is an integral part of the agreement, serving as legal proof of the transfer of ownership from the seller to the buyer. It includes a comprehensive list of assets being transferred, their conditions, and any warranties or guarantees provided by the seller. When drafting a detailed description of the Cuyahoga Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it is crucial to incorporate relevant keywords such as "sale of business assets," "lease transfer," "non-compete agreement," "transition services," "purchase price allocation," and "bill of sale" to cover these different types of agreements under this category.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Contrato de Venta de Negocio por Empresa Unipersonal con Local Arrendado - Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Cuyahoga Ohio Contrato De Venta De Negocio Por Empresa Unipersonal Con Local Arrendado?

Do you need to quickly create a legally-binding Cuyahoga Agreement for Sale of Business by Sole Proprietorship with Leased Premises or maybe any other form to take control of your personal or corporate affairs? You can select one of the two options: hire a professional to write a valid paper for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive professionally written legal papers without paying sky-high prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Cuyahoga Agreement for Sale of Business by Sole Proprietorship with Leased Premises and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the Cuyahoga Agreement for Sale of Business by Sole Proprietorship with Leased Premises is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to verify what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Cuyahoga Agreement for Sale of Business by Sole Proprietorship with Leased Premises template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!